Policy and Valuation Analysis of Zhejiang Shibao After Consecutive Limit-Up Days

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- The first batch of L3 vehicle access permits highly align with the company’s L3+ product rhythm, forming a closed loop of policy, product, and capacity, but real mass production and large-scale commercial use need to wait until the second half of 2026, making the current upward trend show the characteristics of “expected fulfillment ahead of schedule”[2][3][4][5][6][7][8].

- The main net inflow accounted for more than half in the Dragon and Tiger List data, the limit-up was opened three times, and the turnover rate soared, indicating that the long-short game in the market has intensified, and continuing to chase high in the short term may be amplified by fluctuations caused by capital withdrawal[1].

- Autonomous driving/by-wire concept stocks in the industry resonate, and Zhejiang Shibao is regarded as a core supplier at the execution layer. If by-wire steering is mass-produced as scheduled, the technical barrier will be strengthened, but if order negotiations or policy rhythm lag, high valuations are likely to be repriced[0][9].

- Valuation Correction Risk: PE of 63.72x is significantly higher than the industry average, and the short-term gain of nearly 20% in 5 days and the high sector sentiment make it easy to trigger a volume pullback when there is a slight negative news[0].

- Policy Fulfillment Rhythm: The landing of the first batch of L3 policies is a phased breakthrough, but the mass production of by-wire steering is in the second half of 2026, and real large-scale commercialization will take more than 1.5 years, so there is a gray area between expected fulfillment and actual rhythm[2][3][4][7].

- Volatile Market Sentiment: The industry performance of three limit-up openings in the Dragon and Tiger List, soaring turnover rate, and callback after the general rise of concept stocks all suggest that the downward trend will be amplified when short-term hot money withdraws, and it is still driven by policy/sentiment[1][9].

- Capacity and Performance Pressure: The 130 million yuan capacity expansion and production line debugging will erode cash flow and profit margins in the short term. If downstream orders are not released as scheduled, it will make high valuations more difficult to sustain[8][7].

- Policy + Technology Dividends: The first batch of L3 vehicle access permits has brought the industry into the commercialization stage. The company’s products have been clearly adapted, and it has a wide range of partners. Policy benefits have certain sustainability[2][3][4][5][6].

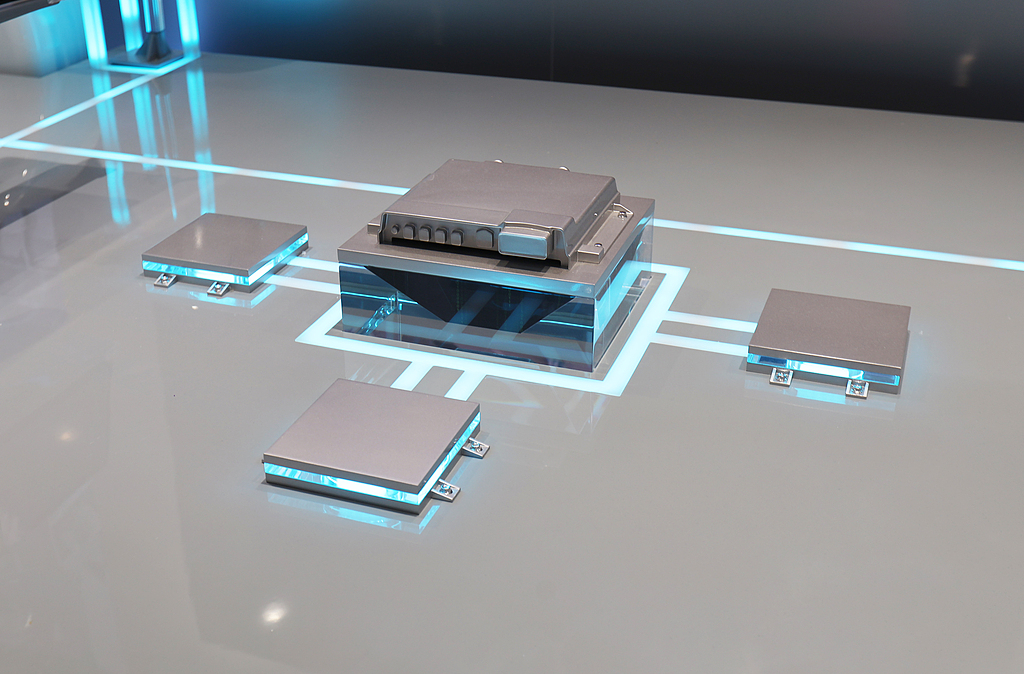

- By-wire/Rear-wheel Steering Dual Layout: By-wire steering will be mass-produced in the second half of 2026, and rear-wheel steering has been put into production in Q4 2025. If the mass production rhythm is synchronized with the mass delivery of vehicle manufacturers, it will form a technical barrier that cannot be easily replicated[7][8].

- Capital Structure Support: At present, the main capital accounts for more than 50%. If the policy and performance verification process goes smoothly, it will continue to support the valuation and buffer short-term shocks[1].

- The event at 17:15:46 on December 17, 2025 (UTC+8) triggered Zhejiang Shibao to enter the strong stock pool and achieve two consecutive limit-ups, with high activity indicators such as turnover of 2.142 billion yuan and trading volume of 150.54 million shares[0][1].

- The first batch of L3 vehicle access permits from the Ministry of Industry and Information Technology on December 15, the company’s intelligent steering products adapted to L3/by-wire steering, the 2026H2 mass production plan, and the 130 million yuan capacity expansion form a policy-technology-capacity chain[2][3][4][5][6][7][8].

- The first three quarters of 2025 revenue was 2.462 billion yuan (+35.44%), net profit was 150 million yuan (+33.66%), but valuations such as PE 63.72x and EV/OCF 44.62x are high, meaning that the current premium needs to be verified by continuous orders[0].

- Autonomous driving/by-wire concept stocks resonate with Zhejiang Shibao, positioning it as a core supplier at the execution layer. If orders are fulfilled, its position will be consolidated; otherwise, high valuations are likely to correct[9].

科新发展强势分析准备

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.