Envicool's Strong Performance: Liquid Cooling Orders and High Valuations Go Hand in Hand

#强势股 #液冷 #英伟达 #资金流向 #AI算力

Mixed

A-Share

December 17, 2025

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

002837

--

002837

--

Comprehensive Analysis

- Event & Situation: At 17:15:53 on December 17, 2025 (UTC+8), tushare_strong_pool announced that Envicool (002837) was selected into the strong stock pool. On that day, it opened at 88.00 yuan, with an amplitude of 87.96-92.95 yuan, closed at the daily limit for the whole day and hit a 60-day high. The high position was accompanied by an expanded trading volume of 71.85 million shares, a volume ratio of over 1.3x, a turnover rate of 8.43%, and a main capital net inflow of 816 million yuan, indicating that institutions were actively accumulating at high positions [0][2].

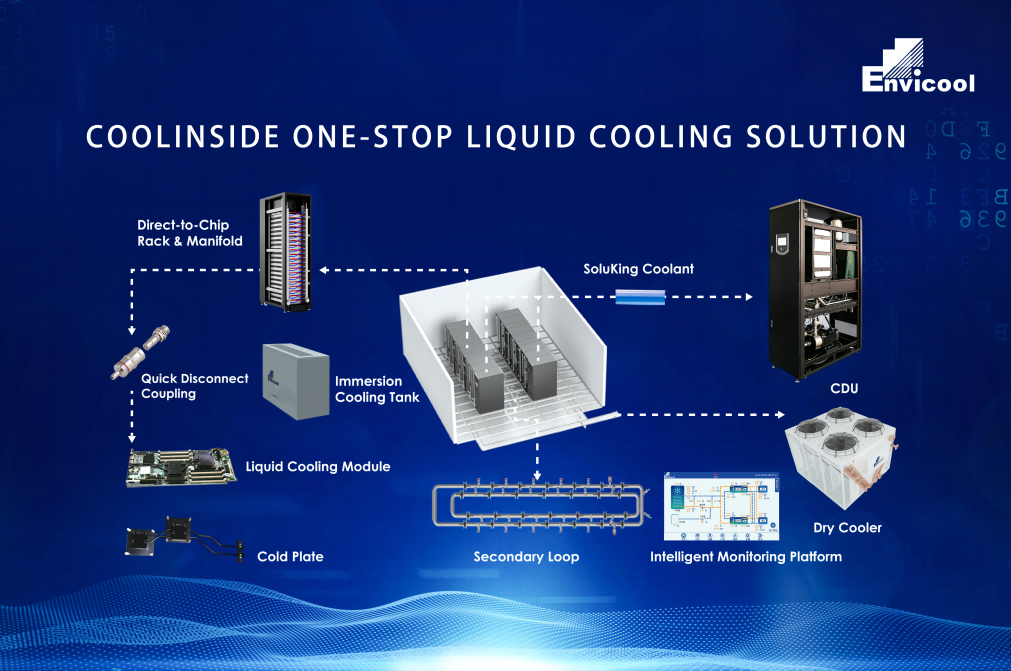

- Catalysts & Order Progress: NVIDIA GB300/NVL72 RVL liquid cooling is regarded as a necessary configuration for high-power servers. As the only supplier in mainland China with Tier 1 certification and participating in standard setting, Envicool’s order expansion logic of 700,000 yuan per cabinet, 90,000 units expected in 2026, corresponding to a 63 billion yuan market, has been repeatedly emphasized in brokerage reports and industry in-depth reports [3][4][1].

- Policy & Fundamentals: The U.S. recently relaxed H200 chip exports to China, releasing long-term demand for computing power infrastructure construction [6]; the company’s operating income in the first three quarters of 2025 was 4.026 billion yuan, net profit attributable to parent company was 399 million yuan, gross profit margin was 27.32%, non-net profit growth exceeded 14%, but the TTM price-earnings ratio was about 178x, and the price-to-book ratio was 26.92x, indicating that valuations are highly dependent on performance fulfillment [0].

- Technology & Capital Structure: Multi-dimensional indicators such as KDJ/RSI show overbought, with a short-term technical correction risk of 10-15%. MA5/10/20 maintain a long arrangement but need to pay attention to consolidation after a breakthrough; the financing balance is 3.402 billion yuan, with a net financing repayment of 146 million yuan. Funds still hold high positions but leverage faces withdrawal pressure [0][2].

Key Insights

- Main capital net inflow combined with multiple public fund holdings, against the background of continuous expansion of turnover rate and volume ratio, indicates that funds prefer the liquid cooling story, but high financing balance and year-end cash withdrawal rhythm may still trigger short-term volatility [2].

- Industry and brokerage consensus regard GB300 liquid cooling as a “breakthrough point”, corresponding to a market space of 63 billion yuan and an estimated shipment of 90,000 units at 700,000 yuan per cabinet. Once orders are fulfilled in batches, the current valuation pressure is expected to be gradually消化 by growth [3][4][1].

- High PE and overbought technical indicators suggest that the current market trend is driven by sentiment and expectations, and prices have already incorporated 2026 orders and profits in advance. If the rhythm is not synchronized, the pullback may quickly test the vicinity of the 20-day moving average [0][4].

- The loosening of the U.S. H200 export policy provides institutional support for domestic computing power procurement, increasing visible order clues for Envicool in the expansion of cloud vendors and AI data centers [6].

Risks & Opportunities

- Main Risks

- The current TTM price-earnings ratio is about 178x, and valuations depend on future profit release. Once orders or profit growth rates are lower than expected, the pullback risk is significant [0].

- KDJ/RSI data have entered the overbought range, and the probability of technical adjustment after continuous volume increase is rising [0].

- The order and shipment rhythm of GB300 major customers have not been fully announced, and 2026 is the key to performance fulfillment. The expectation gap may amplify volatility [4].

- The financing balance of up to 3.402 billion yuan may trigger liquidation pressure when the stock price pulls back, further amplifying fluctuations [2].

- Opportunity Windows

- NVIDIA GB300/NVL72 RVL liquid cooling orders, combined with Envicool’s Tier 1 qualification and participation in standard setting, build a scenario-based implementation path for the 100-billion-level liquid cooling track [3][4].

- The relaxation of H200 export policy provides external institutional support for domestic high-power AI server procurement, increasing the urgency of switching from air cooling to liquid cooling [6].

- Multiple brokerages’ initial coverage and buy ratings, institutional holdings and public fund participation provide continuous core funds, which are expected to form stable support after technical adjustments [1][2].

Key Information Summary

- The strong performance on December 17 was accompanied by main capital net inflow and volume expansion, indicating that the day’s market was dominated by institutional pulling and theme resonance [0][2].

- GB300 liquid cooling orders and Envicool’s Tier 1 identity form a medium- to long-term core catalyst. If batch delivery occurs in 2026, the growth logic will support the return of valuations to a reasonable range [3][4].

- High valuations and overbought technical aspects require callback confirmation. Investors should closely observe order progress, capital trends and policy dynamics to judge sustainability [0][4][6].

References

Ask based on this news for deep analysis...

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

002837

--

002837

--