In-depth Analysis of CPO Co-Packaged Optics Technology: New Investment Opportunities in AI Data Centers

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

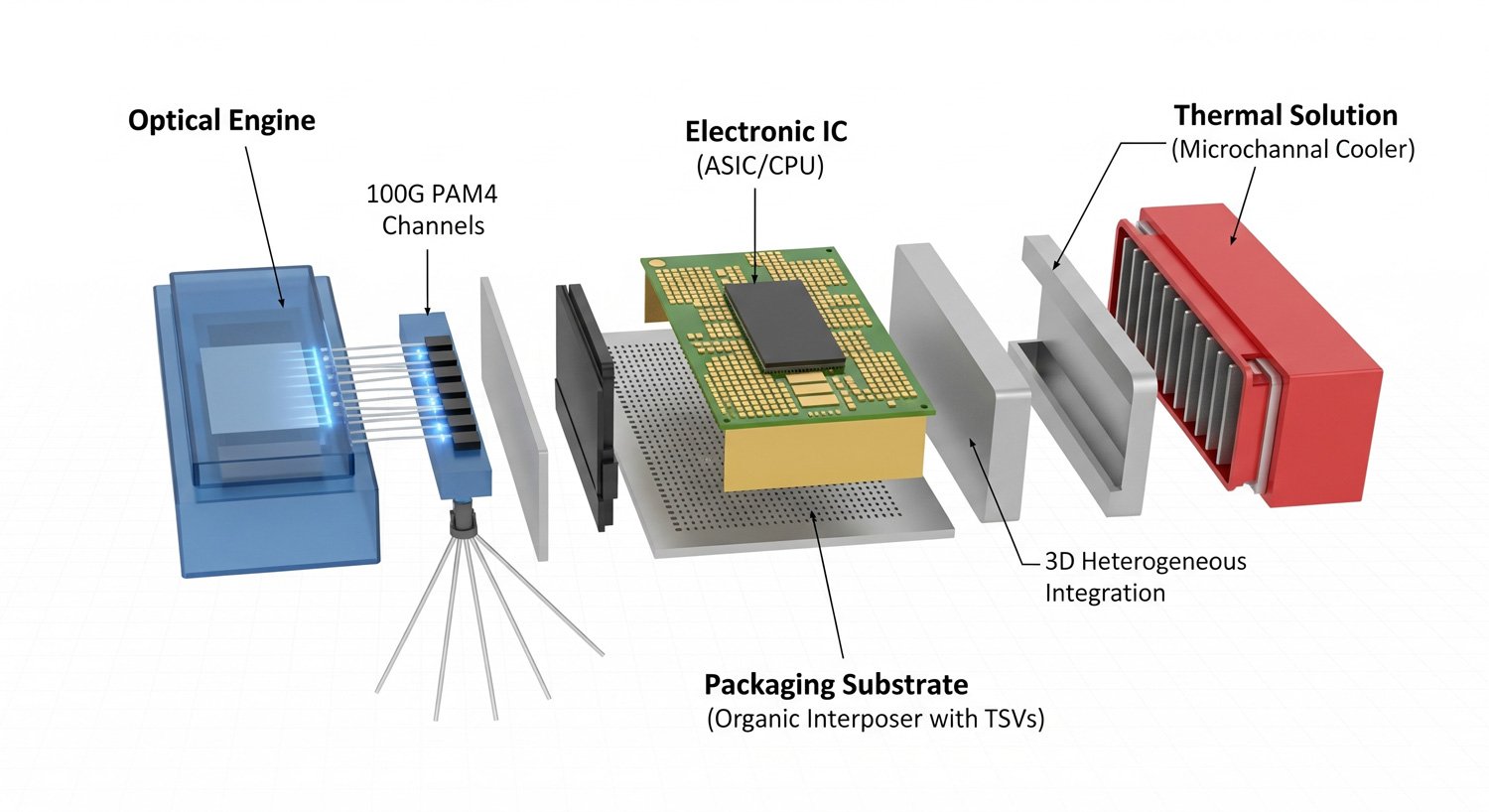

CPO (Co-Packaged Optics) technology is emerging as a disruptive solution in the fields of AI data centers and high-performance computing. By packaging silicon photonics devices and electronic devices together, this technology achieves a revolutionary improvement in photoelectric conversion efficiency. According to industry forecasts, AI’s demand for network speed is more than 10 times the current level. Against this backdrop, CPO technology is expected to reduce the power consumption of existing pluggable optical module architectures by 50%, effectively addressing key pain points in high-speed, high-density interconnection transmission scenarios.

From the market development trajectory, CPO technology is experiencing explosive growth:

- 2024 Market Size: Approximately $1.2 billion, accounting for only 12.4% of the overall optical module market

- 2030 Forecasted Size: Expected to reach $23.5 billion, with a compound annual growth rate (CAGR) of up to 68.7%

- Market Share Change: By 2030, CPO technology is expected to occupy 68.7% of the overall optical module market share

- Current Stock Price: $173.18, Market Capitalization $4.22 trillion

- Technological Advantage: Holds 90% share in the data center chip market [0]

- Financial Performance: Data center business revenue is $115.19B, accounting for 88.3% of total revenue [0]

- Valuation Level: P/E ratio of 42.70 times, relatively reasonable

- Analyst Expectations: Target price of $250.00, with an upside potential of 44.3% [0]

- Outstanding Stock Price Performance: 6-month increase of 271.73%, year-to-date increase of 274.99% [0]

- Technological Positioning: Has significant advantages in the AI cloud optics field

- Latest Developments: The board of directors added a senior semiconductor industry professional to strengthen AI strategy [1]

- Risk Warning: Current P/E ratio of 202.03 times, valuation is relatively high

- Steady Growth: 6-month increase of 118.64%, year-to-date increase of 73.39% [0]

- Business Structure: Laser business accounts for 60.1%, material business accounts for 39.9% [0]

- Technological Barrier: Has core technological advantages in laser and optical material fields

- Valuation Analysis: P/E ratio of 109.51 times, reflecting market’s high expectations for CPO technology

- Stable Performance: 6-month increase of 17.24%, year-to-date increase of 29.59% [0]

- Strategic Transformation: Actively deploys AI security framework and integrated solutions [2]

- Valuation Advantage: P/E ratio of 29.40 times, relatively low

- Business Foundation: Network products account for 44.5%, service revenue accounts for 34.5% [0]

E Fund’s concentrated layout in CPO concept stocks reflects the following investment logic:

- LumentumandCoherent, as core suppliers in the optical communication field, directly benefit from the trend of CPO technology replacing traditional optical modules

- The recent sharp rise in the stock prices of the two companies (6-month increases of 271.73% and 118.64% respectively) confirms market recognition [0]

According to the latest data, U.S. AI data centers have paid more than $6 billion in tariff costs in 2025 [3], which reflects the huge scale and urgent demand for AI infrastructure construction. As a key solution to reduce power consumption and improve efficiency, CPO technology will become the preferred technology for AI data center construction.

- Power Consumption Advantage: CPO technology can reduce power consumption by 50%

- Density Improvement: Supports higher-density interconnection transmission

- Cost-effectiveness: Long-term operating costs are significantly reduced

From the chart analysis, CPO technology is at a key node transitioning from the initial stage to the explosive growth stage, and 2025-2026 will be a critical period for technology commercialization.

- Technology Maturity Risk: CPO technology is still in the early stage of commercialization, and technical stability needs to be verified

- Overvaluation Risk: Related concept stocks generally have high valuations, with correction pressure

- Increased Competition Risk: Traditional optical module manufacturers and new entrants are accelerating the deployment of CPO technology

- Batch Position Building: Considering the technology development cycle, it is recommended to deploy related targets in phases

- Focus on Technology Leaders: Prioritize companies with core competitiveness in the CPO technology field

- Balance Risk and Return: Combine valuation levels and growth to build a diversified investment portfolio

CPO co-packaged optics technology represents a major technological breakthrough in the optical communication field, with irreplaceable advantages in AI data centers and high-performance computing scenarios. The collective surge in E Fund’s heavy holdings reflects the market’s deep recognition of this technology trend. From an investment perspective, this field is at the golden intersection of technological explosion and commercial implementation, but investors need to balance technological prospects and valuation risks, and adopt a rational and active investment strategy.

[0] Jinling API Data - Stock prices, financial data, market performance and analyst expectations

[1] Lumentum Board Appointment News Report (https://marketchameleon.com/Blog/post/2025/12/16/lumentum-board-appointment-thad-trent-signals-growth)

[2] Cisco AI Security Framework Release (https://blogs.cisco.com/ai/security-framework)

[3] Forbes - AI Data Center Tariff Cost Report (https://www.forbes.com/sites/annashedletsky/2025/12/10/ai-data-centers-have-paid-6b-in-tariffs-in-2025)

[4] Zhihu - Compilation of CPO Industry Research Reports (https://www.zhihu.com/tardis/zm/art/1908522614655288003)

美联储货币政策分化与流动性紧缩对A股市场的持续影响深度分析

A股高胜率价值指数策略分析报告

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.