Investment Value Analysis of Zhenlei Technology and Qianzhao Optoelectronics in the Space Power Station and Phased Array Technology Industry Chain

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on in-depth analysis, Zhenlei Technology (688270) and Qianzhao Optoelectronics (300102) have

- Market capitalization: $23.76 billion, current share price: 110.99 yuan [0]

- Year-to-date increase: 228.37%, extremely strong performance [0]

- Net profit margin:24.65%, gross margin:22.17%, excellent profitability [0]

- Current ratio:12.72, sound financial condition [0]

- Focused on R&D of microwave and millimeter-wave chips and modules [0]

- Has core technical barriers in the field of phased array T/R component chips

- Products are widely used in high-end fields such as aerospace, military industry, and communications

- Market capitalization: $21.81 billion, current share price:24.26 yuan [0]

- Year-to-date increase:139.01%, good growth momentum [0]

- Net profit margin:4.09%, relatively weak profitability [0]

- Current ratio:1.61, relatively conservative financial status [0]

- Focused on compound semiconductor materials such as gallium arsenide and gallium nitride [0]

- Has technical advantages in the field of optoelectronic devices

- Products cover applications such as LEDs, lasers, and solar cells

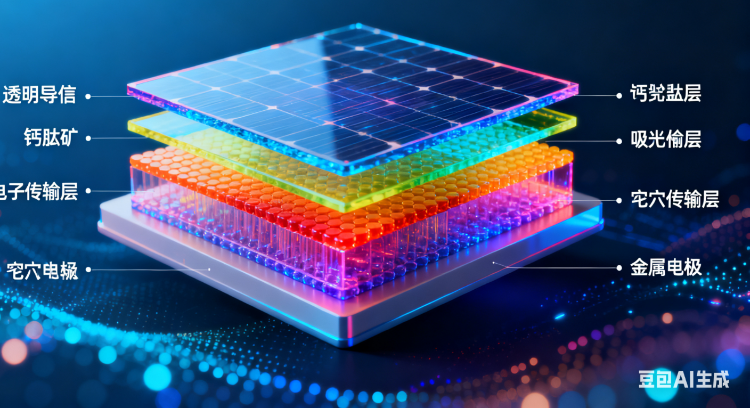

As an important direction of future clean energy, space solar power station technology focuses on collecting solar energy through space orbits and transmitting it to the ground [1]. This technology has the following characteristics:

- All-weather power generation: Unaffected by weather and time, high power generation efficiency

- Green and clean: No carbon emissions, in line with carbon neutrality goals

- Strategic significance: Has dual-use value for military and civilian purposes, including applications such as space charging piles, computing power centers, and directed energy weapons

- Phased array antenna system: Achieves precise microwave energy transmission

- Solar cell materials: High photoelectric conversion efficiency

- Microwave power devices: High power density transmission

- Control system: Precise attitude control and energy management

##3. Positioning of the Two Companies in the Industry Chain

- Has monopolistic technical advantages in the field of phased array T/R component chips

- Products are directly applied to core devices of microwave energy transmission systems

- Strong customer stickiness in aerospace and military industries, stable orders

- High technical barriers, new entrants are difficult to shake

- High customer concentration, dependent on military orders

- High valuation (P/E ratio: 227.47x) [0]

- Civilian market expansion still needs time

- Gallium arsenide materials are widely used in space solar cells

- Compound semiconductor technology can be extended to multiple application scenarios

- Large production capacity, obvious cost advantages

- Relatively diversified customer structure

- Relatively low technical barriers, fierce competition

- Weak profitability (net profit margin:4.09%) [0]

- Obvious impact of industry cyclicality

##4. Investment Value Assessment

- Technical scarcity: Extremely high threshold for phased array chip technology

- Policy-driven: Continuous increase in military investment

- Market space: SSPS projects will bring long-term incremental demand

- Valuation support: High ROE (4.78%) combined with high growth [0]

- Long-term value: ★★★★★

- Short-term risk: ★★★☆☆

- Suitable for investors: Investors with strong risk tolerance and optimistic about the long-term development of military aerospace

- Industry chain position: Compound semiconductor material supplier

- Diversified applications: Multiple fields such as LEDs, lasers, and solar energy

- Scale advantages: Large production capacity, cost competitiveness

- Policy support: In line with the development direction of new material industry

- Long-term value: ★★★☆☆

- Short-term risk: ★★★★☆

- Suitable for investors: Investors pursuing relative stability and optimistic about the long-term trend of new materials

##5. Risk Assessment

- Technical risk: SSPS technology is still in the early stage of development, and industrialization time is uncertain

- Policy risk: Project progress depends on continuous government investment

- Valuation risk: Both companies’ valuations are at historical highs

- Volatility risk of military orders

- Technical iteration risk

- Customer concentration risk

- Risk of intensified industry competition

- Raw material price fluctuation risk

- Technical substitution risk

##6. Investment Recommendations

- Aggressive investors: Can focus on Zhenlei Technology, accounting for 60-70%

- Moderate investors: It is recommended to allocate both companies evenly, or focus on Qianzhao Optoelectronics

- Conservative investors: It is recommended to wait and see, and consider again when the valuation returns to a reasonable range

- Short-term: Pay attention to technical correction opportunities, support level for Zhenlei Technology:76.11 yuan, support level for Qianzhao Optoelectronics:20.82 yuan [0]

- Medium-term: Pay attention to the progress of major projects such as the

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.