Barron's 2025 Analysis: Long-Term Tech Investing (NVIDIA) Outperforms Short-Term Volatility

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

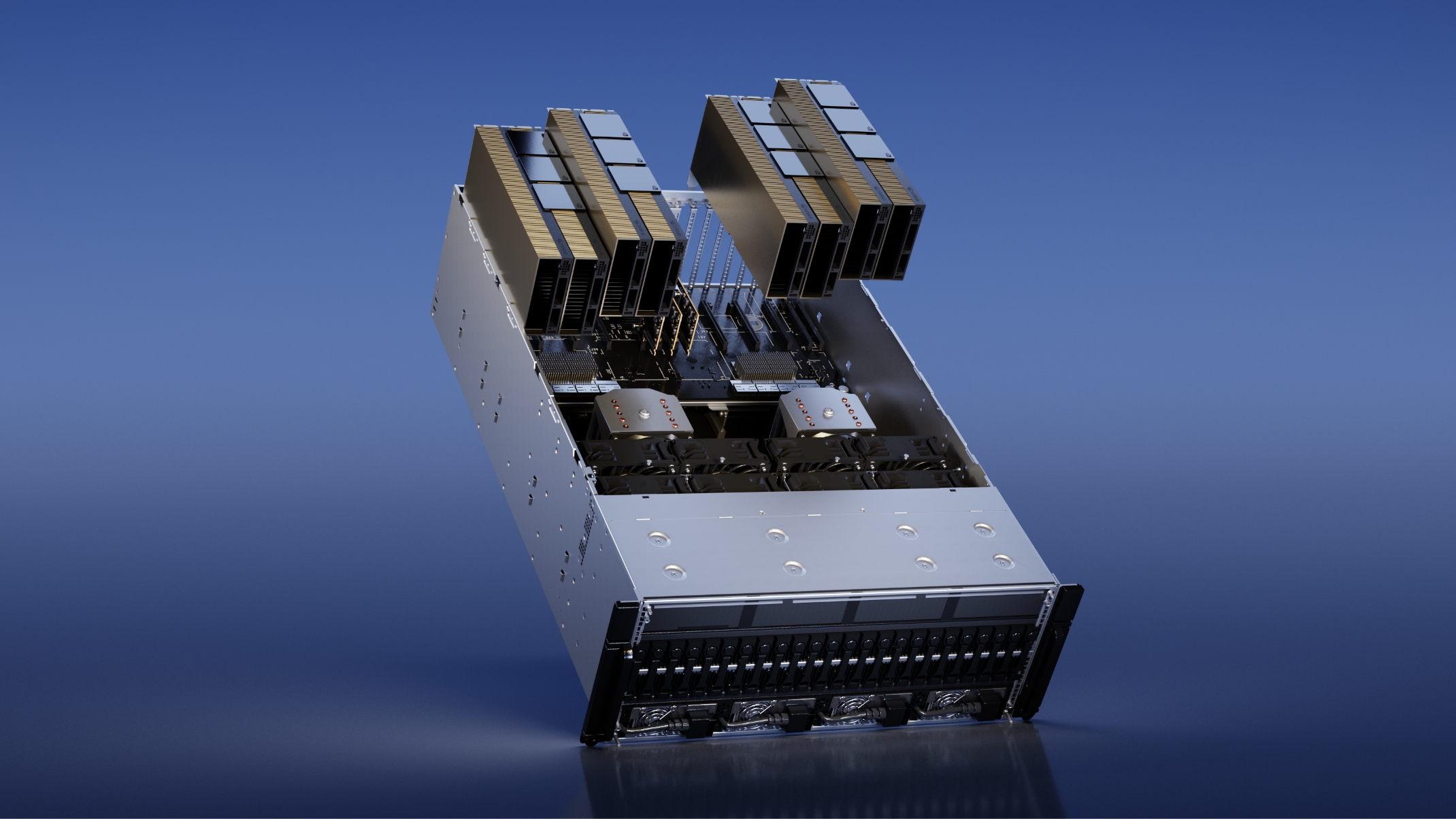

This analysis is anchored in the Barron’s article [1], which emphasizes that long-term investment strategies focused on transformative trends (like AI) outperformed short-term market noise in 2025. On the day of publication (December 17, 2025), NVDA and the broader Tech sector faced headwinds: NVDA declined ~3%, and the Tech sector fell -2.27% [0][2]. Short-term volatility drivers included investor concerns about an AI bubble, competition from new entrants (e.g., MetaX Integrated Circuits’ 700% IPO surge), and worries over debt financing for AI data-center buildouts by Oracle and CoreWeave [2][3][4].

Over the 12 months ending December 17, 2025, however, NVDA’s long-term performance was strong, with a 32.42% return [0] that outpaced the S&P 500 (11.05%) and NASDAQ Composite (12.93%) [0]. This outperformance is attributed to NVDA’s leadership in the AI chip market, a sector projected to grow rapidly: UBS forecasts 35% global AI capex growth in 2026 to $571 billion [2], and Bank of America has identified NVDA as a top AI stock pick for 2026, citing early-stage AI adoption and rising compute capacity demands [2].

- Tension between short-term sentiment and long-term fundamentals: Short-term volatility (driven by bubble fears and competitive news) contrasted sharply with long-term outperformance, highlighting the importance of filtering daily market noise for trend-focused investors.

- NVDA’s AI leadership underpins growth: The company’s dominant position in AI chips directly contributed to its 12-month return, which outperformed major indices despite recent short-term declines (~16% over 2 months as of December 17, 2025) [2].

- Sustained AI demand forecast: Analysts’ projections for 35% AI capex growth in 2026 indicate ongoing demand for NVDA’s products, supporting long-term growth expectations.

- Institutional and prominent investor divergence: While analysts remain optimistic, prominent investors like Michael Burry and Jim Chanos have shorted NVDA, reflecting contrasting views on AI stock valuations and contributing to short-term volatility [2].

- AI bubble concerns: Short-term volatility may persist as investors debate whether AI stock valuations align with fundamentals [2].

- Increased competition: New AI chipmakers (e.g., MetaX) and existing rivals (AMD, Broadcom) could erode NVDA’s market share [2].

- Regulatory risks: Changes in U.S.-China chip export policies could disrupt NVDA’s revenue streams [5].

- Supply chain constraints: A projected 50% decrease in NVDA’s RTX 50 GPU supply in 2026 may impact consumer segment revenue and brand loyalty [6].

- Global AI capex growth: The 35% projected AI capex growth in 2026 [2] signals sustained demand for NVDA’s AI-related products.

- Early-stage AI adoption: Ongoing early-stage AI adoption across industries suggests long-term growth potential for AI chip providers.

- Rising compute demands: Increasing compute capacity requirements for AI applications support NVDA’s core business momentum [2].

- NVDA’s 12-month return (2024-12-17 to 2025-12-17): +32.42% [0]

- S&P 500 12-month return: +11.05% [0]

- NASDAQ Composite 12-month return: +12.93% [0]

- Technology sector 1-day change (December 17, 2025): -2.27% [0]

- NVDA 2-month decline (as of December 17, 2025): ~16% [2]

- UBS projected 2026 global AI capex growth: 35% [2]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.