ASML EUV Monopoly Concerns and Valuation Vulnerability After Chinese Prototype Report

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

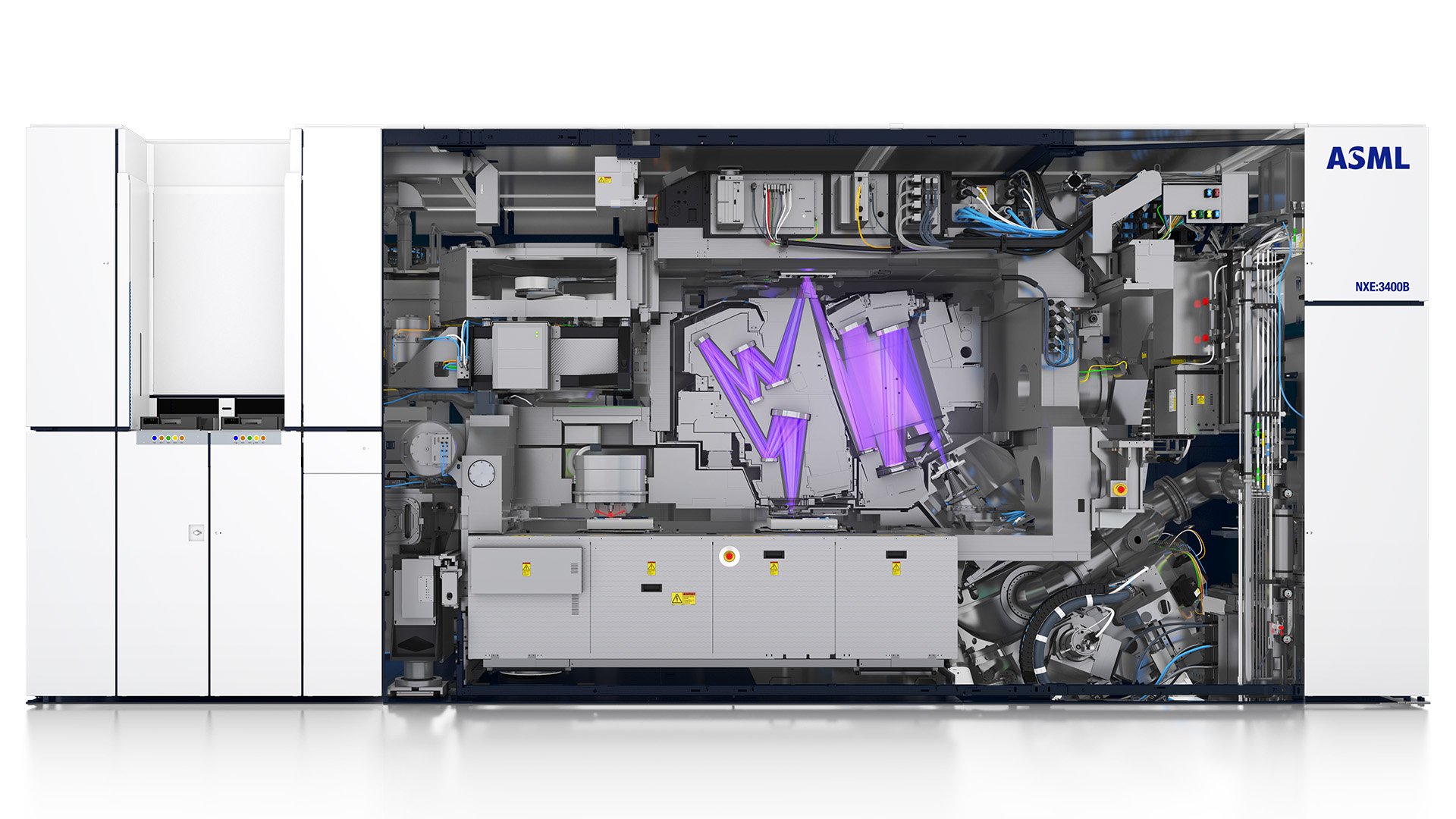

The Reuters report that a Shenzhen laboratory has assembled a crude yet operational EUV lithography prototype—part of a classified effort to achieve semiconductor independence—has triggered a swift 6% decline in ASML shares, underscoring investor concern about the longevity of its EUV monopoly and pricing power [1]. While the prototype likely relies on legacy ASML components (optical platforms, light sources, vacuum chambers), the mere existence of such a project suggests China may be closer to eroding ASML’s technological moat than Western policymakers assumed. Nevertheless, ASML’s exceptionally high multiple and valuation remain anchored to its irreplaceable command of the full EUV value chain, and the current share price near $1,015 is still well above even optimistic standalone DCF scenarios, signaling a vulnerability to downside risk if the geopolitical or competitive landscape worsens [0].

ASML’s stock is trading at $1,015.43 after hours, down roughly 5.6% on the day and 8.5% over five days, reflecting panic selling on the Reuters headline [0]. Despite this pullback, institutional consensus remains bullish (average $1,045 target), but the valuation is already rich: the DCF analysis shows even the optimistic scenario values ASML at $596—about 41% below today’s price—suggesting that any meaningful reduction in ASML’s monopoly premium would force a material valuation reset [0]. The gap between market price and model-implied intrinsic value creates sensitivity to events that might signal structural erosion of the moat.

ASML’s moat is built on decades of systems integration, extreme optics, EUV light sources, and the ability to supply complete toolsets with uptime guarantees—capabilities that took nearly 20 years and billions in R&D to commercialize (first machines delivered in 2019) [1]. The prototype described by Reuters is reportedly significantly larger and cruder than commercial tools and is still far from producing chips. Key bottlenecks—laser power scaling, mirror cleanliness, EUV source lifetime, and advanced reticle handling—remain controlled by ASML and its European suppliers. Consequently, although China demonstrating a prototype shifts the narrative and may increase political pressure, actually replicating ASML-grade EUV is still “many, many years” away, in line with management’s longstanding view [1]. That said, even the perception of narrowing gaps adds uncertainty to ASML’s pricing power and may justify a higher risk premium, especially given its current premium valuation [0].

Should China continue progressing down this path, the global equipment supply chain could bifurcate. Western restrictions on supplying ASML systems to China have driven Beijing to reverse-engineer older tools and cultivate domestic suppliers for lasers, optics, and metrology. If China attains even limited EUV capability, other chipmakers (e.g., SMIC) may source domestic systems, reducing ASML’s addressable market in the world’s largest semiconductor end market. Moreover, the supply chain may fragment as Western customers seek alternative sources for mission-critical components to guard against geopolitical risk, prompting increased investment in domestic or allied EUV-compatible ecosystems. Conversely, ASML’s dependence on high-end optics (Zeiss), light sources, and vibration isolation still serves as a chokepoint: those partner companies are not easily replaced, preserving ASML’s grip on full-system delivery even if partial replication occurs [1]. Nevertheless, the incident accelerates the urgency for ASML’s customers to diversify their equipment sourcing strategies and for ASML to reinforce its export-control-aligned business model.

From a valuation perspective, the current share price already embeds an assumption of sustained near-monopoly status and double-digit revenue growth. The emergence of a plausible Chinese EUV effort increases the probability of downside outcomes, especially if the prototype evolves into a credible commercial contender before ASML can further entrench barriers (e.g., next-generation High-NA EUV). For investors, maintaining a close watch on evidence of actual commercial tape-outs from the prototype, changes in export controls, and ASML’s spare capacity for rapid deployment in non-U.S. markets will be critical. Should the emerging capability begin to displace orders or force price concessions, the premium embedded in ASML’s multiples will need revaluation.

[0] Ginlix API Data – ASML real-time quote, stock performance, and DCF valuation snapshots (2025-12-17).

[1] “Exclusive: How China built its ‘Manhattan Project’ to rival the West in AI chips,” Reuters, December 17, 2025. https://www.reuters.com/world/china/how-china-built-its-manhattan-project-rival-west-ai-chips-2025-12-17/

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.