Reshaping of the Orthopedic Industry Landscape by Volume-Based Procurement (VBP) Policy: Response Strategies of Leading Enterprises in Segmented Sectors and Investment Value Analysis

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

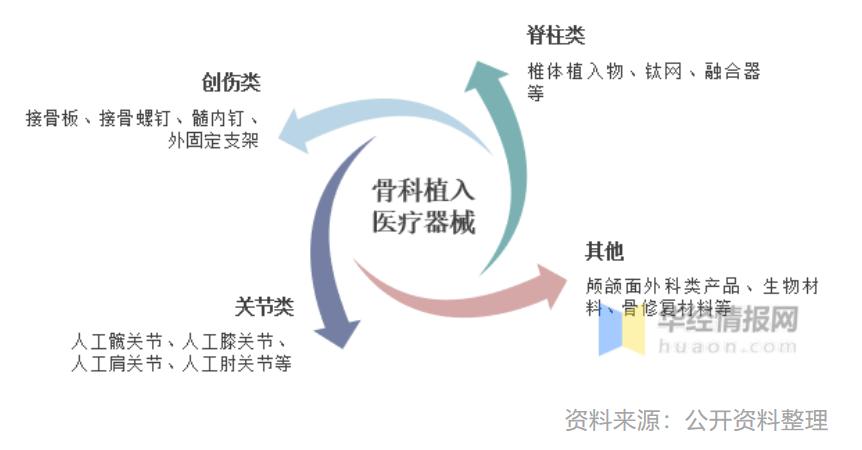

The national organized volume-based procurement (VBP) for orthopedic consumables is one of the most influential policies in the medical device industry in recent years. Since the start of artificial joint VBP in 2021, the four major categories of orthopedic consumables (artificial joints, spine, trauma, sports medicine) have basically achieved full VBP coverage.

- The average price of artificial joints decreased by 82%, with hip joints dropping from 35,000 yuan to about 7,000 yuan and knee joints from 32,000 yuan to about 5,000 yuan [1]

- Categories such as spine and trauma also face significant price reductions, turning orthopedic consumables from high-margin to medium-margin products [1]

This drastic price restructuring has completely changed the profit model and development logic of the orthopedic consumables industry, forcing enterprises to carry out strategic transformation.

The VBP policy has driven fundamental changes in the industry landscape. Leading enterprises have gained more market share due to channel advantages, while small and medium-sized enterprises have gradually exited the market due to cost pressures. According to the “China Medical Device Blue Book 2024”:

- The CR3 of domestic orthopedic consumables brands reached 18.2% in 2023, an increase of 5.3 percentage points compared to 2021

- The CR5 of domestic brands was 27.9%, an increase of 9 percentage points compared to 2021 [2]

This increase in concentration is mainly reflected in leading enterprises expanding their market share further through VBP volume reporting, while small enterprises exit the market as their sales profits gradually decline to insufficient levels to support costs—this part of the market share is often taken over by leading enterprises.

VBP has created a “window period” for domestic enterprises to expand their market volume. In the renewal procurement of artificial joints,

As an industry leader, Weigao Orthopedics faces significant pressure under the impact of VBP. In 2024, the company’s revenue and net profit margin declined sharply, reflecting the unsustainability of the traditional high-margin model in the VBP environment.

- Cope with price pressure through cost control and operational efficiency improvement

- Maintain competitiveness relying on group advantages and scale effects

- Adjust product structure and optimize resource allocation

Dabo Medical achieved record revenue through category expansion strategies, becoming one of the few enterprises to achieve revenue growth in the VBP environment. In 2024, the company’s net profit attributable to parent company returned to positive growth, showing strong adaptability [2].

- Diversified product layout: Expand from traditional orthopedics to other medical consumables fields

- Cost advantages: Reduce costs through large-scale production and supply chain management

- Channel optimization: Establish a more flat sales channel to improve operational efficiency

Chunli Medical adjusted its business structure through high-growth exports.

- International breakthrough: Actively expand overseas markets to reduce dependence on the domestic VBP market

- Technology leadership: Recognized as a single-item champion enterprise in artificial joint prosthesis manufacturing by the Ministry of Industry and Information Technology

- Rich product line: Covers orthopedic consumables such as joints, spine, sports medicine, and trauma, and also布局齿科、PRP、机器人以及骨科动力产线 [3]

Aikang Medical adopted a relatively steady development strategy in the VBP environment, coping with price pressure through product structure optimization and cost control. The company maintained a certain market share in the renewal procurement of artificial joints, showing strong product competitiveness.

Facing VBP pressure, Sanyou Medical chose a development path of merger-driven innovation, realizing business diversification by entering the new field of ultrasonic bone knives. Although the full-year net profit declined by 87% in 2024 [4], sales volume continued to rise, showing that scale effects are emerging.

- Technological innovation: Acquire new technologies through mergers and acquisitions to enhance product added value

- Segmented market: Focus on specific technical fields to establish differentiated competitive advantages

- Long-term layout: Although short-term performance is under pressure, it lays the foundation for future development

After 2-3 years of digesting the impact of VBP, the orthopedic consumables industry has passed its performance trough, showing the following investment logic:

-

Policy environment tends to stabilize: VBP rules continue to improve. The “Government Work Report” in March 2025 clearly proposed to optimize the procurement policy for drugs and consumables, and the policy environment tends to stabilize [5]

-

Fundamentals gradually improve: Domestic enterprises gradually digest the impact of the VBP policy through improving product competitiveness, optimizing cost structure, expanding new markets and product lines [2]

-

Domestic substitution continues to deepen: VBP promotes the process of domestic substitution, and the market share of domestic enterprises continues to increase

Based on the response strategies and fundamental performance of each enterprise, the recommended attention order is as follows:

- Chunli Medical: The internationalization strategy has been successfully implemented, and performance has begun to stabilize and rebound

- Dabo Medical: Category expansion has achieved remarkable results, and the growth rate of net profit attributable to parent company has returned to positive

- Weigao Orthopedics: Valuation is at a low level, with repair potential

- Aikang Medical: Balanced development, stable market position

- Sanyou Medical: Innovative layout is worth looking forward to, but needs time to verify

- Policy risk: VBP price reduction幅度 exceeds expectations, expansion of new VBP product categories

- Competition risk: Increased competition in the process of industry concentration

- Technical risk: New product R&D falls short of expectations, technical iteration risk

- International risk: Export business faces exchange rate fluctuations and trade policy risks

Although the orthopedic VBP policy has caused short-term shocks to the industry, it has also promoted the optimization and upgrading of the industry landscape. Leading enterprises have found their own development paths in the new market environment through different response strategies. With the stabilization of the policy environment and the deepening of enterprise adjustments, the orthopedic consumables industry is facing new investment opportunities. Investors should pay attention to enterprises that have successfully transformed, have core competitiveness and international layout capabilities.

[0] Jinling API Data

[1] Caixin Securities Research Report. Securities Research Report. January 24, 2025

[2] Caixin Securities Research Report. Securities Research Report. January 24, 2025

[3] Chunli Medical 2024 Annual Report. Beijing Chunli Zhengda Medical Devices Co., Ltd. March 31, 2025

[4] Sohu Stocks. From Halving to Soaring, 2025 Orthopedics “Squat and Stand Up”. May 28, 2025

[5] Caixin Securities Research Report. Mid-2025 Investment Strategy for Medical Devices and Traditional Chinese Medicine Sectors. July 13, 2025

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.