In-depth Analysis of Temu's Semi-Managed Model Transformation and PDD's Break-Even Prospects

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest market data, PDD Holdings currently has a stock price of $105.00, a market capitalization of $146.93亿, and a price-to-earnings ratio of 10.75x [0]. This valuation level is relatively reasonable compared to the average level of the technology industry, providing a buffer for transformation. The consensus analyst target price is $140.50, implying an upside potential of approximately 33.8% [0].

According to the in-depth analysis article data provided:

- GMV Share: Temu currently accounts for 9% of PDD’s overall GMV

- Operating Margin: Currently -8%

- 2025 GMV Growth Forecast: 43%, targeting 5300亿 RMB (approximately $742 billion)

- Semi-Managed Share in US Market: Already reached 70%

Based on scenario analysis of annual operating margin improvement:

| Annual Improvement Rate | Break-Even Timeframe | Final Margin | Feasibility Within 2 Years |

|---|---|---|---|

| 2% | 4 years | +0.0% | ✗ No |

| 3% | 3 years | +1.0% | ✗ No |

| 4% | 2 years | +0.0% | ✓ Yes |

| 5% | 2 years | +2.0% | ✓ Yes |

Based on Temu’s expected 2025 GMV of $742 billion:

- Operating Income: $0 (just break-even)

- Impact on PDD Valuation: Neutral, mainly driven by growth expectations

- Additional Operating Income: $14.8 billion

- Valuation Impact (15x P/E): $222.6 billion

- New PDD Market Cap: $369.5 billion (151.5% increase)

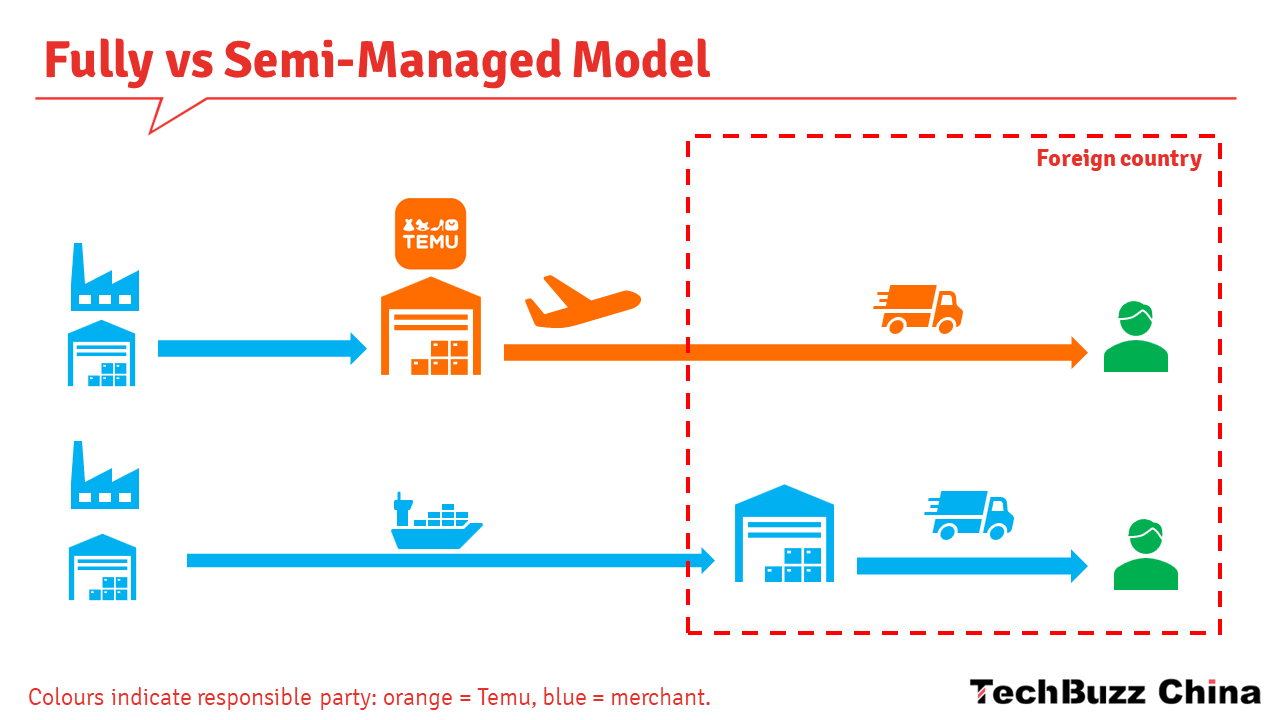

##4. Core Advantages and Challenges of Semi-Managed Model

- Cost Structure Optimization: Semi-managed model significantly reduces fulfillment costs and inventory risks

- Localization Adaptability: 70% semi-managed share in US market indicates strong localization capability

- Scale Effect Emergence: 43% GMV growth forecast shows business model validation

- Regulatory Risk: Potential impact of US tariff policies and EU data privacy regulations

- Competitive Pressure: Direct competition with giants like Amazon and Walmart

- Supply Chain Complexity: Increased difficulty in supply chain management under semi-managed model

##5. Competitive Landscape and Market Position

Compared to key competitors:

- Speed Advantage: Temu scores 8/10 in market expansion speed

- Cost Efficiency: Maintains a 7/10 advantage in price competition

- Localization Degree: Relatively weak, scoring5/10

- Regulatory Risk: Faces significant challenges, scoring4/10

##6. Investment Recommendations and Risk Assessment

- Semi-Managed Model Execution: Replicate US’s70% success to other markets

- Supply Chain Optimization: Further improve efficiency to support margin improvement

- Compliance Management: Effectively address regulatory requirements in欧美 markets

- Competitive Positioning: Find differentiated advantages against giants

Based on current 10.75x P/E ratio and33.8% upside from analyst target price, plus potential value from semi-managed transformation, PDD has medium-to-long-term investment value. However, investors need to:

- Closely Monitorquarterly execution, especially the trajectory of operating margin improvement

- Pay Attention toregulatory policy changes’ potential impact on international business

- Evaluatethe impact of competitive dynamics on market share and pricing power

##7. Conclusion

Temu’s semi-managed model transformation

Investors should view PDD as a

[0] Gilin API Data

[1] Temu-Owner PDD Posts Tepid Revenue Growth, Flags Volatility - Wall Street Journal

[2] Temu Parent PDD’s Results Beat Estimates Despite Tariff Exemption Loss - Investopedia

[3] Temu Owner PDD’s Profit Slides as Woes in the U.S. and China Mount - Wall Street Journal

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.