In-depth Analysis of Multi-Factor Combination Mechanisms and Bull-Bear Market Performance of Strategy-Based Value Indices

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

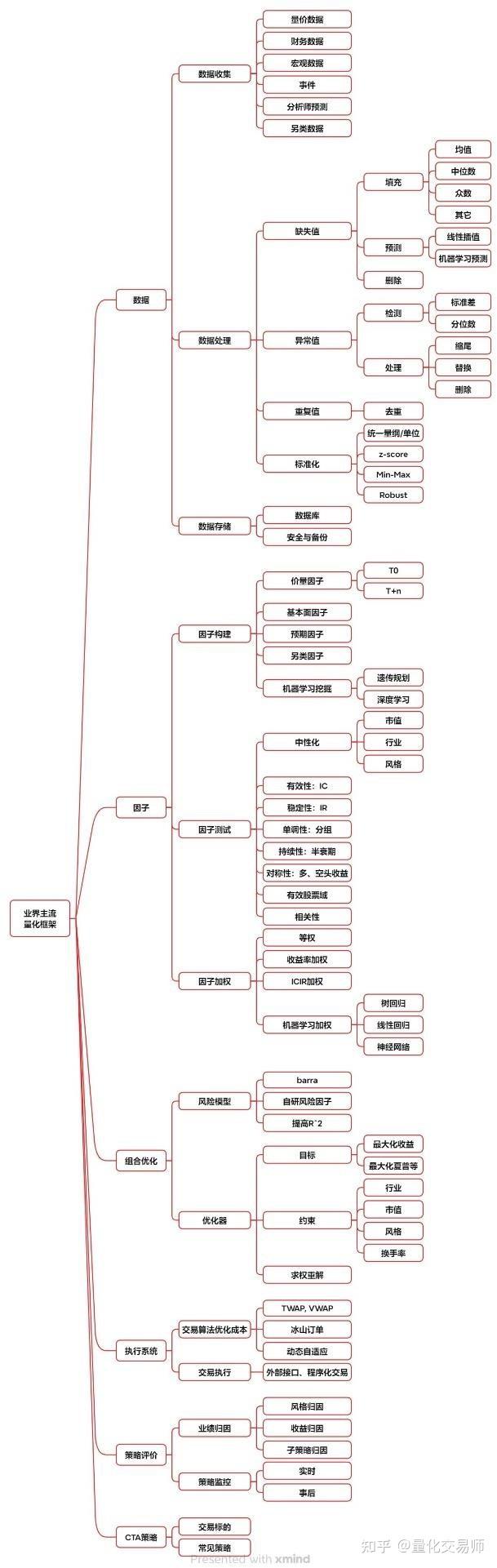

Strategy-based value indices effectively improve A-share investment win rates through systematic multi-factor combinations, with core mechanisms reflected in four dimensions:

As can be seen from the chart, multi-factor value strategies achieve risk-return optimization through scientific factor weight allocation:

- Value Factor(30% weight): Provides basic margin of safety

- Quality Factor(30% weight): Ensures healthy corporate fundamentals

- Low Volatility Factor(20% weight): Reduces portfolio volatility

- Momentum Factor(20% weight): Captures trend opportunities

This balanced weight design allows the strategy to maintain the core of value investing while significantly improving adaptability in different market environments.

Traditional market capitalization weighting has a “large-cap bias” problem, while strategy-based value indices adopt innovative methods such as

- Factor Weighting: Allocates weights based on comprehensive factor scores, with advantageous factors receiving higher allocations

- Equal Weighting: Avoids over-concentration and reduces individual stock risk

- Fundamental Weighting: Allocates weights based on fundamental indicators such as revenue and profit

In bull market environments, the performance of various strategies shows significant differences:

In bear market environments, defensiveness becomes a key consideration:

Based on risk-return analysis, strategies can be divided into three categories:

Based on historical data analysis, it is recommended to adopt a

- Bull Market Phase: Prioritize allocation to high-offensive strategies such as Huazheng Value Preferred 50

- Volatile Phase: Allocate to balanced strategies such as CSI Smart Select 300 Value Stable

- Bear Market Phase: Focus on allocation to defensive strategies such as the Dividend Value Index

For long-term investors, it is recommended to adopt a

-

Multi-Factor Combinations Are Effective: Through scientific multi-factor combinations, strategy-based value indices significantly improve investment win rates

-

No Perfect Single Strategy: Different strategies have their own advantages in different market environments, so selection needs to be based on market conditions

-

Clear Risk-Return Characteristics: Huazheng Preferred 50 is suitable for offense, Dividend Value for defense, and CSI Smart Select for balance

-

Obvious Long-Term Allocation Value: From a 10-year perspective, these strategy-based value indices generally outperform market benchmarks

[0] Gilin AI Financial Data API - Multi-Factor Analysis and Bull-Bear Market Performance Evaluation of Strategy-Based Value Indices

[1] Stock Market Dynamic Analysis Weekly - Value Investment Strategy and Index Performance Analysis in the A-Share Market

[2] Index Investment Era Special Topic - Development Status and Prospect Analysis of Strategy-Based Index Products

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.