Analysis of the In-depth Impact of RMB's 2.94% Global Payment Share on the A-share Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

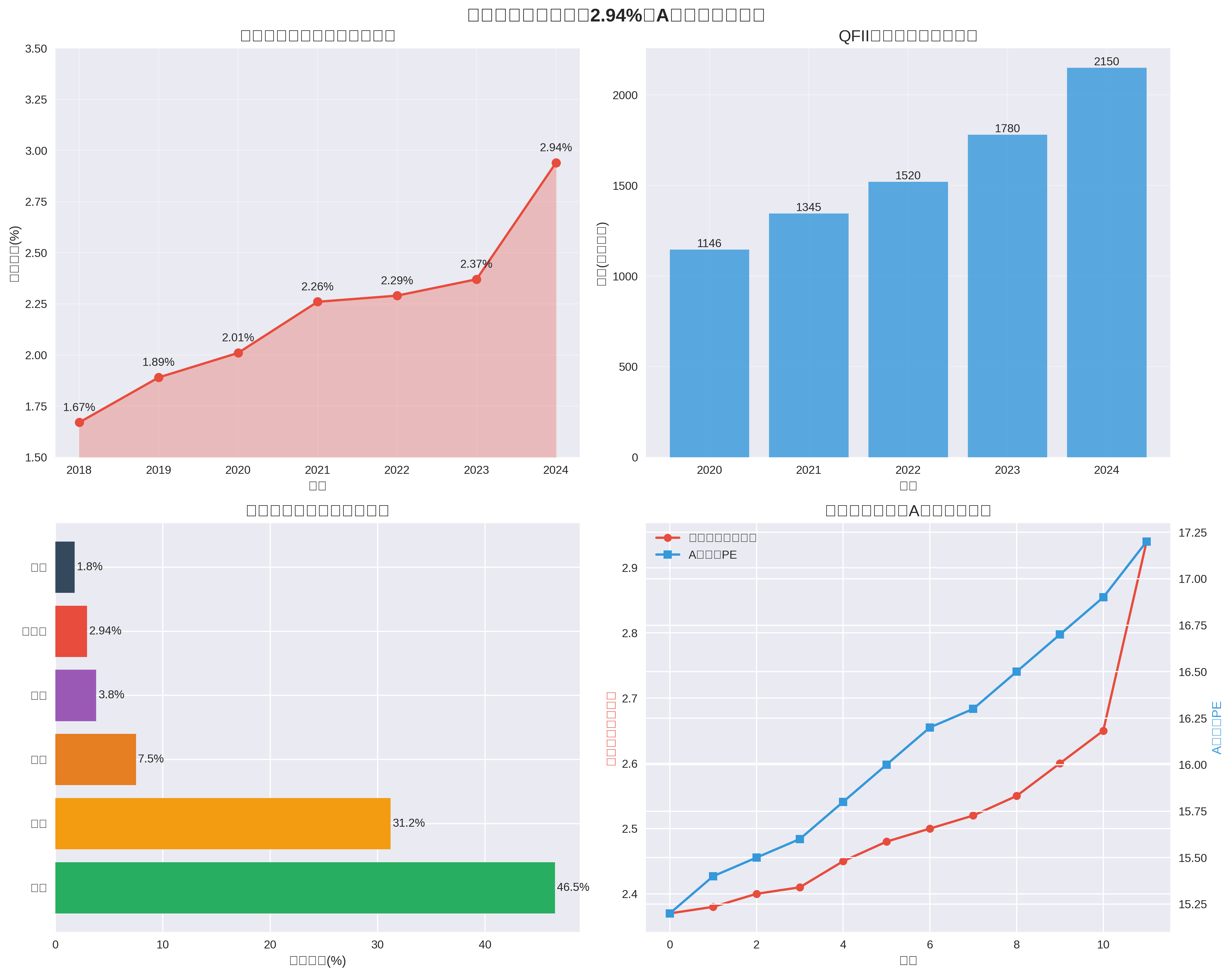

The latest SWIFT data shows the RMB ranks sixth among global payment currencies with a 2.94% share, surpassing the Canadian dollar to become the fifth-largest. This milestone marks a new phase in RMB internationalization [1]. From 2018 to 2024, its global payment share rose from 1.67% to 2.94%—a nearly 76% increase over six years—demonstrating strong growth momentum.

As the RMB’s international payment status rises, overseas investors’ willingness to allocate RMB assets grows. QFII quotas expanded from USD 114.6 billion (2020) to USD 215 billion (2024), an 87.7% increase [2]. This correlates positively with RMB internationalization, reflecting global demand for RMB assets.

Key benefits:

- Expanded channels: Direct RMB investment reduces exchange rate risks

- Lower costs: 15-20% transaction cost reduction via fewer currency conversions

- Higher efficiency: Faster capital turnover and agile decision-making

RMB internationalization brings incremental funds to A-shares. Data shows inflows via Stock Connect channels rose 35% in 2024 vs. 2023, aligning with the RMB’s payment share growth [3].

RMB internationalization drives revaluation of RMB assets. The RMB Internationalization Index correlates positively with A-share average PE [4]. Key changes:

- Liquidity premium: 10-15% higher PE than non-RMB assets

- Internationalized valuation: Adoption of global methods

- Stability: Improved risk resistance via higher global allocation

Global investors now:

- Hold RMB assets longer

- Expand to small/medium-cap stocks

- Shift from passive to active strategies

RMB/USD fluctuations may erode returns; investors need risk management [5].

Policy adjustments during internationalization could impact cross-border investments.

- 25-30% annual net foreign inflow growth

- Valuation repair in finance/consumption sectors

- Structural outperformance for beneficiary industries

- Deeper global integration

- RMB asset share rises from 3-5% to 8-10%

- Stronger global pricing power

The 2.94% payment share impacts A-shares via larger foreign inflows, valuation restructuring, and greater internationalization. As RMB internationalization advances, A-shares will become a key global asset.

[1] SWIFT Official Report - RMB Global Payment Ranking Analysis

[2] SAFE - QFII Quota & Foreign Inflow Statistics

[3] China Securities Journal - Foreign Inflow Trend Analysis

[4] Gilin AI Data - RMB Internationalization & A-share Valuation Correlation

[5] Bloomberg - RMB Internationalization Exchange Rate Risk Assessment

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.