Earnings Season Workflow Optimization Framework with Calendar Integration

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on available financial data and industry best practices, here’s a comprehensive framework for optimizing earnings season workflow using calendar integration and live call synthesis to improve decision-making accuracy:

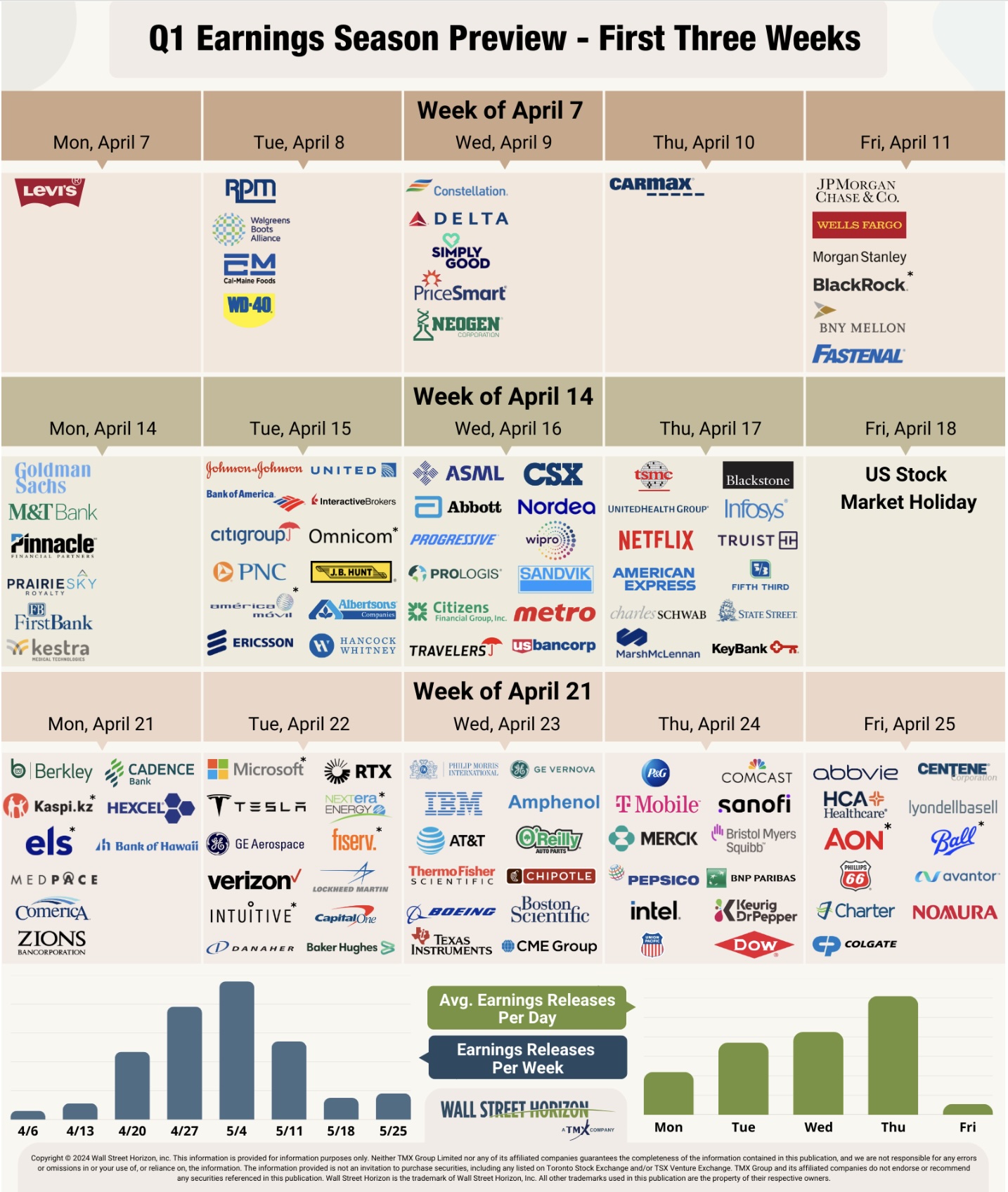

- Centralized Earnings Calendar: Utilize integrated earnings calendars that automatically sync with personal scheduling tools to create a unified view of all earnings events, conference calls, and key deadlines

- Tiered Alert System: Implement a multi-tiered alert system with different priorities for portfolio holdings, watchlist stocks, and sector peers

- Pre-Earnings Research Timeline: Establish automated reminders 7 days, 3 days, and 1 day before earnings calls to complete incremental research phases

- Historical Performance Review: Analyze previous 8 quarters of earnings reactions and management guidance patterns

- Consensus Expectations: Compile analyst estimates, revenue projections, and key operational metrics

- Guidance Range Analysis: Document management’s typical guidance ranges and historical accuracy

- Sector Context: Prepare relevant sector performance metrics and competitive positioning data

- AI-Powered Transcription: Deploy real-time transcription services with keyword detection for crucial terms like “guidance,” “outlook,” “margin pressure,” and “demand”

- Sentiment Analysis: Implement automated sentiment scoring during calls to identify tone shifts and confidence levels

- Financial Metric Extraction: Use automated systems to extract and validate key numbers in real-time

- Guidance Changes: Immediate detection of any forward-looking statement modifications

- Margin Commentary: Real-time tracking of gross margin, operating margin, and profit margin discussions

- Demand Signals: Monitoring of customer behavior, pipeline health, and order flow commentary

- Competitive Positioning: Tracking mentions of market share gains/losses and competitive pressures

- Immediate Reaction Assessment: Compare actual results vs. expectations across 5-7 key metrics

- Guidance Impact Analysis: Quantify the dollar impact of guidance changes on valuation models

- Margin Trend Evaluation: Assess whether margin commentary aligns with reported financials

- Cross-Referencing: Validate management commentary against competitor results and sector trends

- No Action Required: Results in line with expectations, guidance maintained

- Incremental Adjustment: Minor guidance changes, consider position size review

- Significant Rebalancing: Major guidance shifts, revenue trajectory changes, or margin pressure

- Urgent Review: Unexpected strategic shifts, management changes, or material restatements

- Multi-Platform Integration: Sync earnings calendars across Google Calendar, Outlook, and mobile devices

- Automated Reminders: Set up cascading reminders for research preparation, call attendance, and post-call analysis

- Team Collaboration: Share calendars with research teams for coverage coordination and insight sharing

- Real-Time Data Feeds: Integrate live market data during calls to assess immediate market reactions

- Cross-Reference Alerts: Set up alerts when management discusses metrics that differ from competitors

- Documentation Automation: Use automated note-taking with timestamp markers for key statements

- Focus on Fundamentals: Prioritize guidance and margin trends over short-term price reactions

- Historical Context: Compare current guidance changes to historical patterns and typical management conservatism

- Multiple Data Points: Synthesize information from earnings calls, SEC filings, and competitive intelligence

- Pre-Defined Criteria: Establish clear thresholds for what constitutes actionable information

- Second-Level Analysis: Require multiple data points before making significant portfolio changes

- Documentation Standards: Maintain detailed records of decision rationale and expected outcomes

- Response Time: Track time from earnings release to decision completion

- Accuracy Rate: Measure the percentage of decisions that align with subsequent stock performance

- Information Capture Quality: Assess completeness of key data point extraction during calls

- Quarterly Reviews: Analyze workflow effectiveness after each earnings season

- Tool Evaluation: Regularly assess and upgrade technology platforms

- Process Refinement: Continuously improve checklists and decision frameworks based on performance data

This framework helps investors transform earnings season from reactive trading to systematic analysis, improving decision accuracy by focusing on meaningful business fundamentals rather than market noise. The combination of calendar integration and live call synthesis creates a structured approach that reduces emotional decision-making while enhancing the quality and speed of investment analysis.

[0] Ginlix API Data

[1] Bloomberg - “Navigating Earnings Season: Essential Bloomberg Tools for Analysts” (https://www.bloomberg.com/professional/insights/webinar/navigating-earnings-season-essential-bloomberg-tools-for-analysts/)

[2] Bloomberg - “Five tools to enhance your earnings season analysis” (https://www.bloomberg.com/professional/insights/markets/five-tools-to-enhance-your-earnings-season-analysis/)

[3] Yahoo Finance - “Company Earnings Calendar” (https://finance.yahoo.com/calendar/earnings/?fr=sycsrp_catchall)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.