Analysis of China's Social Retail Data-Stock Market Divergence & Consumer Stocks Investment Value

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the background information you provided and the latest data obtained, I will conduct an in-depth analysis of the divergence between China’s social retail data and the stock market, and systematically evaluate the investment value of consumer stocks.

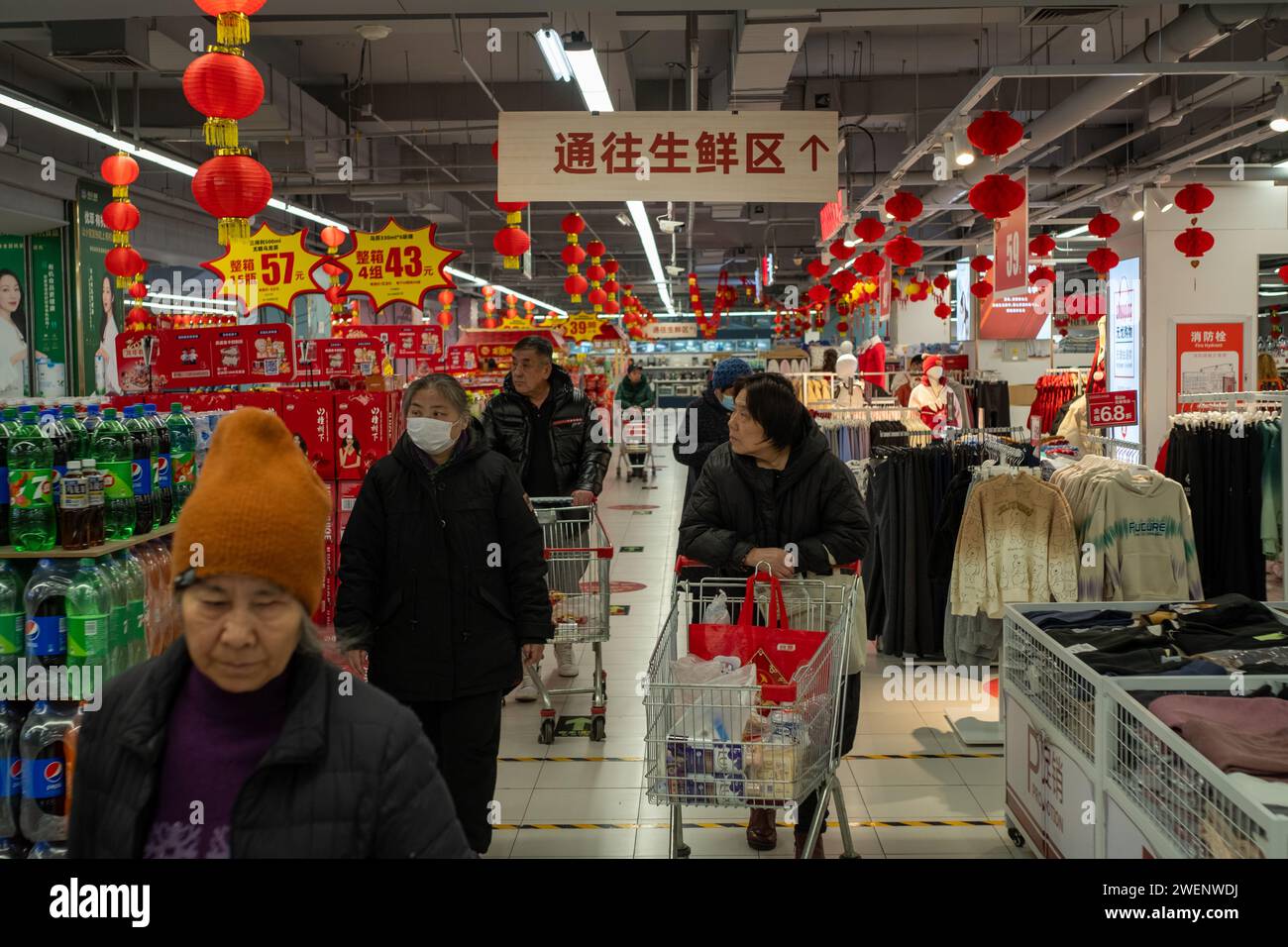

China’s November 2023 social retail sales data grew by 1.3% year-on-year, hitting the lowest monthly level since 2023, far below the market expectation of 2.8%[1]. This data reflects the deep weakness in the consumer market:

- Severe Differentiation in Consumption Structure: Auto consumption fell by 8.3% year-on-year, while real estate-related consumption (building materials, furniture, home appliances) all saw significant declines

- High-end Consumption Significantly Impacted: Cumulative revenue of high-end baijiu dropped by 6.2% from January to November, with an 11% decline in November alone

- Industrial Production Slowed Simultaneously: The value-added of industrial enterprises above designated size increased by 4.8% year-on-year, the lowest level since August 2024[2]

According to online search results, Chinese consumers generally have a “tighten their wallets” phenomenon, and the targeted stimulus measures the government is trying have so far had little effect[1]. This consumer apathy mainly stems from:

- Continuous adjustment of the real estate marketdragging down the related consumption chain

- Weak employment and income expectationsleading to a decline in residents’ consumption willingness

- Insufficient consumer confidenceand increased tendency for precautionary savings

From the six representative consumer stocks we analyzed, the performance in 2024 showed significant differentiation:

- Ningde Times: Annual increase of 73.06%, the best performance in the consumer sector[0]

- BYD: Annual increase of 47.79%, strong demand for new energy vehicle consumption[0]

- Kweichow Moutai: Annual decline of 6.74%, insufficient demand for high-end consumption[0]

- Wuliangye: Annual increase of only 6.76%, weak growth in high-end baijiu[0]

- Midea Group: Annual increase of 35.81%, export business supported performance[0]

- Gree Electric: Annual increase of 35.65%, benefited from product upgrades[0]

Although social retail data is weak, the overall average return rate of consumer stocks reached 32.05%, and 5 out of 6 stocks recorded gains[0]. This divergence phenomenon mainly stems from:

- The market expects the government to introduce more consumer stimulus policies

- Investors layout consumer stocks that benefit from future policy dividends in advance

- The trend of new energy vehicles replacing traditional car consumption is clear

- Export-oriented home appliance enterprises benefit from RMB depreciation and international demand

- Kweichow Moutai: P/E 19.91x, P/B 6.97x, ROE 36.48%[0]

- Wuliangye: P/E 15.08x, P/B 3.01x, ROE 20.15%[0]

- Midea Group: P/E 13.50x, P/B 2.74x, ROE 20.25%[0]

- Moutai: Net profit margin 51.51%, gross profit margin 71.37%, current ratio 6.62[0]

- Wuliangye: Net profit margin 34.59%, gross profit margin 46.67%, current ratio 4.59[0]

- Midea Group: Net profit margin 9.90%, gross profit margin 9.16%, but high proportion of overseas business[0]

According to technical analysis, Moutai is currently in a sideways consolidation state with no clear buy or sell signals; the reference trading range is [1528.48, 1586.86][0].

- High-end baijiu still faces consumption weakness pressure in the short term; it is recommended to wait and see

- Pay attention to consumer stimulus policies that the government may introduce, especially in the auto and home appliance sectors

- Home appliance enterprises like Midea Group benefit from export business and product upgrades

- Consumer stocks related to the new energy vehicle industry chain have growth potential

- High-end baijiu brands have deep moats, and valuations have a safety margin

- As residents’ income improves, high-end consumption demand is expected to gradually recover

- The trend of new energy vehicles replacing traditional cars remains unchanged

- Emerging consumption areas such as smart home appliances and health consumption have growth potential

- Consumption recovery is less than expected: If social retail data remains weak, it will suppress the performance of consumer stocks

- Limited policy effect: If the stimulus policy is insufficient or ineffective, market expectations may fail

- Deterioration of external environment: Global economic slowdown may affect export-oriented consumer enterprises

The divergence between China’s social retail data and stock market performance reflects the market’s advance response to policy expectations. Obvious differentiation has emerged within consumer stocks:

- Short-term Avoidance: It is recommended to avoid traditional consumer stocks highly dependent on domestic consumption, such as high-end baijiu

- Key Focus: Export-oriented home appliance enterprises and consumer stocks related to the new energy vehicle industry chain

- Long-term Layout: High-quality consumer leaders can be laid out at low prices when valuations are reasonable, waiting for consumption recovery

Current consumer stock investment should focus on structural opportunities; the overall allocation ratio is recommended to be controlled at a medium-to-low level, and gradually increase positions after clear improvement signals appear in consumption data.

[0] Gilin API Data

[1] The Wall Street Journal - “Chinese Consumers Tighten Their Wallets, Space for Boosting Domestic Demand Policies Squeezed” (https://cn.wsj.com/articles/中國消費者捂緊錢袋-提振內需政策空間受擠壓-6a7e97e4)

[2] The Wall Street Journal - “China’s Economic Indicators Deteriorate Across Multiple Areas” (https://cn.wsj.com/articles/china-seconomic-activity-loses-steam-3d668020)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.