In-depth Analysis of Pinduoduo (PDD): Can Temu's Semi-Managed Model Support Break-Even and Valuation Revaluation Within 2 Years?

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on current market data [0] and business analysis,

- Two-year stock price trend: From $143.32 at the start of 2023 to the current $105.00, a cumulative drop of 26.74% [0]

- Volatility analysis: Daily average volatility of 3.02%, annualized volatility of approximately 31.40%, indicating highly sensitive market sentiment

- Valuation level: Current PE ratio of 10.75x, significantly lower than the industry average, reflecting market doubts about growth prospects

According to the latest financial report data [0]:

- Operating profit margin: 22.10% (mainly from domestic Pinduoduo main site business)

- Net profit margin: 24.43%, showing strong profitability of core business

- ROE: 29.30%, excellent capital utilization efficiency

- Liquidity: Current ratio of 2.36, stable financial structure

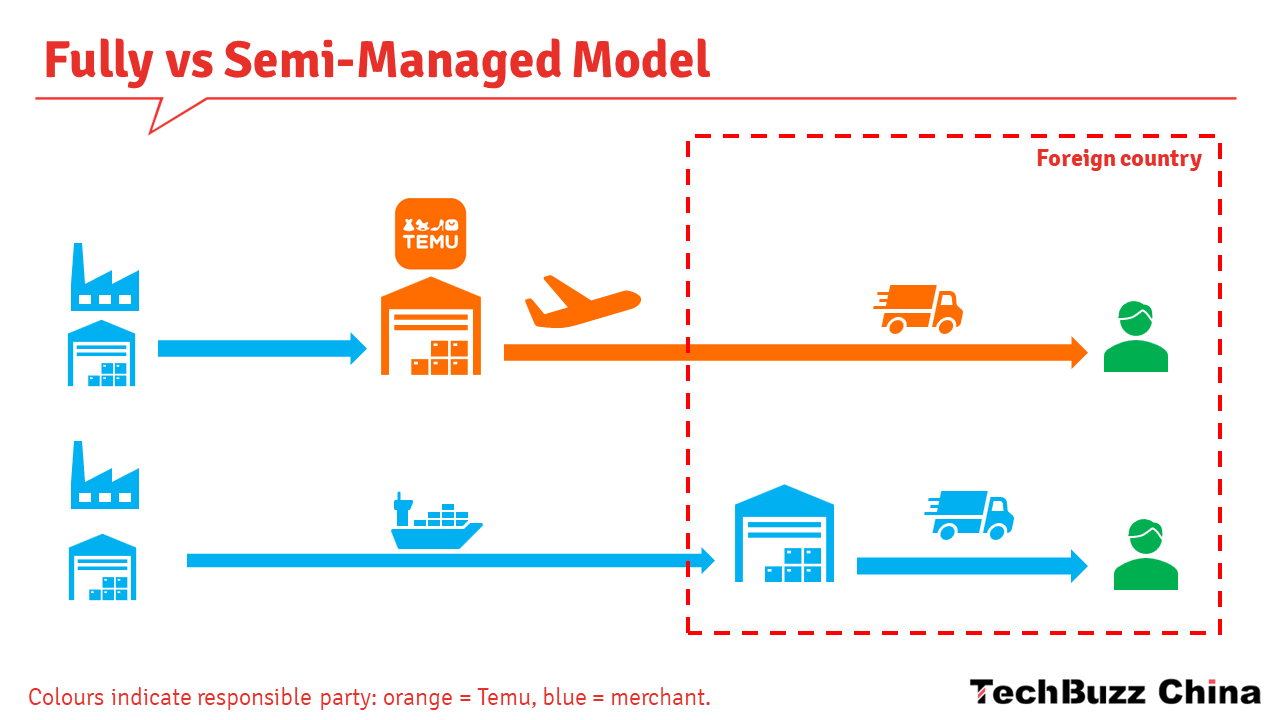

Temu’s semi-managed model (Y2 model) was launched in the US in March 2024, with core advantages including:

- Reduce warehousing costs by 30%-50% [1]

- Mandatory use of TEMU platform waybills to optimize last-mile logistics

- Total logistics cycle of 14 days (9 days for stock preparation +5 days for delivery)

- Exclusive search recommendation traffic support for semi-managed model [1]

- Relaxation of penalties for delayed delivery, even exemption from compensation

- Priority exposure in blue ocean categories

According to the latest industry analysis [2]:

- 2025 GMV forecast: 530 billion RMB, year-on-year growth of 43%

- US market structure: Semi-managed model accounts for 70% of US GMV

- Global position: Temu maintains a leading position in global e-commerce app downloads and monthly active users

- Temu accounts for approximately 9% of PDD’s total GMV, but operating profit margin is -8%

- US market importance: Accounts for 31% of Temu’s global GMV, but growth is affected by tariff policies

- Q4 2025 break-even forecast: Based on cost optimization effects of semi-managed model

- Logistics costs significantly reduced through semi-managed model

- 30%-50% reduction in warehousing costs improves cash flow

- Scale effect begins to emerge

- Revenue/GMV ratio is expected to increase from 12% in 2024 to 20% in 2027

- Increase in proportion of high-margin products

- Local Seller Program (LSP) contributes higher profit margins

- Strong growth in European market, year-on-year growth of 80%-100%

- Rapid expansion in emerging markets such as Latin America and Southeast Asia

- Reduce dependence on the US market

- Impact of US tariffs: Trump administration raises tariffs to 145%, cancels $800 duty-free policy [1]

- EU investigation: European regulators raid Temu’s Dublin headquarters to investigate alleged Chinese subsidies [2]

- French new regulation: Impose a 2 EUR tax on packages below 150 EUR starting from 2026

- Amazon’s counterattack: Launch similar low-price product strategy

- Shein competition: Outperforms Temu in some parts of Europe

- Rise of local platforms: Local e-commerce platforms in various countries receive policy support

- Logistics complexity: Semi-managed model has higher requirements for merchants’ operational capabilities

- Compliance costs: Regulatory differences among countries increase operational costs

- Brand image: Low-price strategy faces doubts about quality and sustainability

- US market achieves break-even as scheduled in Q4 2025

- European market maintains high growth of 80%-100%

- Semi-managed model accounts for more than 60% of GMV

- Current PE ratio of 10.75x → Target PE ratio of 15-18x

- Target price of $140.50 (+33.8% upside potential) [0]

- Market capitalization revaluation to $180-200 billion range

- Achieve overall break-even in 2026

- US market growth recovers moderately

- Semi-managed model is successful but efficiency is lower than expected

- PE ratio repairs to 12-14x

- Stock price rebounds to $120-130 range

- Partially reflects Temu’s long-term value

- US and EU regulatory policies continue to tighten

- Promotion of semi-managed model is hindered

- Increased competition leads to market share loss

- PE ratio remains below 10x

- Stock price fluctuates in the $90-110 range

- Temu’s business value is significantly discounted

- Temu’s operational data in Q1 2025 financial report

- Specific implementation of US tariff policies

- Growth in number of merchants joining the semi-managed model

Maintain cautious observation, wait for clearer break-even signals

- Whether the US market achieves break-even in Q4 2025

- Verification of sustainable growth in European market

- Revenue contribution of Local Seller Program (LSP)

If Q4 data meets expectations, there may be a valuation repair market

- Temu becomes one of the top three global e-commerce platforms

- Semi-managed model becomes industry standard

- PDD transforms from Chinese e-commerce leader to global technology platform

If strategic goals are achieved, PE ratio can rise to 15-20x, and stock price is expected to break through $150

Temu’s semi-managed model

However,

- Friendliness of regulatory environment

- Execution efficiency of semi-managed model

- Evolution direction of competitive landscape

[0] 金灵API数据

[1] 极风WMS Blog - “TEMU半托管Y2模式分析” (https://www.jfwms.com/blog/zh_CN)

[2] Tech Buzz China - “Temu Watch 10: Logistics in times of tariffs” (https://techbuzzchina.substack.com/p/temu-watch-10-logistics-in-times)

[3] Business of Fashion - “Temu-Owner PDD Fires Dozens of Workers After Fistfight With China Officials” (https://www.businessoffashion.com/news/retail/temu-owner-pdd-fires-dozens-of-workers-after-fistfight-with-china-officials/)

[4] Retail Touchpoints - “Temu Launches Shopify Seller Integration” (https://www.retailtouchpoints.com/topics/digital-commerce/temu-launches-shopify-seller-integration-in-bid-to-expand-u-s-based-assortment)

[5] The Guardian - “EU watchdogs raid Temu’s Dublin HQ in foreign subsidy investigation” (https://www.theguardian.com/business/2025/dec/11/eu-watchdogs-raid-temu-dublin-subsidy-investigation)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.