MediciNova Chemotherapy-Induced Neuropathy Trial Enrollment Completion Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the information I have collected, I will analyze the impact of MediciNova’s completion of enrollment in its chemotherapy-induced neuropathy trial for you:

MediciNova’s key asset MN-166 is an oral small molecule compound that exerts its pharmacological effects by inhibiting phosphodiesterase-4 (PDE4) and inflammatory cytokines (including macrophage migration inhibitory factor MIF) [5]. This dual mechanism of action gives it unique advantages in the treatment of chemotherapy-induced peripheral neuropathy (CIPN).

Chemotherapy-induced peripheral neuropathy is an important area of unmet medical need:

- The market size is expected to grow from $1.5 billion in 2024 to $3.2 billion in 2033, with a compound annual growth rate (CAGR) of 9.2% [6]

- Another report shows the market will grow from $1.78 billion in 2025 to $2.49 billion in 2029, with a CAGR of 8.8% [6]

- The U.S. neuropathic pain market was $3.01 billion in 2025 and is expected to reach $5.92 billion by 2034, with a CAGR of 7.81% [6]

Up to 50% of patients receiving chemotherapy develop CIPN, which causes tingling, numbness, and pain in the hands and feet. Due to limited effective treatments, many patients have to reduce or terminate their treatment early [3].

As of December 18, 2025, MediciNova’s stock price was $1.47, with a market capitalization of $72.09 million [0]. The company is currently in the clinical stage, and its financial indicators show:

- P/E ratio of -6.10x [0]

- Current ratio as high as 13.26, indicating good liquidity [0]

- Consensus analyst rating is “Buy”, with all 4 analysts giving a Buy rating [0]

Completion of patient enrollment is a key milestone in clinical trials, meaning:

- Reduced trial execution risk: The enrollment phase is usually one of the most challenging stages in clinical trials

- Accelerated data readout timeline: The company can more accurately predict the timing of trial result announcements

- Enhanced pipeline certainty: Provides a clearer timeline for subsequent commercialization paths

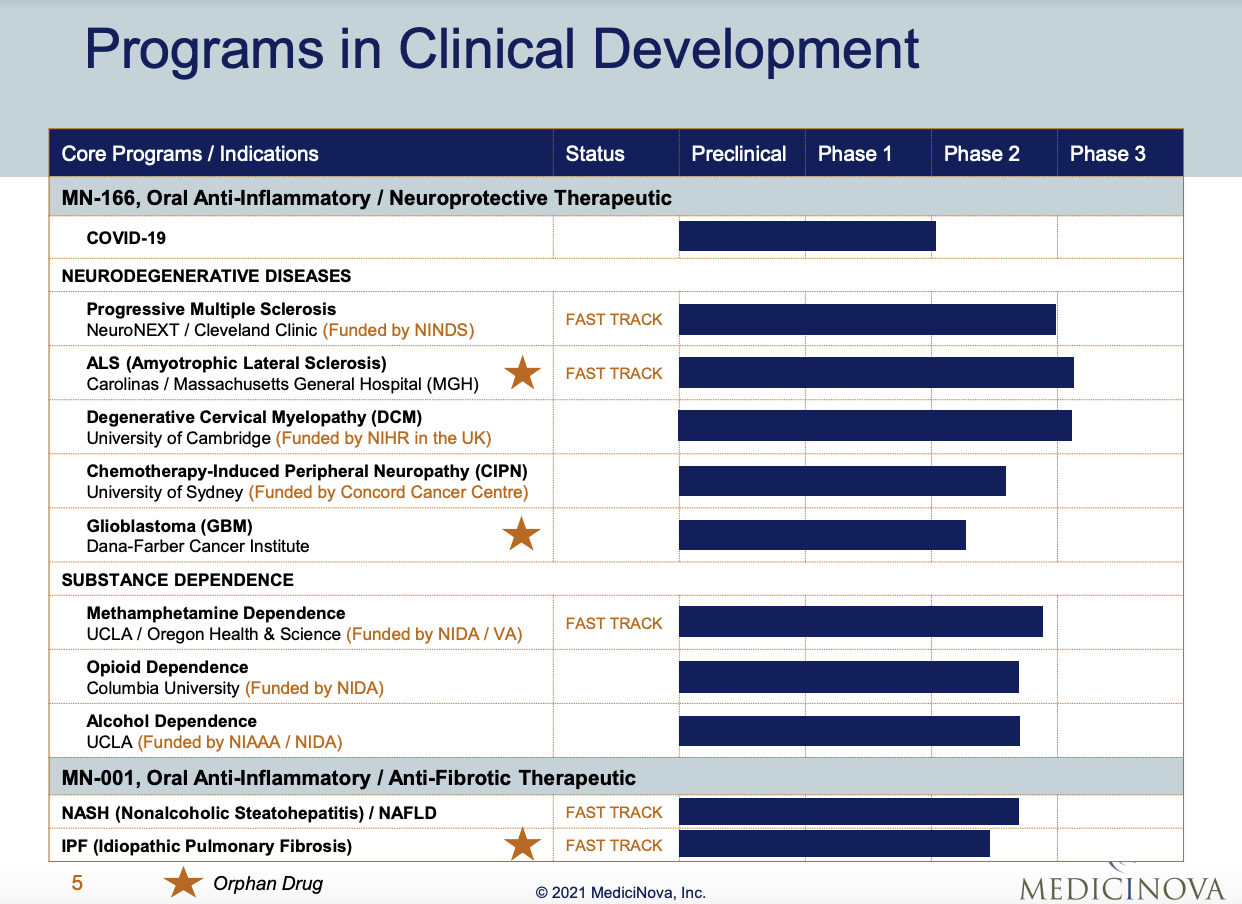

MediciNova has developed 11 clinical programs based on two compounds, MN-166 and MN-001 [5]:

- MN-166 is currently in Phase 3 trials for ALS and degenerative cervical myelopathy (DCM)

- It is ready for Phase 3 trials for progressive multiple sclerosis (MS)

- It is also in Phase 2 trials for Long COVID and substance dependence [5]

The company has performed well in securing research funding:

- The ALS program received $22 million in NIH funding for an expanded access program [5]

- It has a good track record in government-funded investigator-initiated clinical trials [5]

- Uncertainty of clinical results: Although completing enrollment is an important milestone, efficacy and safety data are still pending

- Regulatory approval risk: Even if the trial is successful, there is still uncertainty in the FDA approval process

- Commercialization challenges: As a small biotech company, commercialization capabilities need to rely on partners

- First-mover advantage: The CIPN field lacks effective treatment options, so a successful product may gain market leadership

- Pipeline synergy: Success may drive the development value of other indications

- Strategic cooperation potential: Positive data may attract cooperation or acquisition interest from large pharmaceutical companies

MediciNova’s completion of enrollment in the CIPN trial is an important positive catalyst, but investor reactions will depend on several key factors:

Considering the huge unmet need and rapidly growing market potential of the CIPN market, as well as MediciNova’s diversified pipeline layout, this milestone event has positive implications for the company’s long-term development.

[0] Jinling API Data

[3] ScienceDaily - “A drug already in trials may stop chemotherapy nerve damage” (http://www.sciencedaily.com/releases/2025/11/251121090729.htm)

[5] NASDAQ/Investor News - “MediciNova, Inc. Reports Progress in Enrollment for Clinical Trials” (https://www.nasdaq.com/articles/medicinova-inc-reports-progress-enrollment-clinical-trials-mn-166-and-mn-001)

[6] Market Research Reports - Chemotherapy Induced Peripheral Neuropathy Treatment Market Analysis (https://www.globenewswire.com/news-release/2025/11/17/3189325/0/en/2-95-Bn-Chemotherapy-Induced-Peripheral-Neuropathy)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.