In-Depth Analysis of PSQ Holdings' 536% Growth on Black Friday

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

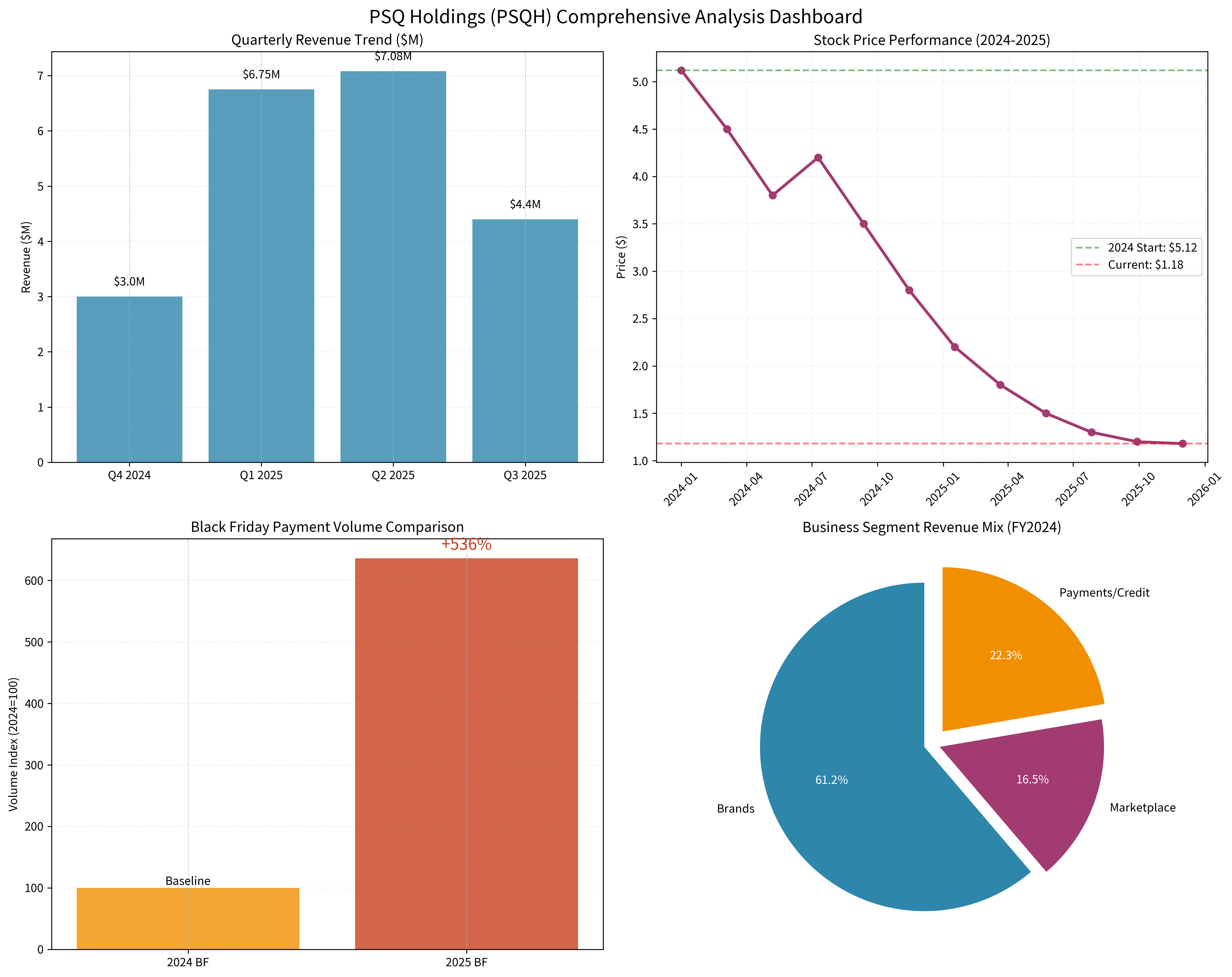

PSQ Holdings (PSQH), a fintech company focused on value alignment, achieved a 536% growth in payment processing volume during Black Friday, with key drivers including:

From financial data, the company shows strong growth momentum in its fintech business [0]:

- Q3 2025 Revenue: $4.4M, up 37% YoY; EPS improved to $(0.26)

- Fintech Segment Performance: Payment business grew 50% QoQ, credit business grew 22% QoQ, overall fintech business grew 28% QoQ

- Operational Efficiency Improvement: Operating expenses decreased by $1.7M (13% drop), cash and equivalents reached $12.3M

- Technical Infrastructure Expansion: The company continues to invest in expanding payment and credit capabilities, building a scalable ecosystem with recurring revenue streams [1]

- Increased Merchant Stickiness: Expanding from single credit services to full payment services significantly increases merchant switching costs

- Operating Leverage Effect: As business scale expands, the effect of fixed cost amortization becomes obvious

- High Volatility: Annual stock price volatility reaches 13.45%, indicating significant disagreement in market expectations for the company [0]

- Profitability Challenges: Current net margin is -178.95%, ROE is -201.88%, indicating it is still in the investment phase [0]

- Cash Burn: Despite improved cash position, continuous business expansion requires significant capital investment

PSQ Holdings is transitioning from a traditional Marketplace model to a high-margin fintech platform. According to FY2024 data, the Brands business contributed 78.8% of revenue ($10.98M), and Marketplace accounted for 21.2% ($2.95M) [0]. The fintech business (payment + credit) is becoming a new growth engine; Q4 2025 guided revenue is approximately $6.0M, including $2.4M from payments and $3.6M from credit.

- Market Cap: $54.64M, Stock Price: $1.18, down 77% from 52-week high of $5.18

- Analyst Target Price: $3.50, with 196.6% upside potential from current price

- P/B Ratio: 3.65x, which is reasonable among tech stocks

- Increased Recurring Revenue Share: The recurring revenue nature of the fintech business will support higher valuation multiples

- Enhanced Network Effects: As more merchants join the PSQ payment network, the platform’s marginal cost decreases

- Niche Market Leadership: Established a strong brand moat in value-aligned niche markets

- Continuous increase in fintech revenue share

- Successful launch of new merchant partnerships

- Achievement of break-even point

- Continuous strengthening of value-aligned consumption trends

- Execution Risk: Complexity of executing the transition from traditional business to fintech

- Regulatory Risk: Payment and credit businesses face strict regulatory requirements

- Market Risk: Niche market size may limit long-term growth potential

- Liquidity Risk: Average daily volume of 1.17M; need to monitor liquidity conditions

PSQ Holdings’ 536% payment volume growth on Black Friday reflects the initial success of its strategic transformation; this growth has good sustainability supported by technical infrastructure expansion and deepening merchant ecosystem. Although it still faces profitability challenges in the short term, its leadership in value-aligned niche markets and transition to high-margin fintech business lay the foundation for long-term value creation. Investors should pay attention to its fintech revenue growth trend, profitability improvement process, and the degree of enhanced network effects.

[0] Gilin API Data - PSQ Holdings Company Overview, Financial Data, and Market Performance

[1] Business Wire - “PublicSquare to Power Payments for Aero Precision’s Firearms” (https://www.businesswire.com/news/home/20251209368114/en/PublicSquare-to-Power-Payments-for-Aero-Precisions-Firearms-Products-Parts-and-Accessories-Sales-Expands-Existing-Credit-Relationship-Into-Full-Payments-Partnership)

[2] StockTitan - “PublicSquare (PSQH) Black Friday GMV Jumps 536% in 2025” (https://www.stocktitan.net/news/PSQH/public-square-reports-strong-year-over-year-gmv-growth-for-payments-eqkeczn5kfmy.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.