2025-12-18: AI Tech Stocks Under Pressure Amid Rotation to Value Sectors

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

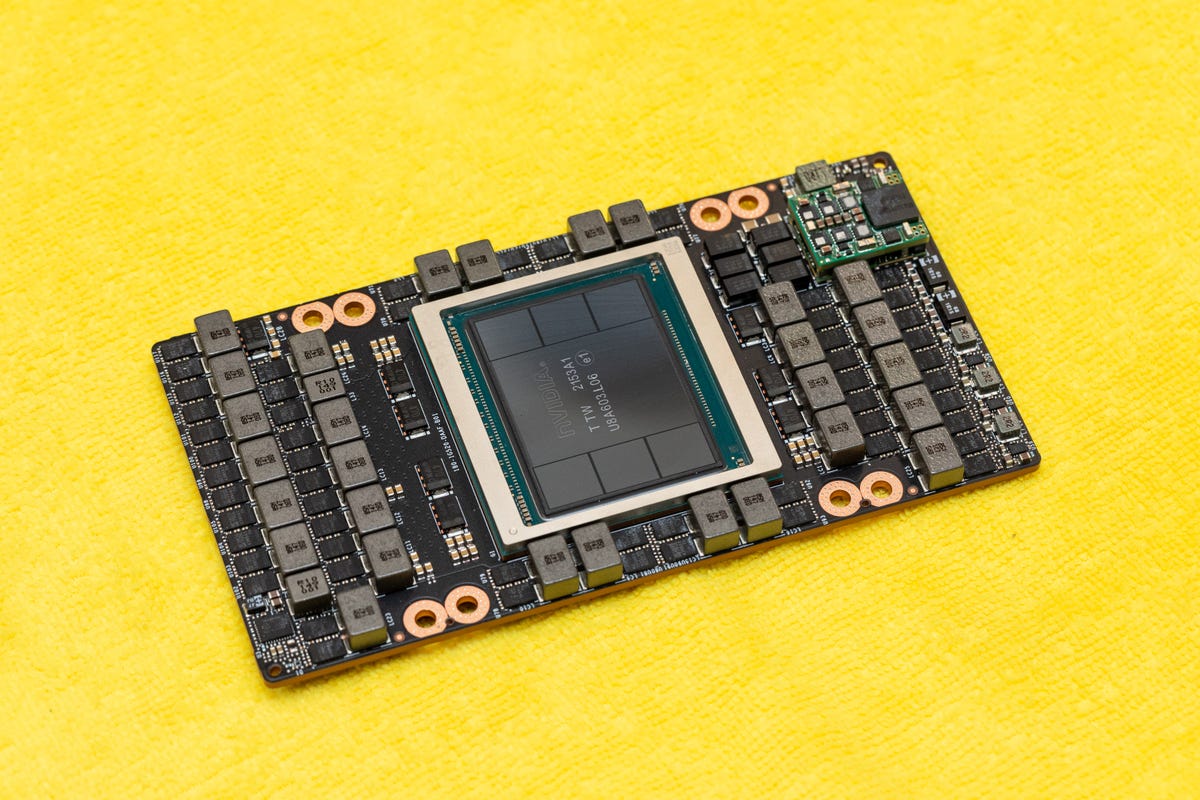

This analysis is based on the Seeking Alpha article [1] published on December 18, 2025, which highlights AI-driven tech stocks under pressure and a rotation to value sectors. The Technology sector declined by 2.27% on December 17 amid the AI stock selloff, with major players like Oracle (ORCL), Broadcom (AVGO), and Nvidia (NVDA) dragging the market lower [0][2]. The Dow Jones Industrial Average confirmed four straight sessions of losses from December 12–17 (-0.53%, -0.37%, -0.55%, -0.59%) [0][3], while the Nasdaq Composite fell 1.81% on December 17, extending a broader tech selloff that the article attributes to a fourth consecutive decline on December 18 [0][1].

Value-oriented sectors outperformed on December 17: Consumer Defensive (+0.36%), Energy (+0.22%), and Basic Materials (+0.06%) [0][2]. This rotation is driven by concerns over AI spending and financing timelines, amplified by a Financial Times report (via CNBC) that Blue Owl Capital paused financing for Oracle’s $10 billion Michigan data center [2]. The equally weighted S&P 500 (RSP) declined by only 0.35% on December 17—far less than the Nasdaq’s 1.81% drop—indicating broader market sentiment remains more resilient than tech-heavy indices [0]. An upcoming U.S. inflation report on December 18 may further impact market dynamics [4].

- Rotation Drivers: The shift from mega-cap tech to value sectors reflects investor skepticism about the short-term payoff of AI infrastructure investments, exacerbated by the Blue Owl financing pause [2].

- Market Sentiment Discrepancy: The resilience of the equally weighted S&P 500 (RSP) suggests the selloff is concentrated in tech stocks rather than a broader market decline [0].

- Cross-Region Impact: The tech selloff has spilled over to Asian markets, with Japanese tech stocks (including SoftBank) declining amid similar AI spending concerns [2].

- Risks: Uncertainty surrounding AI infrastructure financing and project timelines may continue to pressure tech stocks [2]; a prolonged rotation from growth to value could disrupt 2025’s mega-cap tech market leadership; the upcoming inflation report may amplify volatility [4].

- Opportunities: Value-oriented sectors (Consumer Defensive, Energy) are experiencing outperformance amid the rotation, offering potential relative strength [0][2].

- Tech Sector Performance: Technology sector down 2.27% on December 17; major AI stocks (ORCL, AVGO, NVDA) contributed to losses [0][2].

- Index Movements: Dow Jones (four straight losses December 12–17); Nasdaq Composite (1.81% drop December 17, fourth consecutive decline December 18 [0][1]); equally weighted S&P 500 (RSP) down 0.35% December 17 [0].

- Sector Rotation: Value sectors (Consumer Defensive +0.36%, Energy +0.22%) outperformed December 17 [0].

- Driving Factors: AI investment financing jitters (Blue Owl pause on Oracle data center funding) [2]; upcoming inflation report [4].

- Data Gaps: December 18 closing data for the Nasdaq is pending to confirm the fourth straight session; root causes of December 18 pre-market declines require further details [1].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.