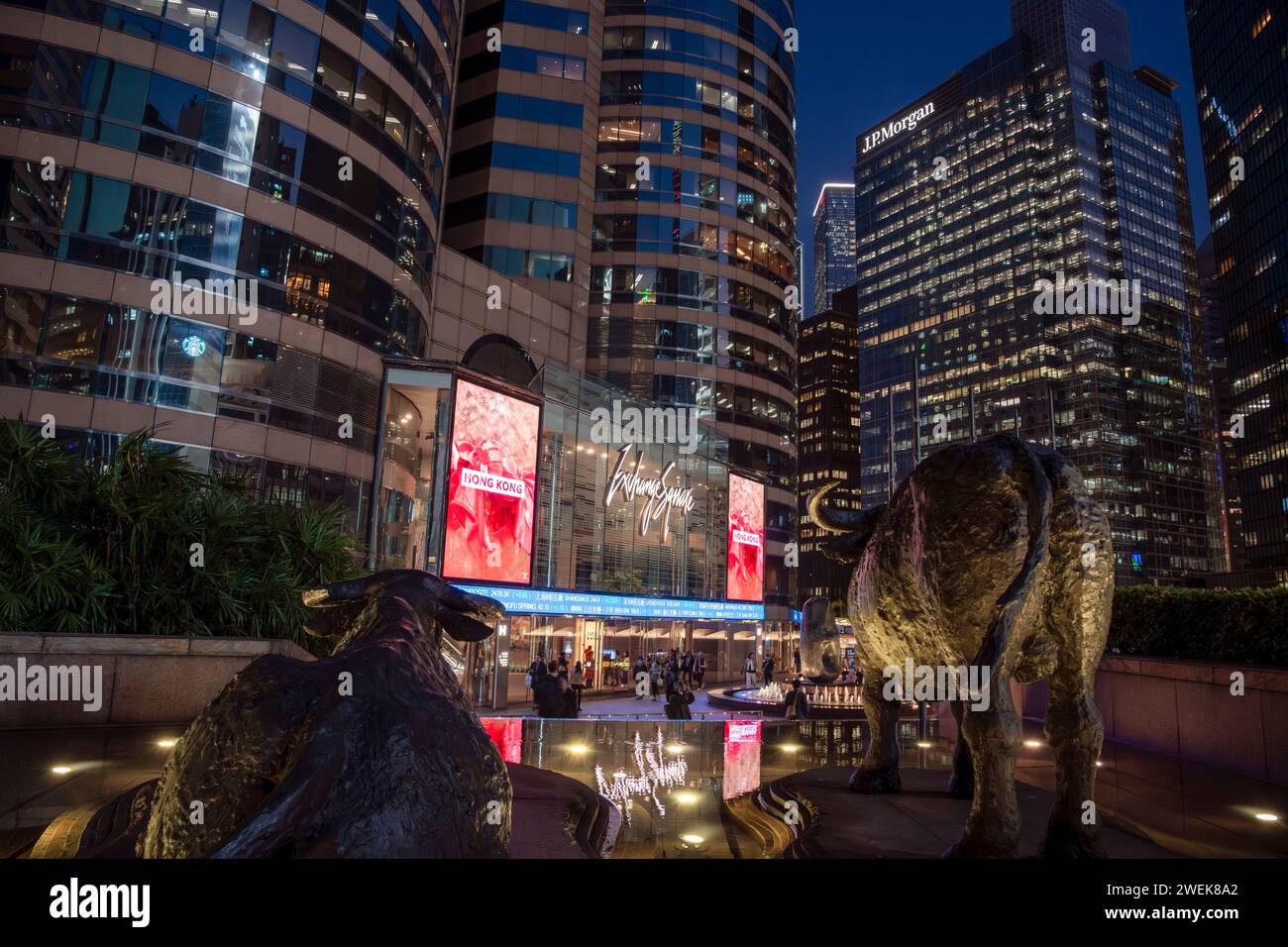

港股岁末交易窗口投资机会与优质资产分析

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

港股在2025年9月上涨后,10月进入震荡调整阶段,当前AH两地已同步完成中期调整,优质资产重新进入高性价比区间[0][1][2][3]。恒指2025年以来涨幅超28%,恒生科指涨超20%,领跑全球核心市场[5]。北水(南向资金)年内净买入额达1.4万亿港元,远超2024年全年,其中阿里巴巴-W、美团-W、腾讯等科技公司获大额抢筹[5]。机构普遍认为,港股作为离岸市场,流动性改善对市场影响迅速,北水持续流入和外资回流将推动估值中枢上移[5]。

- 内地投资者定价权增强:截至2025年三季度末,港股通持仓市值突破6.3万亿港元,占港股总市值12.7%,北水配置方向对港股影响显著[5]。

- 板块配置逻辑清晰:机构建议关注红利和成长板块,如互联网板块关注AI商业化拐点,创新药板块受益于医保调整,新消费关注高增长潮玩领域[1][3]。

- 流动性与盈利共振:北水增量资金、外资回流叠加企业盈利修复,成为港股岁末行情的核心驱动因素[5]。

港股当前处于中期调整完成后的高性价比区间,北水持续配置与年末宏观改善形成共振,科技、创新药等板块具备投资潜力。内地投资者定价权提升,流动性与盈利修复是核心驱动。但需密切关注外部环境与政策变化,理性评估投资风险与收益。

丰田2026年美国制造车辆日本销售战略分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.