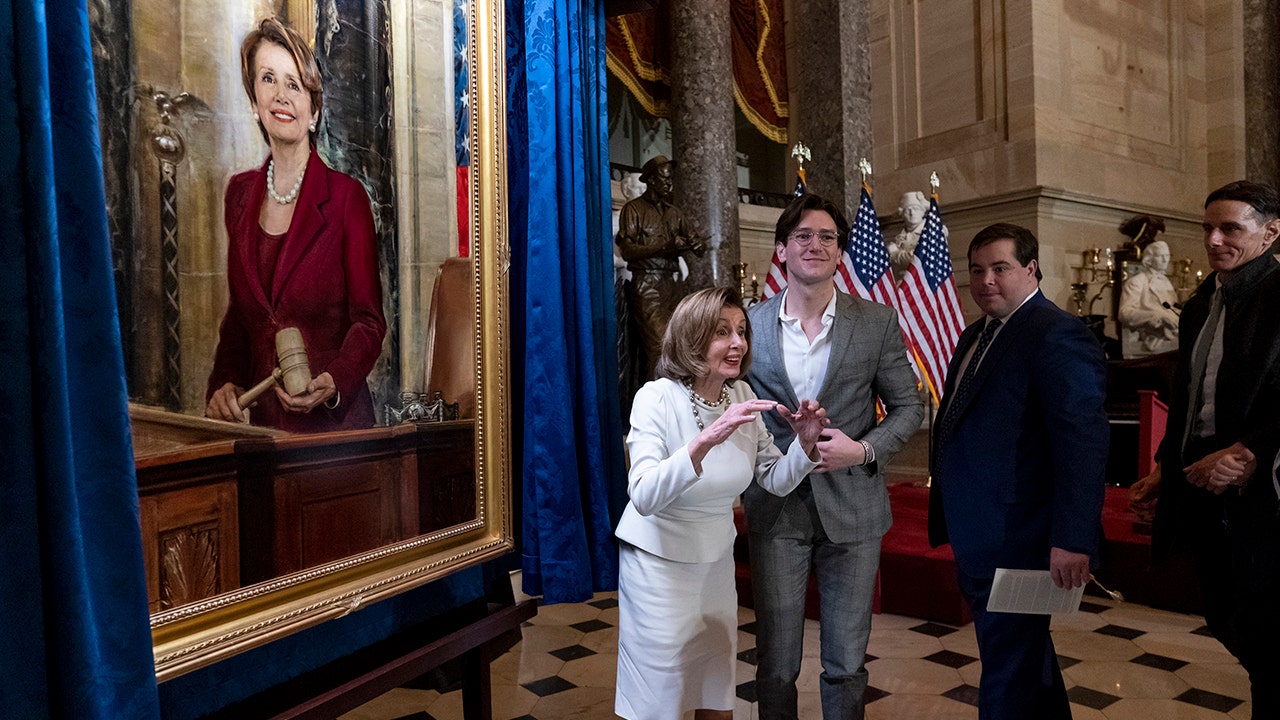

Analysis of Nancy Pelosi’s Long-Term Market Outperformance: Strategies, Controversies, and Retail Investor Insights

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Our analysis of Nancy Pelosi’s market performance identifies three core contributing factors [0]. First, her portfolio employs deep-in-the-money call options, limiting initial capital outlay while amplifying upside exposure to stock movements. Second, investments are concentrated in high-conviction, momentum-driven technology and semiconductor sectors, with notable positions in NVDA and GOOG—stocks that delivered extraordinary returns over the period. Third, trading activities are executed by her husband, Paul Pelosi, a seasoned venture capitalist with expertise in these sectors. Performance metrics highlight a 2024 return of ~71% for her trades, compared to the S&P 500’s ~25% over the same period [0].

Regulatory and ethical context is critical: the STOCK Act of 2012 mandates public disclosure of congressional trades, which applies to Pelosi’s portfolio [0]. However, the PELOSI Act—legislation banning members of Congress from owning individual securities—has stalled, sparking controversy. Allegations of information asymmetry, where congressional members may access non-public policy insights impacting markets, have led to calls for a GAO review of Pelosi’s trading history [0].

- Strategy Distinction: Pelosi’s options-focused, sector-concentrated approach contrasts with Buffett’s value-investing strategy, highlighting how specialized tactics can drive outperformance in tech-dominated bull markets.

- Systematic Advantage Risks: The controversy underscores potential unfair advantages tied to congressional access to early policy briefings—an edge unavailable to most retail investors.

- Regulatory Gaps: The stalled PELOSI Act exposes ongoing debates about balancing congressional members’ investment rights with the need to prevent market inequities.

- Risks for Retail Investors: Replicating Pelosi’s options strategy requires advanced expertise and carries significant loss risk if momentum reverses. Retail investors also lack access to the potential non-public policy insights that may inform congressional trades.

- Opportunities: Retail investors can learn from the focus on high-conviction, growth-focused sectors, though this should be paired with rigorous research and risk management.

- Regulatory Watch: The ongoing debate may lead to stricter congressional trading rules, reshaping portfolio management practices for members.

This analysis synthesizes findings on Pelosi’s market outperformance, including her options strategy, sector concentration, and the role of regulatory frameworks. The controversy surrounding potential information asymmetry highlights systemic issues in congressional trading. For retail investors, the insights emphasize aligning strategies with individual expertise and risk tolerance, while monitoring regulatory changes that could impact market fairness. No prescriptive investment recommendations are provided.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.