NVIDIA (NVDA) & Eli Lilly (LLY): 37% Portfolio Return Drivers & Volatile Market Risk-Adjusted Strategies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis evaluates the performance drivers of NVIDIA (NVDA) and Eli Lilly (LLY) in 2025, their contribution to a reported 37% annual portfolio return, and portfolio management strategies for volatile markets. Data covers the period up to December 20, 2025 [0].

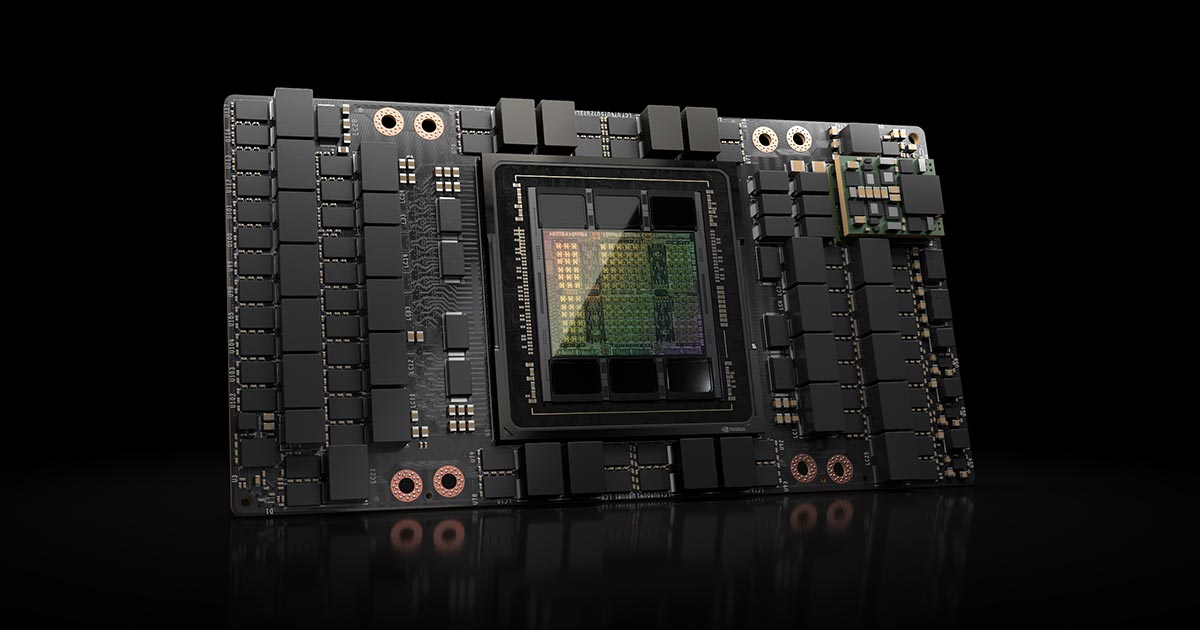

NVDA delivered a 33.08% YTD return through December 19, 2025 [0], fueled by surging demand for AI infrastructure: Q3 2025 data center revenue reached $30.8 billion (112% YoY growth) from Hopper/Blackwell GPUs, AI Enterprise revenue exceeding $2 billion (with major clients like Accenture and AWS), and sovereign AI partnerships in India and Japan [1].

LLY achieved a 37.26% YTD return [0] due to dominant GLP-1 drug performance: Zepbound (obesity) and Mounjaro (type 2 diabetes) generated $12 billion in Q3 2025 revenue, with Zepbound capturing 71% of new U.S. obesity prescriptions. Pipeline advancements (positive Phase III data for oral GLP-1 orforglipron) and global expansion (55 countries for Mounjaro) further drove growth [2].

-

Dual Growth Sectors Driving Returns: NVDA’s AI infrastructure (technology) and LLY’s GLP-1 drugs (healthcare) represent distinct, high-growth secular trends. Their complementary performance—with LLY directly matching the 37% portfolio return and NVDA contributing strong secondary growth—likely underpinned the reported portfolio result.

-

Risk Profile Balance: NVDA (3.16% daily volatility) is slightly more volatile than LLY (2.58% daily volatility) [0], creating a natural balance in concentrated positions. However, sector-specific and company-specific risks (e.g., NVDA export controls, LLY PBM pricing pressures) highlight the need for active risk management.

-

Modern Strategies Outperform Traditional: LLM-enhanced Black-Litterman models tested through February 2025 achieved higher Sharpe ratios than traditional mean-variance models [5], indicating potential for better risk-adjusted returns in volatile environments.

- Company-Specific: NVDA faces supply chain constraints for Blackwell systems, U.S.-China export controls, and AI hardware competition [1]. LLY confronts PBM pricing pressures, generic GLP-1 competition, and pipeline regulatory delays [2].

- Market-Specific: High sector valuations (technology/healthcare) and geopolitical/regulatory changes may trigger corrections [3,4].

- Portfolio-Specific: Concentrated exposure increases idiosyncratic risk, requiring ongoing rebalancing [3].

- NVDA’s AI infrastructure demand remains robust due to enterprise and sovereign AI initiatives [1].

- LLY’s GLP-1 pipeline (orforglipron) and global expansion offer upside [2].

- Diversification beyond S&P 500 exposure and modern optimization techniques can enhance risk-adjusted returns [3,5].

NVDA and LLY delivered strong 2025 YTD returns of 33.08% and 37.26%, respectively [0], driven by AI infrastructure demand and GLP-1 drug leadership. A portfolio with significant positions in these two stocks would align with the reported 37% annual return. To maximize risk-adjusted returns in volatile markets, recommended approaches include diversification, focus on high-quality companies, and LLM-enhanced optimization models [3,4,5].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.