Analysis of the Popularity Reasons and Market Prospects of Snowman Group (002639.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Price and Trading Performance: Snowman Group’s stock price has fluctuated significantly recently: it rose by 9.48% on December 11, 6.82% on December 12, 1.66% on the 17th, and 1.65% on the 19th. During the same period, the trading volume exceeded 3 million lots, far higher than the average level of 1.62 million lots on December 10 [0]. High trading volume and price fluctuations reflect increasing market attention.

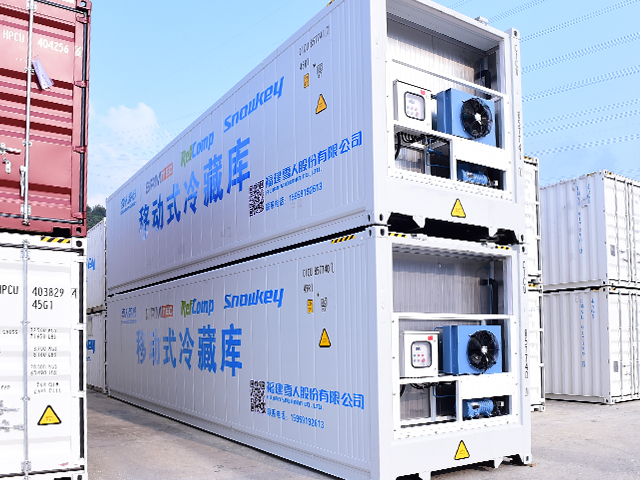

- Concept and News Drivers: The company is involved in multiple popular concepts such as cold chain logistics, fuel cells, hydrogen energy, and ice and snow industry. Sina Finance (2025-12-12) reported growth in its ice-making product business in the industrial and ice-snow sectors [1]. Data from Zhongcai.com shows that the company’s turnover rate reached 209.64% in the week ending December 20, indicating extremely high trading activity [2].

- Fundamental Status: The company has risen by 194.84% so far this year, but its price-to-earnings ratio is as high as 361.03 times, return on equity is only 1.67%, net profit margin is 1.60%, and profitability is weak [0]. There is a sharp contrast between high valuation and weak fundamentals.

- The company’s popularity is mainly driven by concept speculation, which contrasts with insufficient fundamental support, reflecting the short-term concept speculation characteristics of the A-share market.

- High turnover rate reflects剧烈 fluctuations in investor sentiment, with high short-term trading risks. However, popular concepts (hydrogen energy, cold chain logistics) align with industrial development directions, and there are potential long-term opportunities.

- The growth of the ice-making product business is one of the few fundamental bright spots; if it can be continuously expanded, it may bring performance support to the company.

- A high P/E ratio of 361.03 times implies significant overvaluation, with the risk of valuation correction [0];

- Low net profit margin and return on equity indicate weak profitability of the company, lacking long-term value support [0];

- High turnover rate and price fluctuations are likely to trigger sharp short-term corrections [0].

- Popular fields such as hydrogen energy and cold chain logistics have broad development prospects. If the company can achieve technological breakthroughs or business expansion, its performance is expected to improve [1];

- The growth of the ice-making product business shows its competitiveness in the niche field, with potential for sustained growth [1].

Snowman Group has become a market focus due to multiple popular concepts and short-term price fluctuations, but its fundamental characteristics of high valuation and weak profitability need attention. Currently, the popularity is more driven by speculative factors; short-term investors need to be alert to volatility risks, while long-term attention should be combined with its business expansion and performance improvement. This report only provides objective analysis and does not constitute investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.