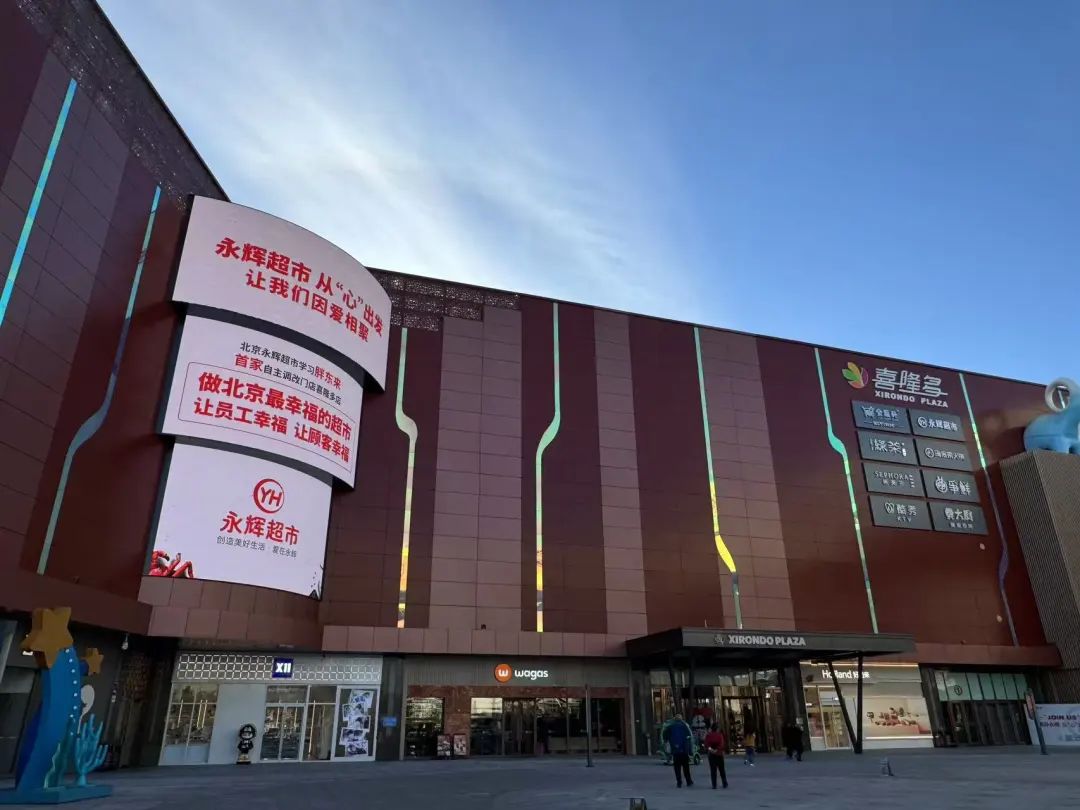

Analysis of the Reasons for Rising Popularity and Attention Worthiness of Yonghui Superstores (601933.SH)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On December 21, 2025 (UTC+8), Yonghui Superstores (601933.SH) appeared on the hot list, and market attention increased significantly [1]. After systematic analysis, no specific news, announcements, or operational data of the company that could directly explain the rise in popularity on that day were retrieved [0]. As a leading domestic large-scale chain supermarket enterprise, the potential indirect driving factors for its rising popularity may include: first, overall policy adjustments or market sentiment changes in the retail industry (such as the expected impact of domestic consumption stimulus policies); second, the company’s long-term promoted digital transformation, supply chain optimization and other strategies may have achieved undisclosed phased progress; third, transactional popularity caused by short-term market capital inflows. However, the above speculations lack direct data support on that day and need further verification.

This rise in popularity was not accompanied by a clear company-level catalytic event, implying that the popularity may be more derived from industry trend transmission or market sentiment fluctuations rather than a single company positive or negative event [0]. Such popularity without clear drivers often has high uncertainty, so it is necessary to focus on whether there are supplementary company announcements or industry information disclosures to clarify the real reasons behind the popularity.

- Risk: Since the popularity lacks clear supporting events, if there is no follow-up of substantive positive news, the stock price may experience short-term fluctuations and decline [0].

- Opportunity: If the popularity hides undisclosed positive signals about the company’s operations or finances, it may bring short-term or long-term attention value to market participants.

- Priority Assessment: Priority should be given to the company’s official channels’ subsequent announcements, retail industry policy trends, and related transaction data to verify the popularity driving factors.

Currently, Yonghui Superstores (601933.SH) is on the hot list, but no direct driving event has been found [1][0]. The popularity may come from industry trends, market sentiment, or potential undisclosed information. It is recommended to continue to pay attention to the company’s official announcements, industry policy changes, and related transaction data to clarify the real reasons behind the popularity before objectively evaluating its attention necessity.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.