Embodied Intelligent Robots: Impact on Traditional Robot Companies Amid Industry Transition

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

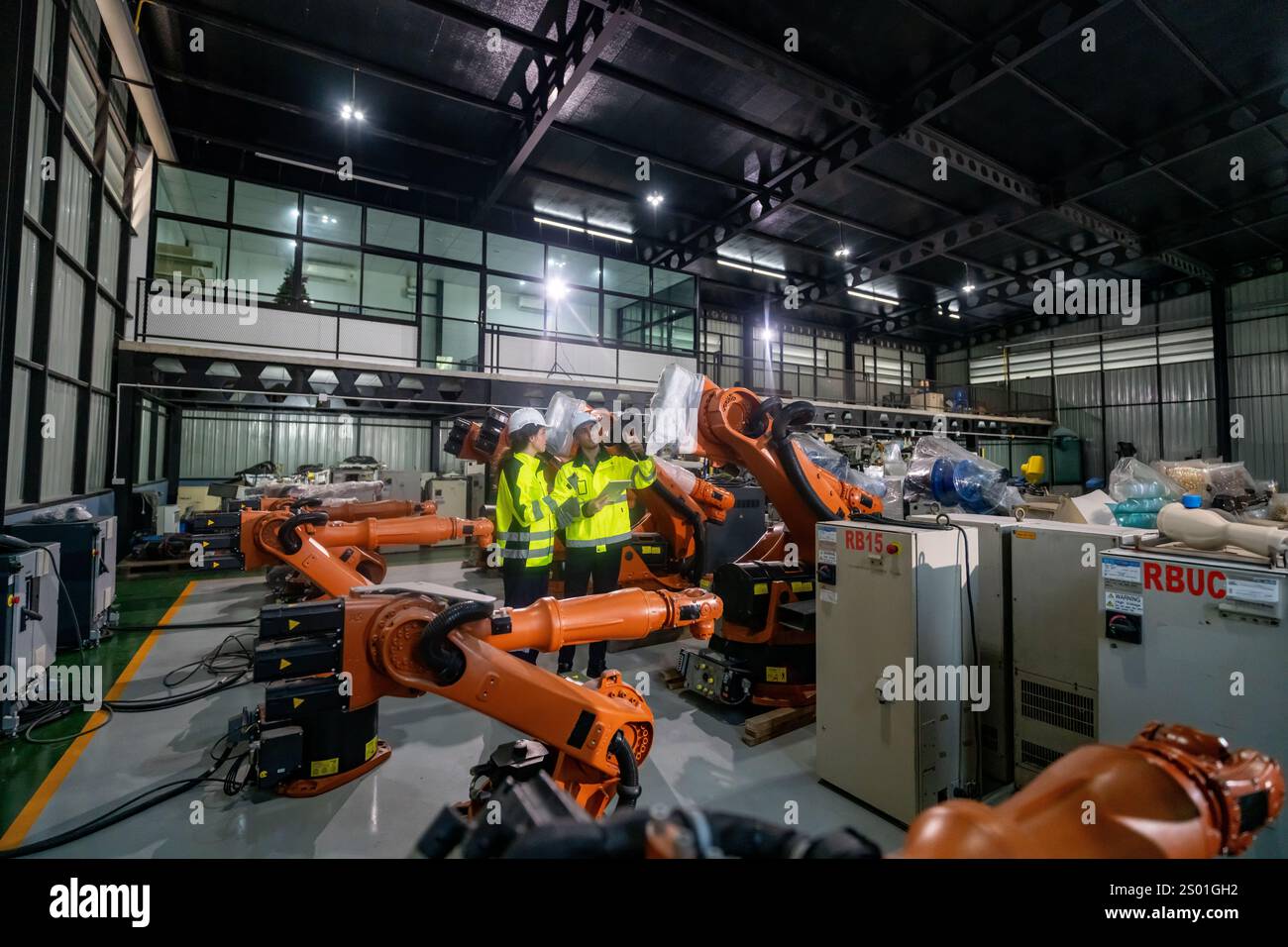

The industrial robot industry is transitioning from “fixed automation” (serving 30% of continuous structured production scenes) to “mobile intelligent automation” to penetrate the 70% of discrete manufacturing scenes with low automation penetration [0]. This shift is driven by the need for flexible, adaptive solutions, where embodied intelligent robots—capable of mobility and multi-arm operation—play a pivotal role.

Market projections indicate the embodied intelligent robot segment will grow from an estimated 53 billion RMB in 2025 to 400 billion RMB by 2030, exceeding 1 trillion RMB by 2035 [4]. This growth attracts robust investment: Galbot, a humanoid robot maker, recently raised $300 million, reaching a $3 billion valuation with partnerships including CATL, Bosch, and Toyota [3]. Traditional players like ABB (2025 market capitalization ~$69 billion, up 38.8% year-over-year [0]) are adapting by integrating AI into their offerings to maintain competitiveness.

Notably, claims about SaZhi Intelligent—including its A++/A+++ round financing, profitability, 300% 2025 growth projection, and clientele (Ideal Auto, Johnson & Johnson, Mitsubishi)—could not be verified through English or Chinese media searches, indicating potential information gaps [0].

- Discrete manufacturing drives growth: The low automation penetration in 70% of discrete manufacturing scenes creates a large “stock replacement” space for embodied intelligent robots, which handle tasks traditional fixed robots cannot.

- Competitive dynamics shift: Emerging players like Galbot (humanoid robots) and Agility Robotics (warehouse automation with Amazon [5]) target non-traditional segments, while traditional companies like ABB pivot to integrate AI solutions.

- Investor sentiment is positive: Significant funding rounds (e.g., Galbot’s $300M raise) and market projections reflect strong interest in embodied intelligence’s potential to revolutionize industrial automation [3][4].

- Technical innovation is critical: Companies like EngineAI (launched the SE01 heavy-load, precision-assembly robot at CES 2025 [6]) push technical boundaries, emphasizing R&D’s role in maintaining competitiveness.

- Risks:

- Unverified SaZhi Intelligent claims require cautious interpretation, as they may not reflect actual performance or market positioning [0].

- Technical maturity and adoption barriers (cost, system integration) could delay widespread deployment of embodied robots.

- Intensifying competition may squeeze margins for laggard companies that fail to adapt.

- Opportunities:

- The untapped discrete manufacturing market offers significant growth potential for all robot companies.

- Collaboration between traditional players (established client bases) and new embodied intelligence firms (innovative technologies) could accelerate market penetration.

- Government support (e.g., China’s embodied intelligence education initiative [4]) and growing investment create a favorable ecosystem.

The industrial robot industry’s transition to mobile intelligent automation is driving the rise of embodied intelligent robots, targeting the large untapped discrete manufacturing market. Projections and investment trends indicate strong growth potential, with traditional players like ABB adapting and new players securing funding. However, SaZhi Intelligent’s details remain unconfirmed, highlighting the need for careful verification of company-specific claims. The segment’s future depends on technical innovation, client adoption, and companies’ ability to navigate intensifying competition.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.