AI Computing Power Sector Investment Opportunities: Value Comparison Between North American Chain and Domestic Chain and Industry Impact Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

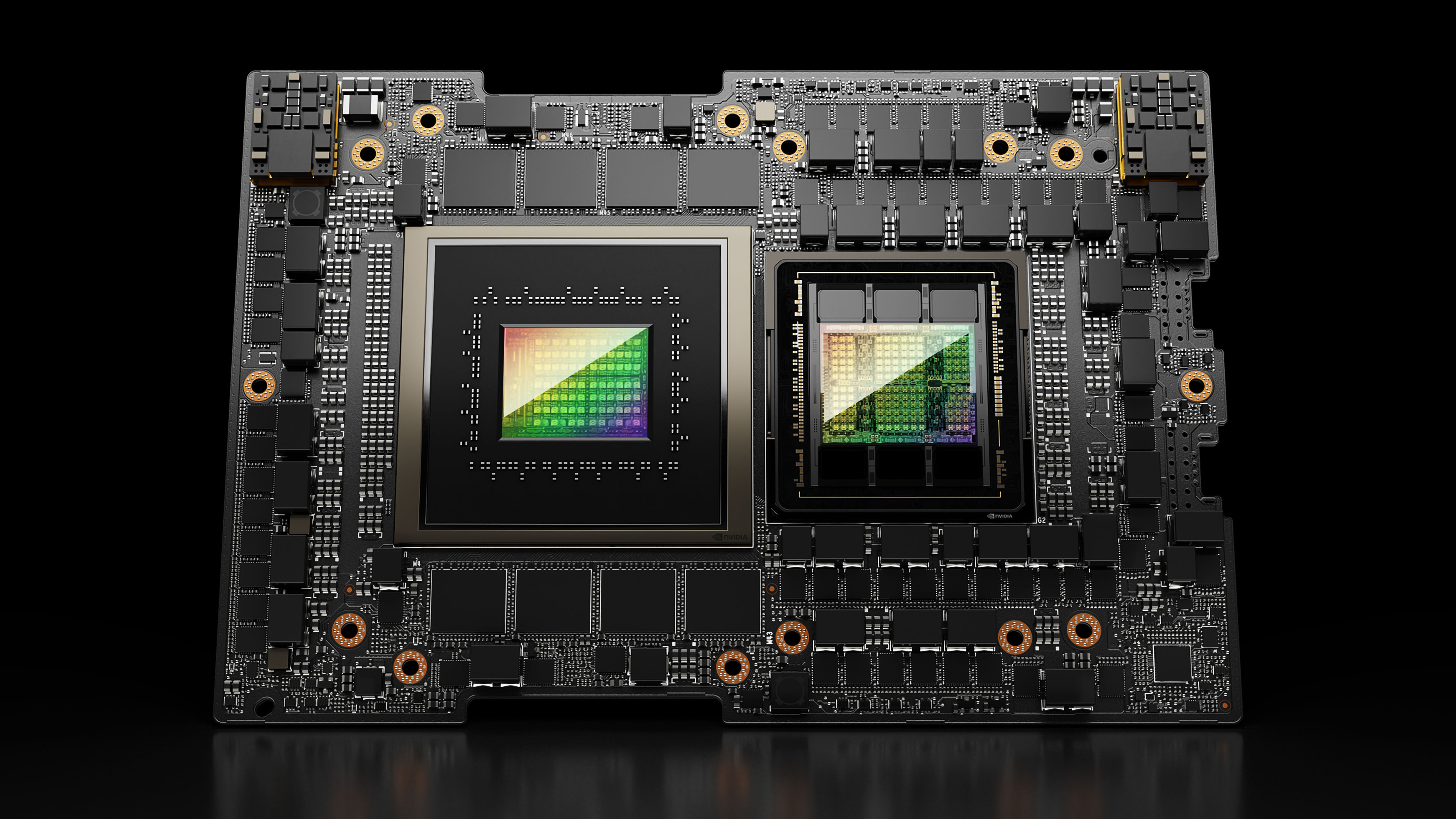

The AI computing power sector shows strong demand due to the continuous iteration and upgrade of large models. JPMorgan predicts that global AI infrastructure capital expenditure will still grow at a high speed in 2026 [1]. NVIDIA’s Blackwell GPU production for 2025 has been sold out, further verifying the extremely strong demand [2].

In the comparison between the North American chain and domestic chain, leading optical module manufacturers such as Zhongji Innolight have more than 60% of their overseas revenue, directly undertaking the demand from North American cloud service providers [1], so North American chain optical module companies have hit new highs recently. On the domestic chain side, the share price of domestic GPU companies like Moore Threads soared by 425% on their first day of listing [3], reflecting domestic investors’ confidence in the local AI chip industry. In addition, domestic AI server manufacturers such as Sugon have orders scheduled until the second quarter of 2026 [1], indicating strong demand for domestic AI infrastructure construction.

The optical module segment has entered the mass production and volume release period for 800G and 1.6T products. The overseas market layout of leading manufacturers like Zhongji Innolight allows them to directly benefit from the growth in North American AI computing power demand. Regarding domestic GPUs, Moore Threads plans to launch a new GPU architecture, and its strong performance after listing reflects market confidence in the development of domestic GPUs [3][4]. Meanwhile, NVIDIA plans to ship H200 AI chips to Chinese customers before the 2026 Lunar New Year; if approved by Beijing, it will accelerate domestic AI infrastructure deployment [2].

- Both the North American chain and domestic chain have their own advantages: North American chain optical module companies directly benefit from North American AI computing power demand and have performed strongly recently; domestic chain companies have undergone sufficient adjustments in the early stage, and the improvement of domestic GPU technology and the demand for domestic AI infrastructure construction provide growth space for them.

- The optical module industry is in a period of technological iteration and volume release; the mass production of 800G and 1.6T products will further promote industry development.

- The improvement of domestic GPU supply capacity and the liberalization of H200 chips are key factors to accelerate domestic AI infrastructure deployment, which will drive the development of related industrial chain companies.

- The penetration rate of liquid cooling technology in intelligent computing centers has exceeded 50% [1], becoming an important support for AI infrastructure deployment.

- NVIDIA’s shipment of H200 chips to China requires approval from Beijing, which has not been finalized yet [2], so there is uncertainty.

- The specific degree of the technical gap between domestic GPUs and overseas platforms has not been confirmed by authoritative data.

Opportunities: - The continuous growth of global AI infrastructure capital expenditure provides a broad market space for the AI computing power sector.

- Domestic AI server demand is strong, with long order lead times; relevant manufacturers are expected to benefit.

- The improvement of domestic GPU technology and the launch of products will promote the independent and controllable development of domestic AI computing power.

The demand for the AI computing power sector remains strong; North American chain optical module companies have performed strongly recently, and the potential of domestic chain companies is gradually being released. The technological iteration and volume release of the optical module industry, the improvement of domestic GPU supply capacity, and the liberalization of H200 chips will jointly promote AI infrastructure deployment. Investors should pay attention to the development trends of North American chain optical module leaders, domestic AI server manufacturers, and domestic GPU companies.

Please note that this report is a comprehensive information analysis and does not constitute investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.