Rocket Lab’s $816M SDA Tranche 3 Contract: Impact on Revenue Growth and Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

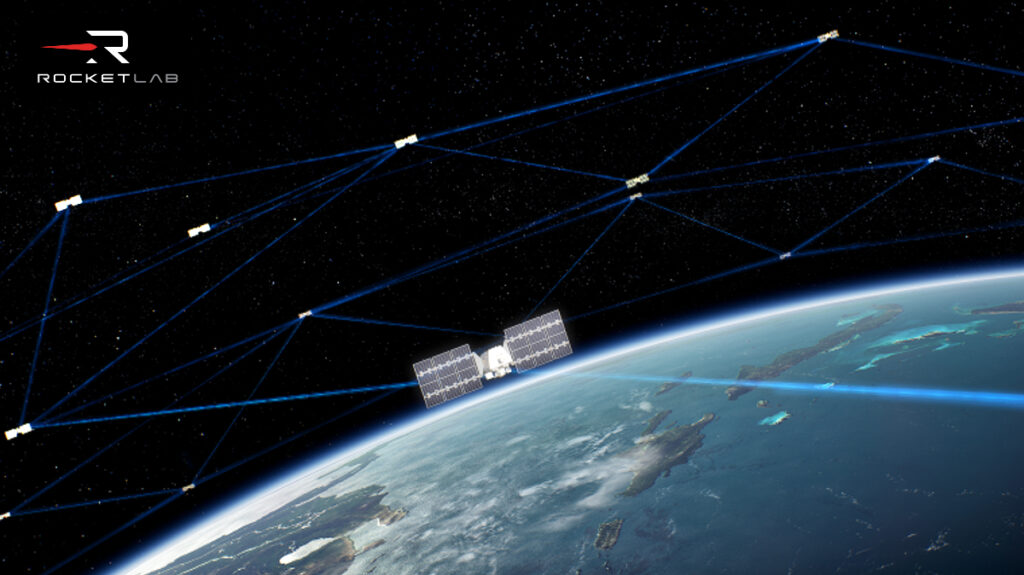

On December 19, 2025, Rocket Lab USA, Inc. (RKLB) was awarded an $816M base contract (plus $10.45M in options) from the U.S. Space Development Agency (SDA) to design, manufacture, and deliver 18 Tracking Layer Tranche 3 satellites for missile warning and hypersonic threat tracking under the Proliferated Warfighter Space Architecture (PWSA) [1][2]. This award directly impacts the company’s revenue growth and valuation:

The contract aligns with Rocket Lab’s Space Systems division, which contributed 71.3% of FY2024 revenue ($310.84M) [0]. With a value more than double the division’s FY2024 revenue, it represents a significant long-term catalyst. Recent revenue trends show Q3 2025 revenue reached a record $155.08M (up 7.3% from Q2 2025), driven by both Space Systems and Launch Services segments [0]. However, revenue recognition will be spread over the contract period, with launches scheduled for fiscal year 2029, delaying near-term top-line impact [4].

Following the contract announcement, RKLB stock surged 15.38% on December 19 (open: $61.12; close: $70.52) with 52.76M shares traded—well above the 22.48M daily average volume [0]. By the event timestamp (December 22, 2025), the stock had climbed an additional 6.32% to close at $77.55 [0]. As of December 23, 2025, RKLB had a market capitalization of $39.59B with a P/B ratio of 31.86x. Despite ongoing unprofitability (negative P/E ratio of -145.84x), analyst consensus maintains a “Buy” rating with a $79.00 price target [0].

Proliferated satellite constellations like the PWSA are a fast-growing trend in both defense and commercial space. Rocket Lab’s success in securing this contract differentiates it from competitors and reinforces its leadership in end-to-end space systems [0][2].

- Defense Sector Validation: The SDA contract validates Rocket Lab’s capabilities in advanced satellite manufacturing for defense applications, expanding its revenue base beyond commercial projects and enhancing long-term growth resilience [0][1].

- Revenue Visibility & Scaling: The contract provides clear revenue visibility through 2029, requiring Rocket Lab to scale its manufacturing capacity. Successful execution could position the company for additional tranche contracts and broader defense sector opportunities [0][4].

- Sector Leadership in Proliferated Constellations: The award solidifies Rocket Lab’s position in the high-demand proliferated satellite constellation market, a key growth driver for the commercial space sector [0][2].

- Future SDA Contracts: The Tranche 3 award positions Rocket Lab to compete for subsequent tranche contracts under the PWSA program, potentially unlocking additional long-term revenue streams [0][4].

- Defense Sector Growth: Rising global defense spending on space systems creates a favorable environment for Rocket Lab’s expanded defense capabilities [0].

- Commercial Space Spillover: Expertise gained from defense contracts can enhance Rocket Lab’s commercial offerings, driving cross-segment growth [0].

- Long-Term Revenue Recognition: The contract’s 2029 launch timeline means revenue will be recognized over multiple years, limiting near-term revenue growth impact [4].

- Execution Risks: Delivering 18 advanced infrared sensor satellites by 2029 requires scaling manufacturing capacity and maintaining technical performance; delays could impact contract milestones and revenue [0][4].

- Intense Competition: The SDA awarded $3.5B in total Tranche 3 contracts to four vendors, meaning Rocket Lab faces ongoing competition for future awards [0].

This analysis provides an objective evaluation of the impact of Rocket Lab’s $816M SDA Tranche 3 contract on its revenue growth and valuation. The contract is the company’s largest to date, aligns with its high-growth Space Systems division, and has driven significant short-term stock price gains. While the contract enhances long-term revenue visibility and sector positioning, investors should be aware of delayed revenue recognition, execution risks, and ongoing competition. This report does not constitute investment advice, but rather provides data-driven context to support decision-making [0][1][2][4].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.