Potential Shift From Mega-Cap Tech Leadership in 2026: Market Trends and Alternatives

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on a YouTube video and Yahoo Finance article titled “Why 2026 Won’t Be a Big Tech Year - and What Replaces It” [4], published on 2025-12-22, which discusses a potential shift in market leadership away from mega-cap tech stocks. The same day’s market data [0] provides early evidence supporting this thesis:

- Mega-cap tech stocks (AAPL: -0.69%, MSFT: -0.25%, GOOGL: -0.03%, AMZN: -0.08%, META: -0.02%, TSLA: -0.23%) declined slightly [0].

- Tech-heavy indices/ETFs underperformed: QQQ (NASDAQ 100): -0.34%, XLK (Technology sector): -0.58%, XLC (Communication Services): -0.02%, NASDAQ Composite: -0.09% [0].

- Broader market and alternative sectors outperformed: S&P 500: +0.19%, Russell 2000 (small-caps): +0.79%, XLF (Financial sector): +1.04% [0].

Key contextual factors include:

- Valuation concerns: Investors are demanding evidence that tech’s AI investments are driving sustainable sales/margin growth, pressuring tech valuations [2].

- Interest rate impact: Federal Reserve rate cuts have shifted sentiment toward small-caps and financials, which typically benefit more from lower rates [2].

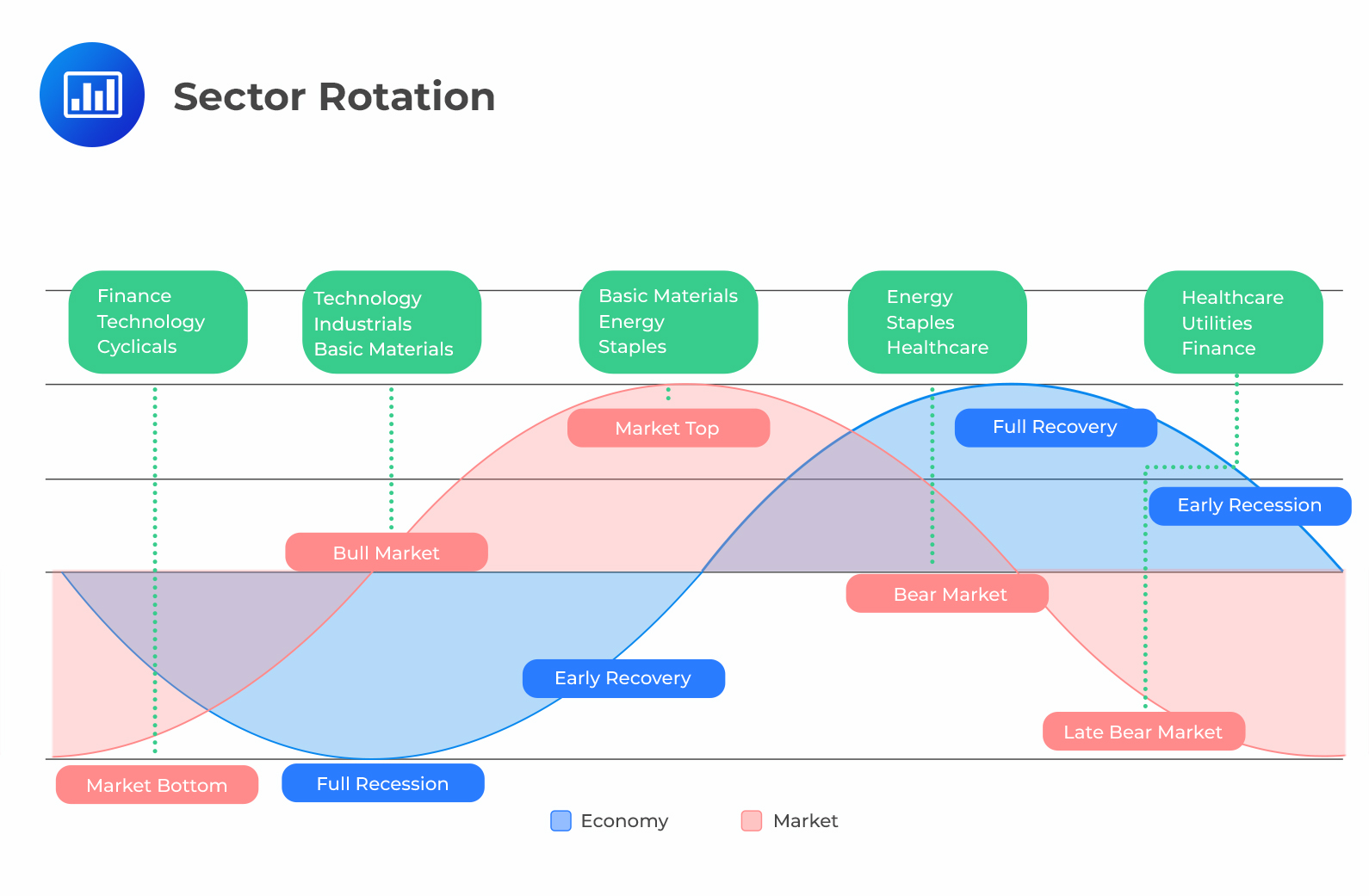

- Sector rotation: Financial stocks are up over 6% in the past month, indicating rotation out of tech [2].

- Market concentration: TheStreet Pro analysts noted divergence in the “Magnificent Seven” mega-cap stocks since summer, highlighting concentration risks [5].

- Analyst sentiment: Morgan Stanley removed tech from its 2026 buy list, except AI chip leaders NVDA and AVGO [6].

- Early shift signs: The 2025-12-22 market moves align with the video’s prediction, showing immediate investor response to sector rotation narratives.

- Multi-factor driver: The potential shift is not isolated but driven by valuation concerns, rate policy, and concentration worries, making it a structural rather than temporary trend.

- AI chip exception: While broad tech is out of favor, AI chip leaders (NVDA, AVGO) are still favored by analysts, indicating nuance in the tech sector outlook [6].

- “Other 493” implication: The video’s reference to “the other 493” suggests opportunities in non-mega-cap stocks, broadening the market beyond the dominant “Magnificent Seven”.

- Tech rebound: Mega-cap tech could rebound if companies report strong AI-driven growth in upcoming earnings [2].

- Rate policy reversal: A change in Federal Reserve rate cut plans could reverse the shift toward small-caps and financials [2].

- Concentration impact: The “Magnificent Seven’s” high weighting in major indices means a sharp tech decline could affect the broader market [5].

- Regulatory risk: Ongoing regulatory scrutiny of tech companies could further pressure valuations [2].

- Small-cap stocks: The Russell 2000’s 2025-12-22 +0.79% gain reflects growing investor interest [0].

- Financial sector: XLF’s +1.04% performance and 6% month-to-date gain highlight opportunities in this rate-sensitive sector [0, 2].

- Non-mega-cap tech: AI chip leaders (NVDA, AVGO) remain favored, suggesting niche opportunities within tech [6].

The 2025-12-22 event highlights a potential 2026 shift from mega-cap tech leadership, supported by concurrent market data showing tech underperformance and strength in small-caps/financials. Key drivers include AI investment ROI concerns, Fed rate cuts, and market concentration worries. Decision-makers should monitor:

- Quarterly earnings reports to assess tech’s AI-driven growth.

- Federal Reserve policy announcements.

- Sector performance trends to confirm ongoing rotation.

- Analyst updates on market concentration risks and alternative investment opportunities.

利柏特(605167)涨停原因及后续走势分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.