Credibility Evaluation of Social Media Investment Research: Actionable Guidance for Retail Investors

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This report tackles the critical challenge of retail investors navigating social media investment research, where fake due diligence, falsified position claims, and photoshopped gains are rampant. The analysis integrates regulatory best practices [0] and market data to outline actionable credibility evaluation steps:

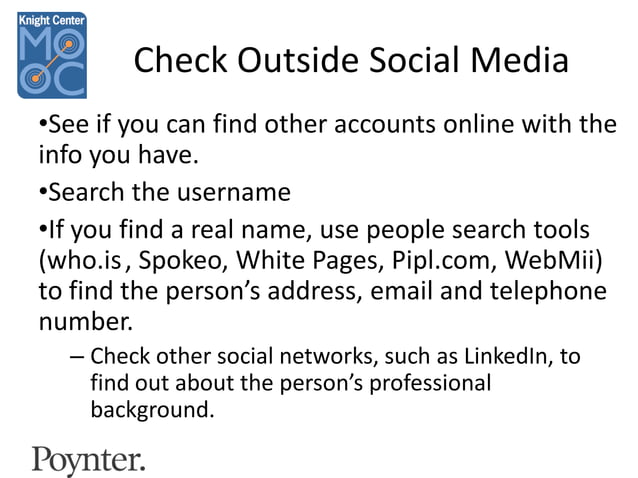

- Source Credential Verification: Regulatory tools like FINRA’s BrokerCheck and the SEC’s Investment Adviser Public Disclosure (IAPD) database confirm if posters are registered investment professionals with oversight, reducing fraud risk [1][2].

- Research Cross-Validation: Social media claims must align with official SEC EDGAR filings, company press releases, and reports from reputable outlets (Bloomberg, Reuters) to ensure accuracy [3][0].

- Gain Claim Scrutiny: Falsified trading screenshots can be identified by inconsistencies (mismatched timestamps, unrealistic returns); anonymous posters cannot verify real positions, making such claims untrustworthy [0].

- Transparency Checks: Legitimate researchers disclose conflicts (e.g., holding the security, compensation), while lack of disclosure signals bias or fraud [1].

- FOMO Tactic Avoidance: Posts urging immediate action are scam indicators; legitimate research allows time for due diligence [4].

A 2025 Fidelity survey (via Investopedia [4]) found 33% of new investors rely primarily on social media for investment information, with 49% of self-directed new traders making regrettable decisions due to such content, highlighting the urgency of these safeguards.

- Democratization vs. Risk: Social media has expanded access to investment information but also enabled fraud at scale, creating a double-edged sword for retail investors [4].

- Regulatory Tools Underutilization: Many investors are unaware of free tools like BrokerCheck and IAPD that provide critical credibility checks [1][2].

- Emerging Threats: AI-generated fake research and deepfaked trading statements will likely increase detection complexity, emphasizing the need for ongoing vigilance [0].

- Risks: Anonymity on social media makes retail poster position verification impossible; inexperienced investors are most vulnerable to misinformation; AI/deepfakes pose evolving threats [0].

- Opportunities: Informed investors can leverage social media by applying rigorous due diligence; regulatory tools offer accessible safeguards; reputable social media researchers may provide valuable, verifiable insights when vetted.

Retail investors can evaluate social media investment research credibility by verifying source registration, cross-validating claims with official filings, checking for transparency, and avoiding pressure tactics. A significant portion of new investors rely on social media for investment information, making these practices critical to mitigating misinformation risks.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.