Hualian Holdings (000036) Analysis of Limit-Up Reasons and Market Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

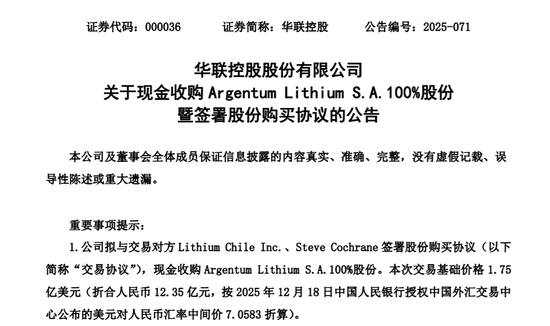

Hualian Holdings (000036) hit the daily limit on December 23, 2025. The core driving factor is the announcement of the acquisition of Argentina’s Arizaro lithium salt lake project released by the company on the evening of December 22 [2][3][4]. The project is located in the core area of the “Lithium Triangle” in South America, with a total area of about 205 square kilometers, and is one of the world’s largest undeveloped lithium salt lakes. It is expected to produce battery-grade lithium carbonate for new energy vehicle battery manufacturing after production [3][5].

From the performance of price and trading volume, Hualian Holdings opened at the daily limit on December 23, with a closing price of 6.13 yuan and an increase of 10.05% [6]. In the previous three trading days (December 19, 22, 23), the cumulative increase reached 20.74%, triggering abnormal fluctuations in stock trading [7]. The trading volume on that day was 211,700 lots, which was a decrease compared to the previous trading day (1,991,900 lots on December 22), but remained active [6].

In terms of market sentiment, the company’s strategic transformation to cross-border entry into the new energy lithium resource sector, combined with the strong demand for lithium resources under the continuous growth of the new energy vehicle industry, has triggered positive expectations from investors [3][4]. At the same time, the overall activity of the lithium extraction from salt lakes sector also provided linkage support for the stock price [8].

- Market Response to Strategic Transformation: Hualian Holdings’ traditional real estate business faces growth bottlenecks. This cross-border acquisition of lithium salt lake assets is an important measure for the company to transform into the high-growth new energy field. The positive response of the market to its transformation expectations reflects the high attention of the current A-share market to the new energy lithium resource track.

- Sector Linkage Effect: The overall activity of the lithium extraction from salt lakes sector has amplified the market impact of Hualian Holdings’ acquisition event. This indicates that under the effect of hot sectors, major events of individual companies are likely to trigger sharp fluctuations in stock prices.

- Risks and Opportunities Coexist: Although the acquisition event has brought short-term stock price increases, the company reminded investors in the abnormal fluctuation announcement that the acquisition has various uncertainties such as mining rights ownership, resource reserves, lithium price fluctuations, cross-border operations, etc. [7]. In addition, the company’s real estate business still has a de-stocking pressure of 2.64 billion yuan in inventory [4], and the capital pressure brought by the acquisition also deserves attention.

- The new energy vehicle industry continues to grow, and the demand for lithium resources is strong in the long term. The company’s transformation to lithium resource development is expected to open up new growth space.

- The acquired project is located in the core area of the “Lithium Triangle” and has great resource potential. If the project progresses smoothly, it may bring substantial returns to the company.

- Transformation Risk: The company lacks mature experience in lithium resource development, and cross-border operations may lead to investment results not meeting expectations [2][3].

- Capital Pressure: The acquisition price is about 1.235 billion yuan, accounting for 24.31% of the company’s latest audited net assets, which may put pressure on the company’s cash flow [2][7].

- External Risks: Lithium carbonate prices fluctuate sharply (prices fluctuated greatly from 2022 to 2025), and Argentina’s policy risks may also affect project returns [3][5].

- Real Estate Inventory Pressure: As of the end of September 2025, the company’s real estate inventory balance was 2.64 billion yuan, and de-stocking pressure still exists [4].

Hualian Holdings (000036) hit the daily limit on December 23, 2025, mainly driven by the event of acquiring the Argentine lithium salt lake project. Market expectations of the company’s strategic transformation to the new energy lithium resource sector drove the stock price up. In the short term, the stock price remains strong driven by the event and sector linkage, but the acquisition has multiple uncertainties, and the company faces de-stocking pressure and capital pressure in its real estate business. Investors should pay attention to key factors such as the progress of the acquisition, the trend of lithium carbonate prices, and the company’s subsequent financing plans, and carefully evaluate investment risks and opportunities.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.