Reddit Investor Sells AI Stocks Amid Bubble Fears vs Strong Fundamentals Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis examines a Reddit investor’s decision to liquidate all holdings in NVIDIA (NVDA), Broadcom (AVGO), Alphabet (GOOGL), and Johnson & Johnson (JNJ) after achieving approximately 12% gains, citing fears of an AI bubble [1]. The investor, influenced by Michael Burry’s perspectives, purchased these stocks at April 2025 lows and now awaits a market correction back to those levels.

The decision contrasts sharply with the underlying fundamental performance of these companies. Recent market data [0] reveals that NVDA has gained 36% year-to-date, AVGO shows 22% revenue growth, GOOGL achieved record Q3 revenue of $102.3 billion, and JNJ provides defensive stability with a 2.79% dividend yield. The AI sector continues to demonstrate robust growth, with NVIDIA securing $500 billion in Blackwell GPU orders and Broadcom establishing a $10 billion partnership with OpenAI [1][4].

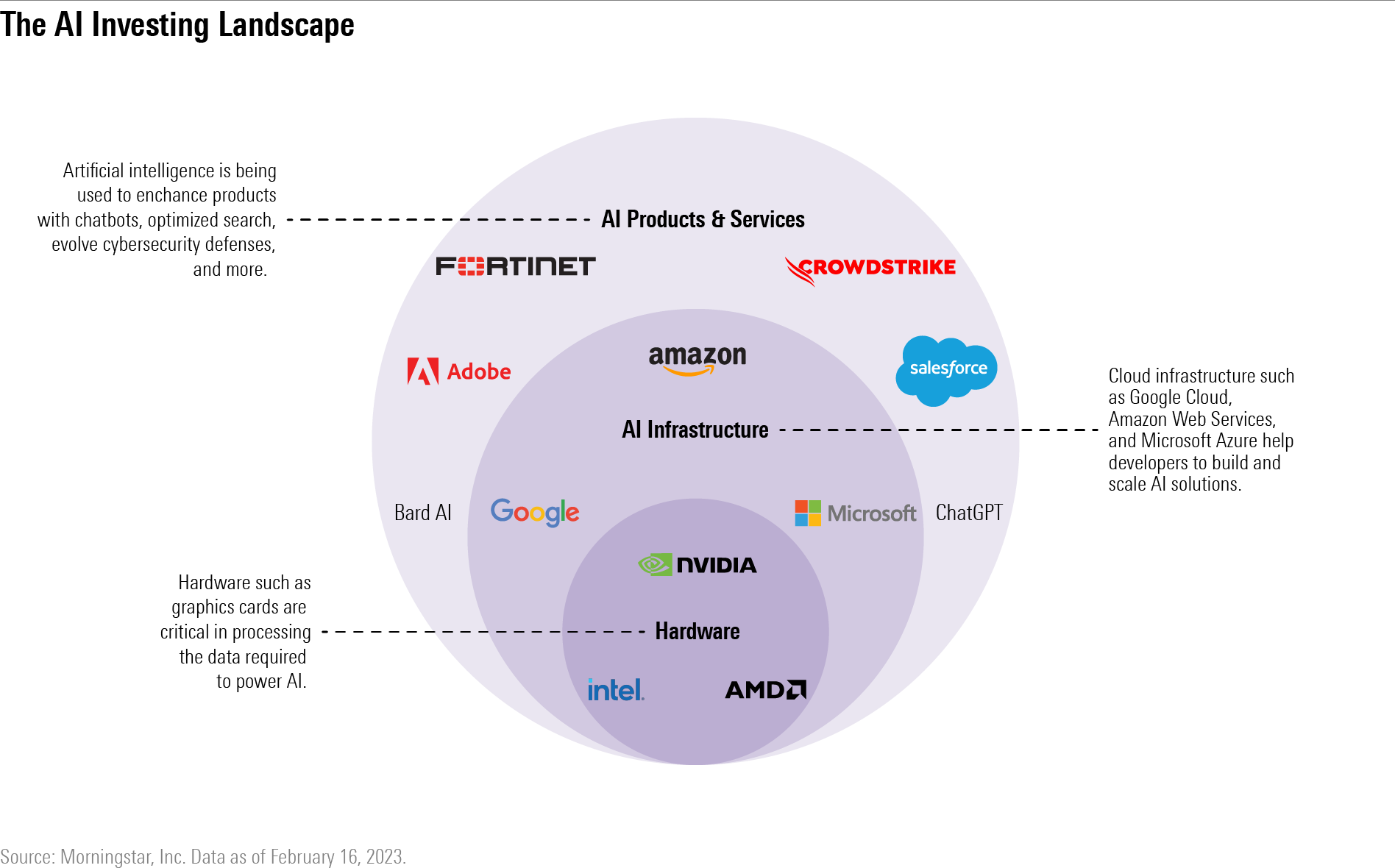

The timing of this liquidation appears particularly questionable given current market dynamics. The five major US technology companies have announced capital expenditures exceeding $470 billion for 2026, with plans to purchase over 3 million AI chips [11]. Cloud computing backlogs at Microsoft and Amazon total $600 billion, indicating sustained demand for AI infrastructure [12].

- Valuation Concerns: High P/E ratios in AI stocks could lead to corrections if growth expectations aren’t met [1]

- Macroeconomic Headwinds: Inflation, tariffs, and unemployment concerns cited by the investor remain valid considerations [1]

- Market Timing Risk: Attempting to time market re-entry to April lows may result in missing continued upside potential

- AI Infrastructure Expansion: The massive capital expenditure commitments from tech giants suggest sustained demand [11]

- Custom Chip Growth: Broadcom’s position in custom AI chips presents significant growth potential through 2027 [4]

- Cloud Computing Growth: Google’s 34% cloud revenue growth indicates expanding market opportunities [7]

The Reddit investor’s liquidation decision appears driven by psychological factors and bubble concerns rather than fundamental analysis. The sold companies demonstrate strong operational performance: NVIDIA’s Blackwell GPU architecture has secured $500 billion in orders, Broadcom’s custom AI chip business is growing 40% annually, Google’s cloud revenue expansion of 34% supports sustained growth, and Johnson & Johnson provides defensive stability through consistent dividends [1][4][7][10].

Market data indicates continued AI sector expansion, with US tech giants planning $470 billion in 2026 capital expenditures and the global Cloud AI market projected to reach $4.63 trillion by 2030 [11][12]. The semiconductor industry, particularly AI-focused companies, shows strong growth prospects with Broadcom’s AI revenue expected to reach $10 billion by 2027 [4].

The decision to exit positions after 12% gains, while the stocks have delivered 30-36% year-to-date performance, suggests potential opportunity cost. However, the investor’s concerns about macroeconomic factors including inflation and tariffs reflect legitimate market risks that should be monitored [1].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.