Analysis of the Reasons for the Slight Decline in the Nikkei 225 Index on December 24, 2025

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

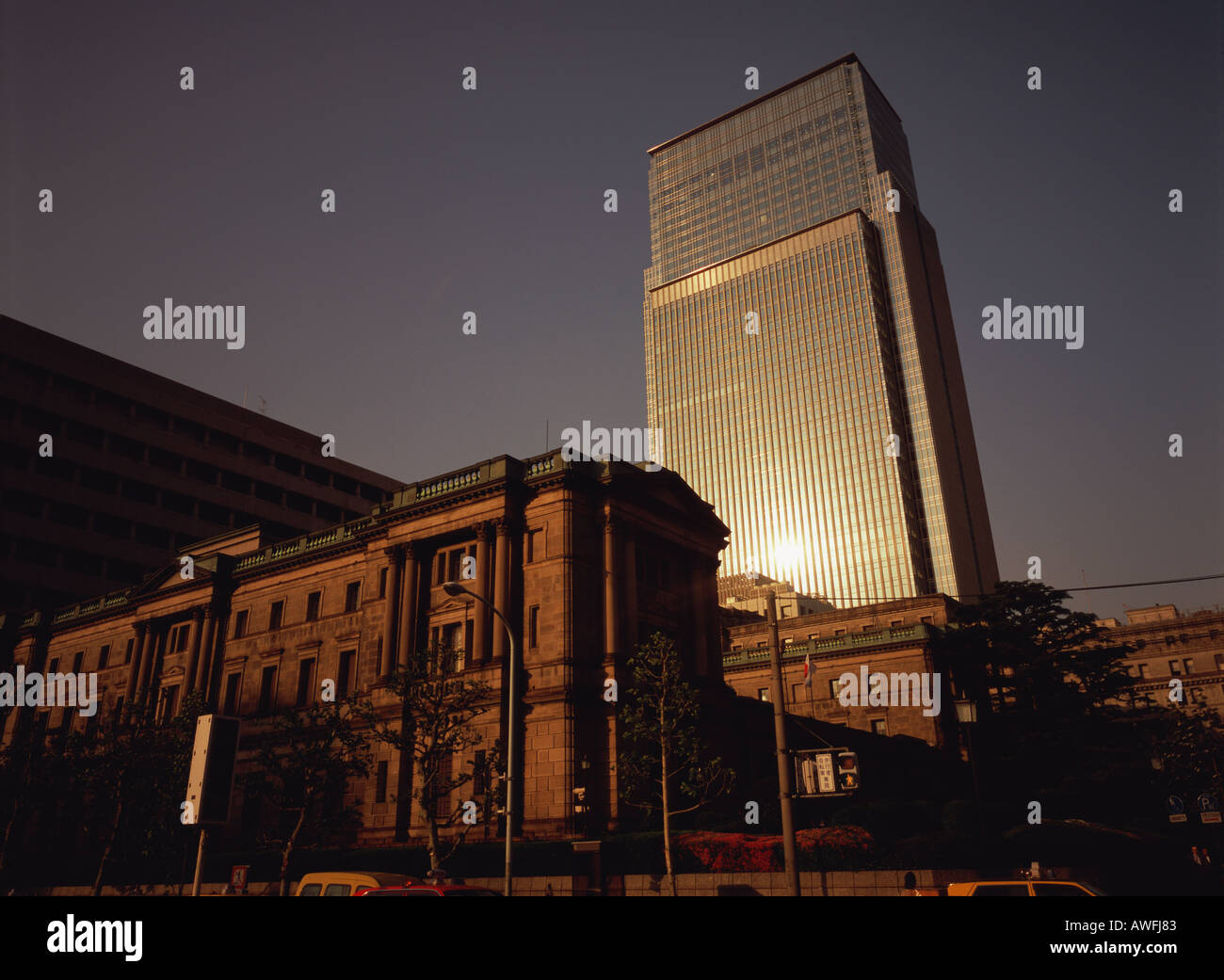

On December 24, 2025, the Nikkei 225 Index saw a mild decline of 0.26%. Its drivers can be traced to three aspects: internal policies, market trading behavior, and timing background. First, since early December, the index has continued to震荡 downward (with a cumulative monthly decline of 1.49%), and profit-taking at high levels is the direct trigger—investors’ willingness to lock in early gains before Christmas has increased [1]. Second, the Bank of Japan’s first interest rate hike in 30 years on December 19 (policy rate raised to the range of -0.10% to 0.10%) has had lagged effects. After the hike, the 10-year government bond yield once exceeded 2% [1], pushing up financing costs and putting pressure on stock market valuations. In addition, thin trading ahead of Christmas (abnormally low trading volume on the day, possibly due to early closing or data delay [0]) amplified the impact of short-term capital flows, leading to slight fluctuations.

Although the decline is mild, this drop reveals three deep-seated signals: First, after the previous rise, the Japanese stock market has entered a high-level consolidation period, and investors’ willingness to take profits highlights cautious sentiment; Second, the policy impact of the Bank of Japan’s interest rate hike is persistent, and the market is gradually digesting the potential impact of interest rate adjustments on financing costs and economic prospects; Third, thin trading caused by holiday factors tends to amplify index fluctuations, and short-term market conditions are more significantly affected by capital flows.

In terms of risks, we need to pay attention to the further pressure on stock market valuations from the continued rise in Japanese bond yields after the Bank of Japan’s interest rate hike, as well as emotional fluctuations caused by policy uncertainty [1]; at the same time, abnormal trading volume data (shown as 0 [0]) suggests that the trading arrangement on that day needs to be verified to avoid misleading analysis. In terms of opportunities, the mild decline indicates that there is no substantial negative news in the market; if the policy digestion is completed and supported by economic data, the index still has the possibility of returning to the upward channel.

The slight decline of the Nikkei 225 Index on December 24, 2025 is the result of multiple factors, including profit-taking at high levels, lagged effects of the Bank of Japan’s interest rate hike, rising Japanese bond yields, and thin holiday trading. This fluctuation reflects investors’ cautious attitude and the market’s digestion process after policy adjustments; the overall sentiment is neutral. Attention should be paid to the data source difference (0.26% vs. 0.11%) and the verification of abnormal trading volume values to better understand market dynamics.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.