Impact of Local Government Shareholding on Energy Project Valuation and Analysis of Beijing Energy Power's Model

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

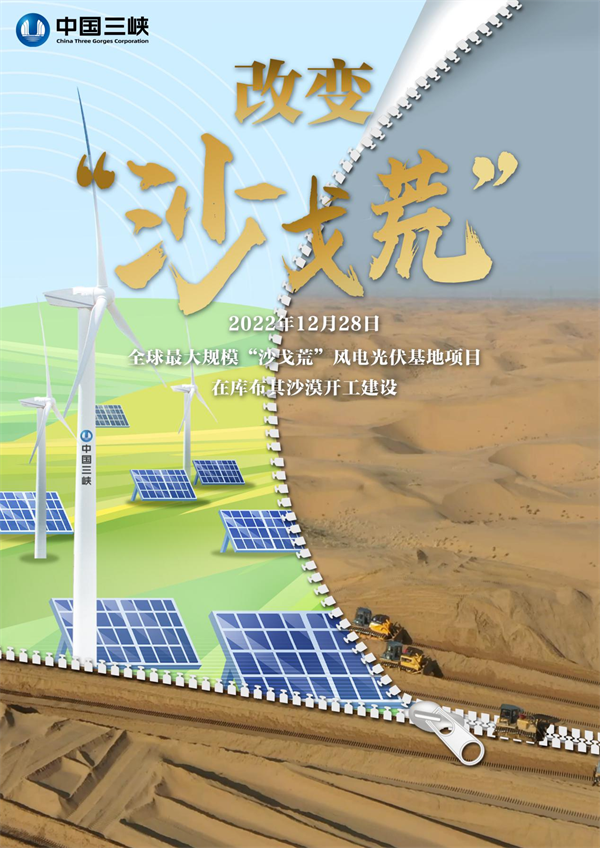

This analysis is based on market data from the Jinling Analysis Database [0], focusing on local government shareholding strategies in energy infrastructure projects. Taking Beijing Energy Power (600578.SS)’s Daihai New Energy Project as an example, this project is the second batch of national large-scale Shagehuang base projects approved in 2022. The company acquired a 90% stake at a valuation of 24.3 billion yuan, with a total investment of 82.87 billion yuan. It will start contributing profits from 2024 and is in a tax exemption period, with expected net profits of 900 million to 1 billion yuan [0].

The impact of local government shareholding on related listed companies is mainly reflected in three dimensions: First, policy and resource advantages—local governments can provide key resource support such as land and grid access, accelerating project implementation and reducing risks. Second, valuation enhancement—government endorsement can lower financing costs and improve project valuation levels. Third, financial contribution—if the project achieves expected profits, it will significantly enhance the company’s profit performance; Beijing Energy Power may thus achieve a net profit growth of approximately 25-30% [0].

In Beijing Energy Power’s model, the local government’s shareholding ratio (10%) forms a balanced cooperation structure, which not only leverages the government’s resource coordination advantages but also ensures the enterprise’s operational dominance. As part of the national Shagehuang large-scale base project, this project aligns with the national energy transition strategy and has clear policy support. Combined with the company’s market performance, Beijing Energy Power’s stock price increased by 81.69% from 2024 to 2025. Technical analysis shows an upward trend, with a buy signal appearing on December 22, 2025 [0], reflecting the market’s positive expectations for such projects.

Local government shareholding strategies in energy infrastructure projects have a positive impact on listed companies’ valuation and investment value through policy support, resource coordination, and risk reduction. Beijing Energy Power’s Daihai Project model has replicability, but it needs to meet prerequisites such as alignment with national policies, local government resource support, and clear profit models. Beijing Energy Power’s market performance reflects investors’ recognition of such projects; in the long run, this government-enterprise cooperation model may become an important development direction in the energy infrastructure field.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.