Rare Earth Export Controls Suspension Drives Market Reversal on November 7, 2025

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis examines the market reversal that occurred on November 7, 2025, driven by China’s suspension of expanded rare earth export controls. The event, initially reported on Reddit and corroborated by official sources, represents a significant development in U.S.-China trade relations and global supply chain dynamics.

The timing of China’s announcement coincided precisely with a notable market turnaround on November 7, 2025 [0]. After experiencing significant declines in the previous session (NASDAQ -1.74%, S&P 500 -0.99%), major indices recovered strongly:

- S&P 500: +32.63 points (+0.49%) to 6,728.81

- NASDAQ: +111.62 points (+0.49%) to 23,004.54

- Dow Jones: +190.08 points (+0.41%) to 46,987.11

- Russell 2000: +24.85 points (+1.03%) to 2,432.82

China officially suspended its expanded rare earth export controls, effective immediately through November 10, 2026 [1][2]. This action formalized a trade truce agreement reached between President Donald Trump and President Xi Jinping. The suspension covered expanded curbs on rare earths materials, equipment, lithium battery materials, and super-hard materials that were originally imposed on October 9, 2025 [2].

The suspension had a dramatic effect on rare earth stocks [0]:

- MP Materials (MP): +12.80% to $58.60, with trading volume surging to 23.15M shares (vs. 14.97M average)

- Lynas Rare Earths (LYSCF): +3.70% to $8.96

This performance contrasts sharply with the October 9 announcement when China initially imposed the restrictions, which had sent MP Materials soaring 36.4% and other rare earth stocks significantly higher [3].

The Reddit author’s analysis appears accurate - the rare earth suspension, rather than AI valuation concerns, was the primary market driver. Bloomberg’s analysis had previously warned that without sufficient rare earth elements, “that will slow down an AI capex boom” [5]. The removal of this supply constraint directly addressed a critical vulnerability affecting multiple sectors:

- Defense systems: 12 of 17 rare earth elements are essential for military applications [3]

- Semiconductors: Critical for manufacturing processes and components

- Electric vehicles: Essential for motor magnets and battery systems

Goldman Sachs had estimated that a 10% disruption in rare earth supply could eliminate $150 billion in global output [3]. The suspension therefore represents significant economic relief beyond immediate market movements.

Notably, mainstream financial media coverage of this market-driving event appears limited, creating an information gap where retail investors on platforms like Reddit may have accessed insights not yet broadly disseminated by traditional financial news outlets. This highlights the evolving landscape of financial information dissemination.

The suspension represents a concrete implementation of the Trump-Xi trade truce, with China committing to issue general export licenses for rare earths, gallium, germanium, antimony, and graphite specifically for U.S. end users [4]. Both the White House and China’s Commerce Ministry had previously indicated such an announcement was forthcoming [2].

The suspension carries inherent political risks:

- Temporary Nature: The one-year timeframe (through November 2026) creates uncertainty for long-term planning [1][2]

- Reinstatement Risk: Controls could be reinstated if geopolitical tensions escalate

- Implementation Risk: The effectiveness of “general licenses” and bureaucratic processing speed remain untested

The dramatic market reaction demonstrates continued dependency on Chinese rare earth supply. Despite U.S. efforts to develop domestic alternatives, China maintains dominant market position through 2030 and likely beyond [3]. This dependency represents a structural vulnerability for U.S. industries.

The suspension creates several opportunity considerations:

- Supply Chain Optimization: Companies can secure rare earth supplies during the suspension window

- Domestic Development Acceleration: The temporary relief may provide time to accelerate U.S. rare earth independence initiatives

- Strategic Planning: Industries can develop contingency plans for future supply disruptions

Decision-makers should track several key indicators:

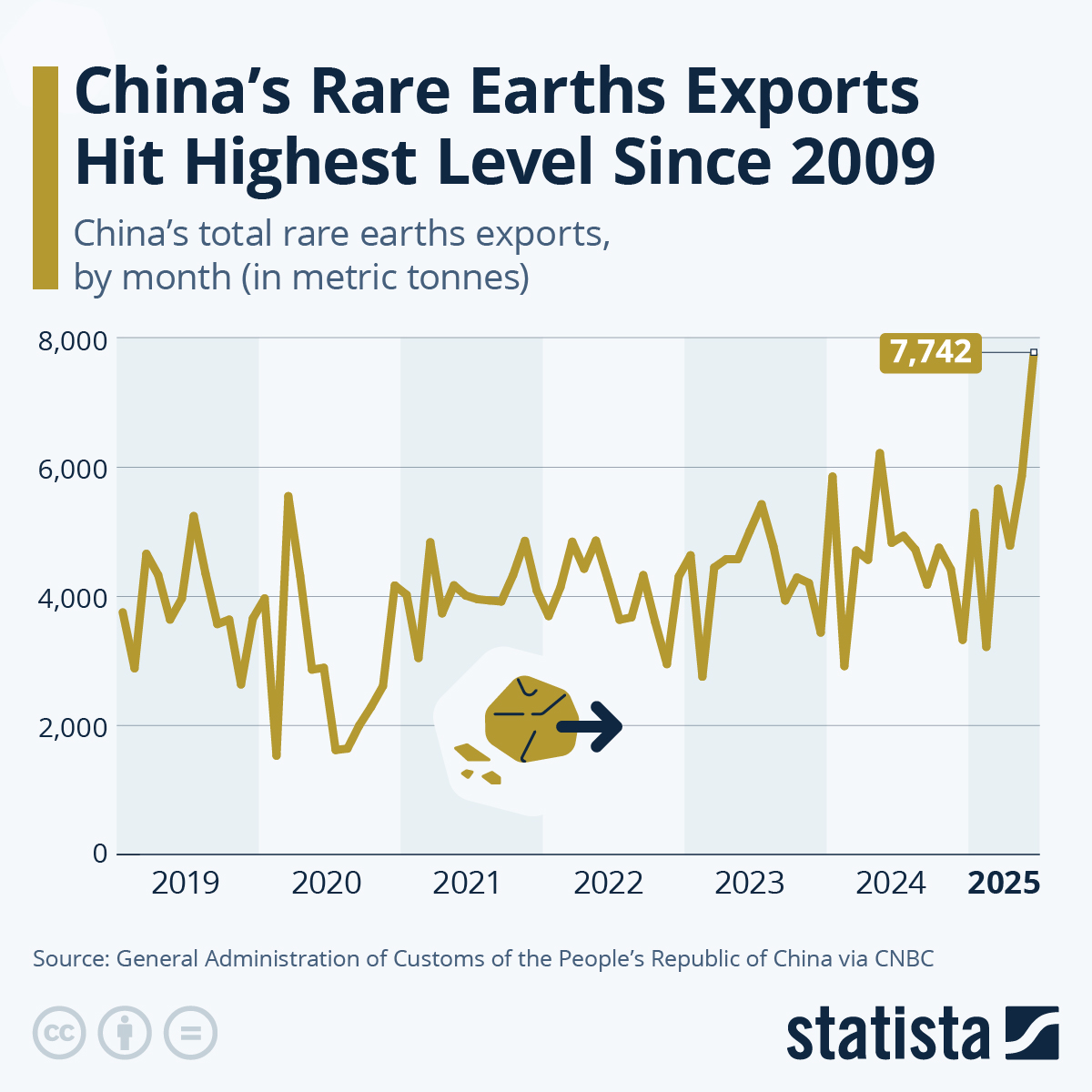

- Actual rare earth export volumes following the suspension

- U.S. domestic rare earth production progress and timelines

- Any modifications to suspension terms or early termination

- Broader U.S.-China trade relationship developments

- AI sector capital expenditure trends and supply chain security investments

The November 7, 2025 market reversal was primarily driven by China’s suspension of expanded rare earth export controls, a policy change that addressed critical supply chain vulnerabilities across multiple strategic industries. The one-year suspension, part of a Trump-Xi trade truce, provided immediate market relief and removed a significant overhang on AI and technology sector valuations.

While the policy change created positive market momentum, it also highlights ongoing structural dependencies in global supply chains. The temporary nature of the suspension and continued Chinese dominance in rare earth production suggest that supply chain security will remain a strategic priority for U.S. policymakers and corporate planners.

The information disparity between retail social media platforms and mainstream financial coverage also underscores the evolving nature of financial information dissemination in modern markets.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.