Puxing Energy (00090.HK) Inclusion Analysis in Hong Kong Stock Hot List (Surge List)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Puxing Energy (00090.HK) is a stock in the New Energy (Utilities - Renewable) sector of the Hong Kong stock market [3]. Its current share price is HK$1.34 with a market capitalization of HK$615 million [1][4][3]. Its 52-week high/low is HK$2.28/0.40. On December 24, the trading volume was 276,000 shares and the turnover was HK$370,100, which is comparable to the average trading volume (249,500 shares) [3].

In terms of performance, Puxing Energy’s year-to-date return is 144.39%, significantly outperforming the Hang Seng Index’s 28.71% over the same period [3], showing a strong long-term trend. The direct reason for its recent entry into the Hot List is a short-term sharp rise of about 9.76% around December 20 [1], combined with the inclusion effect of the East Money App Hot List (Surge List), which further increased market attention. It should be noted that the user event time is December 25, and the announcement of the proposed sale of 51% equity of Puxing Deneng on December 30 [2] occurred after the event and was not a catalyst for this Hot List inclusion.

Puxing Energy’s inclusion in the Hot List reflects market attention to stocks with short-term price movements and high-growth new energy targets. Although the year-to-date gain is significant, investors need to be alert to the inherent high volatility risk of small-cap stocks (market capitalization of HK$615 million). In addition, the fundamental signal of a 6% year-on-year decrease in mid-term net profit [1] deviates from the stock price increase to some extent, prompting investors to carefully evaluate its profit sustainability.

- The small-cap nature (HK$615 million market capitalization) leads to high stock price volatility [1][4][3];

- Mid-term net profit decreased by 6% year-on-year, putting pressure on profit performance [1];

- The year-to-date gain is as high as 144.39%, with potential correction risk [3].

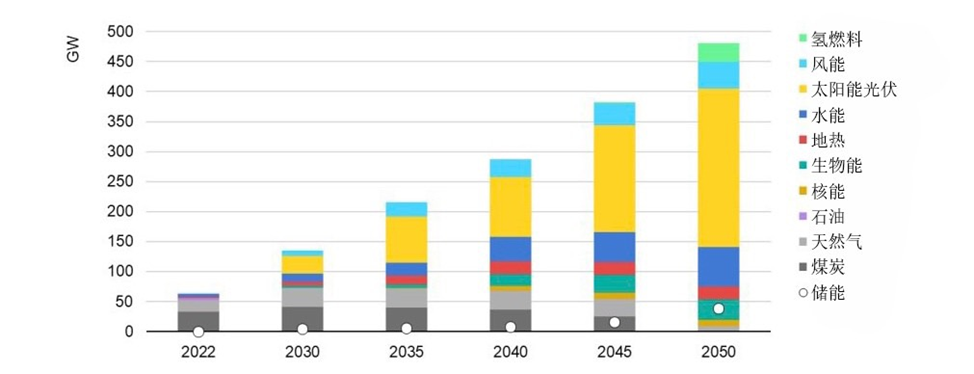

As a new energy sector stock, the long-term development trend of the industry may provide some support, but there are no clear short-term catalysts currently.

Puxing Energy (00090.HK) was included in the East Money Hong Kong Stock Hot List (Surge List) due to short-term price movements and high year-to-date gains. Currently, it has a small market capitalization and under pressure profit performance. Investors need to pay attention to its volatility and correction risks. This report only provides objective analysis and does not constitute investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.