Haozhi Electromechanical (300503.SZ) Reasons for Making the Hot List and Market Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

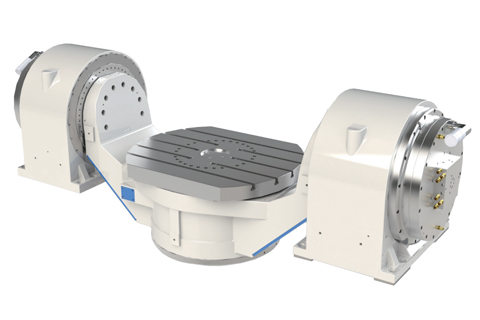

- Sector Catalyst: Leading humanoid robot company UBTech plans to acquire 43% equity of Fenglong Co., Ltd. (002931.SZ) via agreement transfer and tender offer. This event directly drove a general rise in the robot and core components sector. Haozhi Electromechanical, as a supplier of core components such as robot actuators and servo systems, directly benefited [0].

- Price Performance: Today, the stock hit the 20% limit-up, reaching a 52-week high of 43.42 yuan; it has risen 57.89% in the past month and 130.59% since the start of 2025; trading volume was 524,500 shares, three times the average daily volume of the past 60 days (176,500 shares), indicating high attention from market funds [0].

- Fundamental Situation: As of today, the company’s market capitalization is approximately 13.38 billion yuan; in Q3 2025, operating revenue increased by 24.89% YoY, net profit increased by 124.55% YoY, and non-net profit increased by 202.81% YoY, showing significant performance release [0].

- Sector Linkage Effect: Mergers and acquisitions by leading companies in the robot industry have strong transmissibility to the entire industrial chain. Haozhi Electromechanical, as a core component supplier, its stock price performance resonates highly with sector heat [0].

- Signal of Rising Volume and Price: Trading volume increased to three times the average daily level, accompanied by a limit-up to a new high, reflecting market recognition of the company’s position in the robot industrial chain, but short-term speculative sentiment needs to be vigilant against [0].

- Risk Points: Currently, the company’s P/E ratio is 108.23x, at a historically high level; attention needs to be paid to valuation bubble risks; robot sector heat is easily affected by event factors, with possible corrections; intensified industry competition may squeeze profit margins [0].

- Opportunities: The humanoid robot industry is in a stage of rapid development, with sustained growth in demand for core components. Haozhi Electromechanical’s business layout may benefit in the long term; if the high growth trend of performance continues, it can support the company’s value increase [0].

The core reasons for Haozhi Electromechanical (300503.SZ) making the hot list are the resonance between event-driven catalysts in the robot sector and its own high performance growth. The increase in trading volume indicates a significant rise in market attention. However, note that the company’s valuation is high; subsequent comprehensive observation needs to be combined with the long-term development trend of the robot industry, changes in the company’s fundamentals, and the sustainability of sector heat [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.