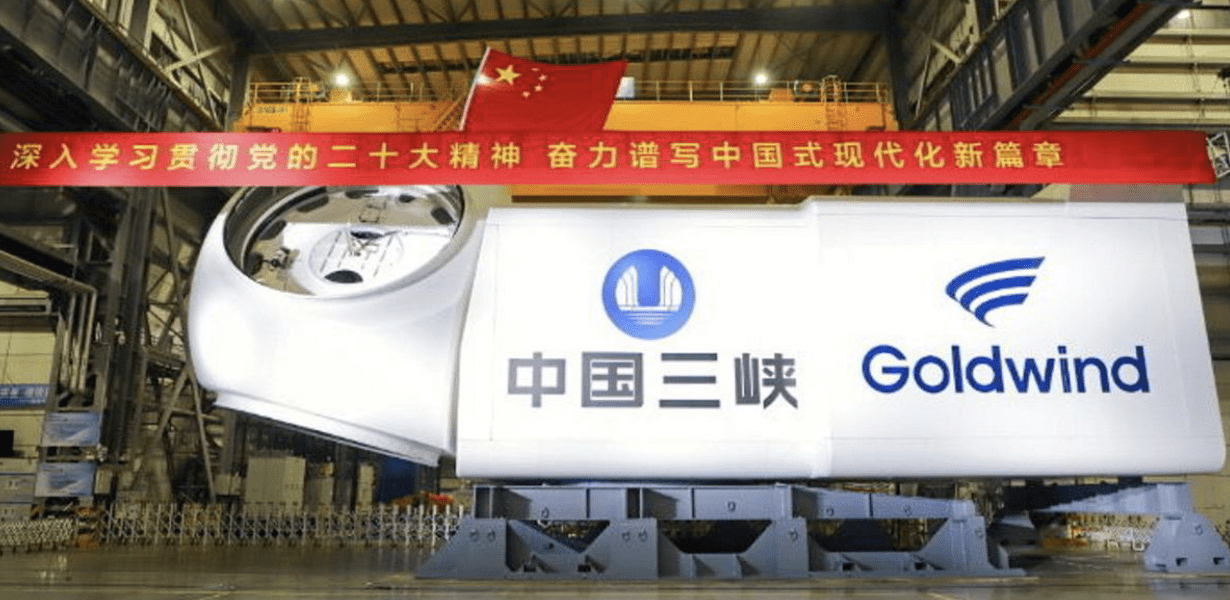

Analysis of Popularity Reasons and Driving Factors for Goldwind Technology (002202.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The core reason Goldwind Technology (002202.SZ) has become a popular stock is the significant rise in its recent stock price and the accompanying increase in trading volume. Today (2025-12-25), the stock price rose by 8.37%, closing at a 52-week high of 19.17 yuan [0]; the 5-day cumulative increase is 17.1%, and the 10-day cumulative increase is 12.8% [0]. Meanwhile, today’s trading volume was 266.53 million shares, higher than the average trading volume of 183 million shares in the past 10 days [0], indicating strong market attention and buying demand, which in turn pushed it onto the popular list.

Although no direct driving event is explicitly mentioned, based on the performance of price and trading volume, the following potential driving factors may exist:

- Industry level: Favorable policies in the wind power industry or higher-than-expected growth in industry demand

- Company level: Possible undisclosed major positive news (e.g., order finalization, better-than-expected performance, etc.)

- Market level: Short-term concentrated capital inflow, driving up the stock price and attracting market attention

- Technical Trend: Goldwind Technology’s stock price has continued to rise since 16.20 yuan on December 19, with an increase of 18.3% in 7 trading days [0], forming a strong upward trend. The technical performance has a significant driving effect on investor sentiment.

- Trading Volume Increase: The trading volume increased to 1.45 times the average level, indicating strong upward momentum and significantly higher market attention and participation in the stock [0].

- Price Breakthrough: Today’s closing price broke through the 52-week high; this breakthrough of a key price level may attract more attention from technical investors.

- The stock price broke through the 52-week high; if it can continue to rise with increased volume, it may further attract market attention and drive the stock price to continue upward.

- The short-term increase is large, market attention is high, and liquidity is enhanced, providing good trading opportunities for investors.

- The short-term increase is too large, so there is a risk of profit-taking.

- Without substantial positive support, the stock price may fluctuate sharply.

- It is necessary to pay attention to whether there will be substantial positive news in the future to verify the sustainability of the current rise.

Goldwind Technology (002202.SZ) has become a popular stock due to its recent sharp rise in stock price, reaching a 52-week high, and a significant increase in trading volume. The technical side shows a strong upward trend, and market attention and participation have increased significantly. However, investors need to pay attention to the risk of profit-taking caused by the excessive short-term increase. It is recommended that investors combine subsequent industry and company-level news to rationally judge the value of continuous attention.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.