Analysis of Haozhi Electromechanical (300503) Strong Performance: Reasons, Support, and Sustainability

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on data from tushare_strong_pool [1]. Haozhi Electromechanical (300503) entered the strong stock pool after hitting a 20% daily limit and a record high on December 25, 2025.

-

Catalytic Factors: Capital integration in the robot industry is accelerating. The news of UBTech’s plan to take control of Fenglong Shares has driven the overall strength of the robot concept sector, with main capital inflow into the sector exceeding 87.77 billion yuan [0]. As a core component provider for robots and humanoid robots, Haozhi Electromechanical directly benefits from the increased industry enthusiasm.

-

Technical Performance: Before entering the strong stock pool, the stock price rose nearly 140% in 12 trading days, which is part of the overall rebound in the technology sector. Sectors such as commercial aerospace, AI, and chips also performed strongly during the same period [0].

-

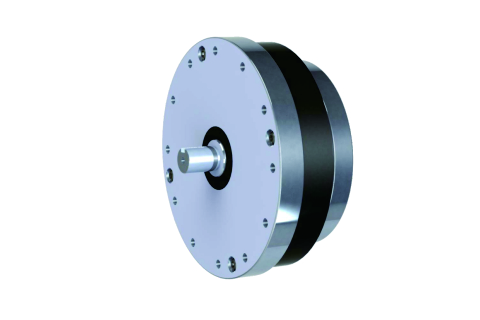

Fundamental Support: In Q3 2025, the company’s revenue was 11.432 billion yuan, an increase of 18.10% year-on-year; net profit was 1.216 billion yuan, an increase of 50.40% year-on-year [0]. Revenue from robot-related products was 168.34 million yuan, up 15.69% year-on-year. Core products include harmonic reducers, motors, encoders, PCB spindles, etc. [0].

- The acceleration of capital integration in the robot industry will drive the growth of demand for core components, and Haozhi Electromechanical’s position as a core supplier will be further highlighted.

- The company’s Q3 net profit growth rate is faster than revenue, indicating improved profitability, and stable fundamentals provide support for the strong stock price.

- The stock price increase is the result of the combined effect of industry dividends and the company’s fundamentals, reflecting the market’s expectations for the future growth of the robot industry.

- Risks: The short-term stock price has risen too much, facing correction pressure; intensified industry competition may affect profit levels.

- Opportunities: The robot industry is in a period of high growth, and the demand for the company’s core products continues to rise; technical reserves and capacity expansion will support long-term development.

- Haozhi Electromechanical (300503)'s strong performance is supported by news of robot industry integration and its own fundamentals.

- The company is a core component provider for robots and benefits from the industry’s growth trend.

- Investors need to pay attention to short-term volatility risks and focus on long-term industry development and the company’s performance.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.