Fengyuan Co., Ltd. (002805.SZ) Limit-Up Analysis on December 26, 2025

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

-

Limit-Up Reason Analysis

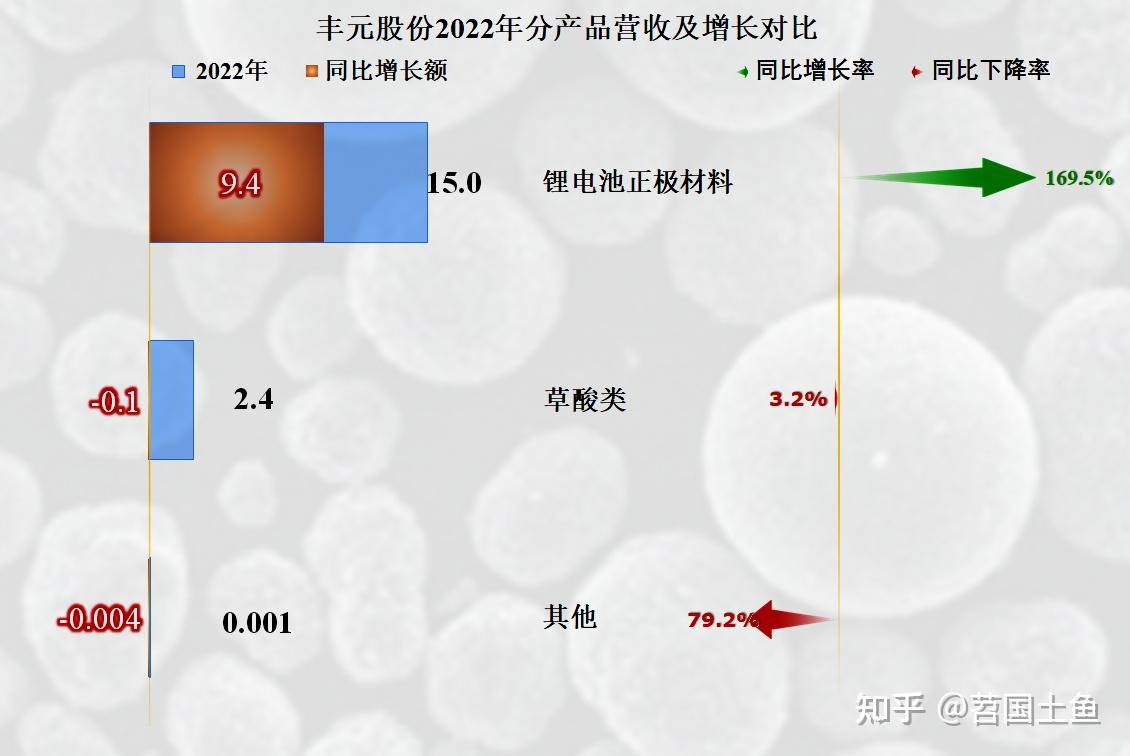

Fengyuan Co., Ltd. (002805.SZ) limit-up was mainly driven by two types of factors: First,industry-wide positive catalyst: Australian lithium mining company PLS hit a record closing high due to lithium price rebound; as a lithium battery cathode material producer, Fengyuan Co., Ltd. directly benefits from the recovery of the lithium industry chain’s prosperity [1]; Second,short-term momentum continuation: The company’s stock price performed strongly in the early stage, with a 5-day increase of 15.69% and a 3-month increase of 35.93%, forming an upward trend, and short-term funds chasing momentum stocks in the market strengthened the limit-up trend [0]. -

Price and Trading Volume Characteristics

The closing price on December 25 was 17.16 USD, and it directly gapped up to the limit-up price of 18.88 USD on the 26th, complying with the A-share limit-up rules [0]. The trading volume was 12.10M, slightly lower than the previous day but still in the active range, indicating limited selling pressure during the limit-up process [0]. -

Market Sentiment Assessment

The lithium battery sector was boosted by the lithium price rebound, and investors’ expectations for the recovery of the new energy industry chain warmed up [1]. However, the company’s financial situation is poor (negative profit, low liquidity), and the sharp rise in stock price reflects more short-term games of speculative funds rather than long-term market supported by fundamentals.

- Transmission effect of industry recovery: The boost of lithium price rebound to the lithium battery industry chain shows a top-down transmission, extending from lithium mining enterprises to mid-stream links such as cathode materials; if this trend continues, it is expected to drive the activity of the entire sector to increase.

- Deviation between fundamentals and stock price: The company’s financial indicators (ROE -41.99%, net profit margin -36.14%, current ratio 0.61) show significant financial pressure [0], but the short-term sharp rise in stock price reflects strong speculative sentiment in the market, requiring vigilance against valuation bubble risks.

- Main Risks

- Financial risk: The company’s profitability and liquidity are insufficient, and its financial situation continues to deteriorate [0].

- Valuation risk: The P/B ratio of 5.35x is far higher than the industry average, and the stock price increase is decoupled from fundamental support [0].

- Industry fluctuation risk: The sustainability of lithium price rebound is unknown; if the industry recovery is less than expected, the stock price may correct quickly.

- Potential Opportunities

- If the lithium price rebound continues, the company as a cathode material producer is expected to benefit from the improvement of industry prosperity.

- The short-term momentum effect may attract more capital inflows, pushing the stock price to rise further, but attention should be paid to the breakthrough of resistance levels.

- The limit-up of Fengyuan Co., Ltd. (002805.SZ) is jointly driven by the recovery of the lithium mining industry and short-term momentum effect [0][1].

- Market sentiment is positive but with speculation; need to be alert to financial, valuation and industry fluctuation risks [0][1].

- Subsequent trends need to focus on the sustainability of lithium price rebound and the improvement of the company’s fundamentals.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.