Activist Investor Stake-Building in Target: Strategic Changes & Investment Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

| Company | Stake Size | Outcome |

|---|---|---|

Kenvue (KVUE) |

Significant | Acquired by Kimberly-Clark for $40B (Nov 2025) |

Kellanova |

Strategic stake | Pushed for operational changes at Pringles maker |

US Steel |

Active position | Advocated for strategic alternatives amid acquisition interest |

According to

- Net sales declined -1.5%year-over-year

- Comparable sales fell -2.7%

- Three consecutive quarters of declining comparable sales[1]

| Metric | Value |

|---|---|

| 52-Week High | $145.08 |

| Current Price | $99.55 |

| YTD Decline | -27.4% |

| 3-Year Decline | -31.6% |

| 5-Year Decline | -43.6%[0] |

| Metric | Value | Assessment |

|---|---|---|

| P/E Ratio (TTM) | 12.02x | Below historical average |

| Market Cap | $45.2B | Down significantly from highs |

| P/B Ratio | 2.92x | Reasonable for retail |

| ROE | 24.87% | Strong profitability[0] |

Based on TCIM’s historical approach and typical retail activist campaigns, the following strategic changes are likely:

- Further corporate workforce reductions (Target already cut 1,800 roles in October 2025)

- Supply chain optimization and inventory management improvements

- Store footprint rationalization

- Administrative expense reductions

- Addition of activist-nominated directors with retail expertise

- Potential removal of long-tenured directors

- Enhanced board diversity and independence

The Accountability Board has already filed a shareholder proposal urging Target to appoint an

- Real estate monetization (Target owns significant store properties)

- Non-core business divestitures

- Strategic alternatives for underperforming segments

- Increased share buybacks

- Dividend policy review

- Rebalancing capital expenditures

- Debt optimization

- Accelerated management transitions

- Enhanced accountability for performance

- Possible addition of turnaround specialists

- Upside Potential:DCF analysis suggests significant upside with:

- Conservative fair value: $296.23(+197.6%)

- Base case fair value: $375.58(+277.3%)

- Probability-weighted value: $412.23(+314.1%)[0]

- Conservative fair value:

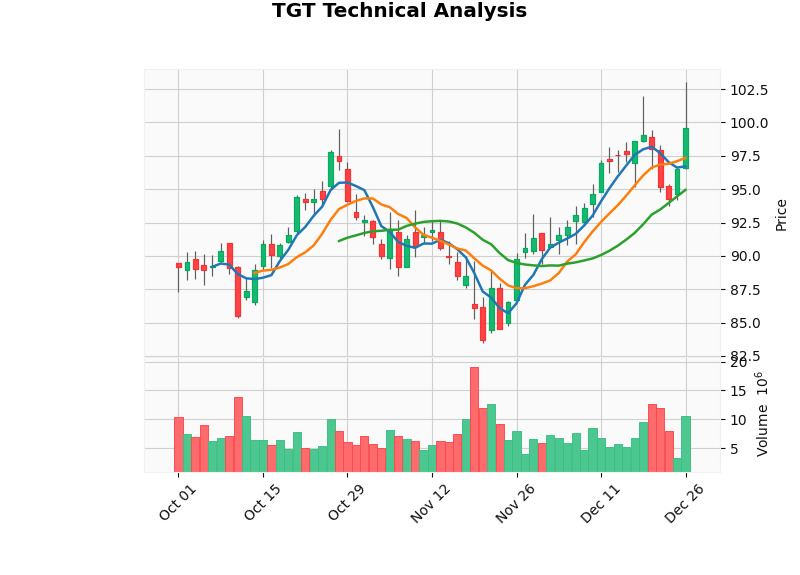

- Technical Position:Stock currently trades in sideways range ($94.95 - $100.96) with potential for breakout[0]

- Analyst Sentiment:Consensus rating of HOLD with 44.8% Buy ratings; price target $92.00[0]

- Volatility during activist campaign

- Potential public disagreements between TCIM and management

- Execution risk on operational changes

- Consumer spending weakness and tariff headwinds[1]

| Scenario | Probability | Shareholder Impact |

|---|---|---|

Cooperative Engagement |

50% | Gradual operational improvements, 20-40% upside |

Aggressive Campaign |

30% | More radical changes, higher volatility, 30-60% upside |

Resistance & Stalemate |

15% | Limited progress, stock remains range-bound |

Full Proxy Contest |

5% | Significant disruption, binary outcome |

- Digital/e-commerce accelerationto compete with Amazon and Walmart

- Private label expansion(Target’s owned brands account for ~30% of sales)

- Same-day delivery and fulfillment optimization

- Loyalty program enhancement

- Format innovation(small-format stores, urban locations)

| Company | Activist | Outcome | Shareholder Return |

|---|---|---|---|

Kohl’s (2022) |

Ancora/Legion/Macellum | CEO replacement, board refresh | Mixed - operational focus, but sales challenges persisted |

Bed Bath & Beyond |

Ancora/Legion | Board overhaul | Negative - bankruptcy (2023) |

JCPenney |

Various (2010s) | Multiple campaigns | Negative - bankruptcy (2020) |

Target (2009) |

Pershing Square | Real estate spin-off rejected | Mixed - shareholder vote supported management[1][3] |

- Activism does not guarantee success; execution and market conditions matter

- Retail turnarounds are particularly challenging in e-commerce era

- Governance changes alone cannot offset secular headwinds

- Cooperate engagement typically yields better outcomes than proxy fights

- Trend:Sideways/no clear trend

- Support:$94.95 (20-day moving average)

- Resistance:$100.96 (recent highs)

- Volume:Elevated on activist news (10.47M vs. 7.66M average)

- Beta:1.12 (higher volatility than market)

- Break above $105 would signal bullish momentum

- Support at $90 (November 2024 lows)

- Major support at $83.44 (52-week low)

- Strong ROE:24.87% indicates efficient capital use

- Reasonable valuation:P/E of 12.02x below 5-year average

- Established brand:Target remains a destination for value-conscious consumers

- Free cash flow:$4.48B (latest) provides flexibility

- Debt risk classified as HIGHby financial analysis

- Current ratio:0.97 (slightly below 1.0, indicates liquidity pressure)

- Quick ratio:0.27 (very low, indicates short-term liquidity concerns)

- 12 consecutive quartersof sales decline

- Significant undervaluation according to DCF analysis (up to 314% upside potential)[0]

- Activist involvement creates catalyst for value realization

- Target’s core franchise remains strong with owned brands and experiential retail

- New CEO (Fiddelke) may bring fresh perspective

- Consumer spending weakness in 2026

- Potential escalation costs if TCIM pursues proxy contest

- Competitive pressure from Walmart and Amazon

- Tariff and inflation headwinds

| Strategy | Entry Price | Target | Rationale |

|---|---|---|---|

Conservative |

<$90 | $110-125 | Attractive risk/reward if activist campaign succeeds |

Moderate |

$95-100 | $130-160 | Fair value considering activist catalyst |

Aggressive |

Current | $175+ | Assumes successful turnaround and multiple expansion |

- January-February 2026: TCIM may file 13DorSchedule 13Gdisclosing stake size

- February 1, 2026: CEO transition (Cornell → Fiddelke)

- Q4 2025 earnings release: First quarterly results under activist scrutiny

- Potential board refresh announcements

- Strategic review announcements

- Possible restructuring initiatives

- Shareholder meeting season (May-June 2026) - potential proxy contest if demands not met

The entry of

- DCF analysis indicates fair value potentially 3x-5x current price[0]

- TCIM’s track record shows ability to unlock value (Kenvue sale, Kellanova improvements)

- Target’s strong brand and owned-portfolio provide turnaround potential

- Retail sector faces structural challenges from e-commerce and discounters

- Consumer spending headwinds in 2026

- Target already initiated restructuring (1,800 job cuts announced October 2025)

- Cooperation vs. confrontation dynamic remains uncertain

- Current shareholders:Hold with position sizing appropriate for turnaround risk

- New investors:Opportunistic entry on weakness with clear exit strategy

- Risk tolerance:Moderate-High given execution and sector risks

The activist stake creates a

[0] 金灵API Data (Stock quotes, technical analysis, financial analysis, DCF valuation, and price data)

[1] PYMNTS.com - “Activist Investor TCIM Makes ‘Significant’ Investment in Target” (https://www.pymnts.com/news/2025/activist-investor-tcim-makes-significant-investment-in-target/)

[2] Financial Times via 13D Monitor - “Pressure Grows on Target as Activist Investor Builds Stake” (https://www.13dmonitor.com/DefaultUS.aspx)

[3] Harvard Law School Forum on Corporate Governance - “The Recent Evolution of Shareholder Activism in the United States” (https://corpgov.law.harvard.edu/2025/12/24/the-recent-evolution-of-shareholder-activism-in-the-united-states/)

[4] AOL/Reuters - “Embattled Target Feeling Heat from Hedge Fund Investor Toms Capital” (https://www.aol.com/articles/embattled-target-feeling-heat-hedge-165142817.html)

[5] Yahoo Finance - “Target Shares Gain as Activist Investor Reportedly Builds Big Stake” (https://finance.yahoo.com/news/target-shares-gain-activist-investor-154111204.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.