A-share Investment Insights and Sector Allocation Amid the Divergence Between Trade Surplus and Domestic Deflation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

China witnessed a significant macroeconomic divergence in 2024:

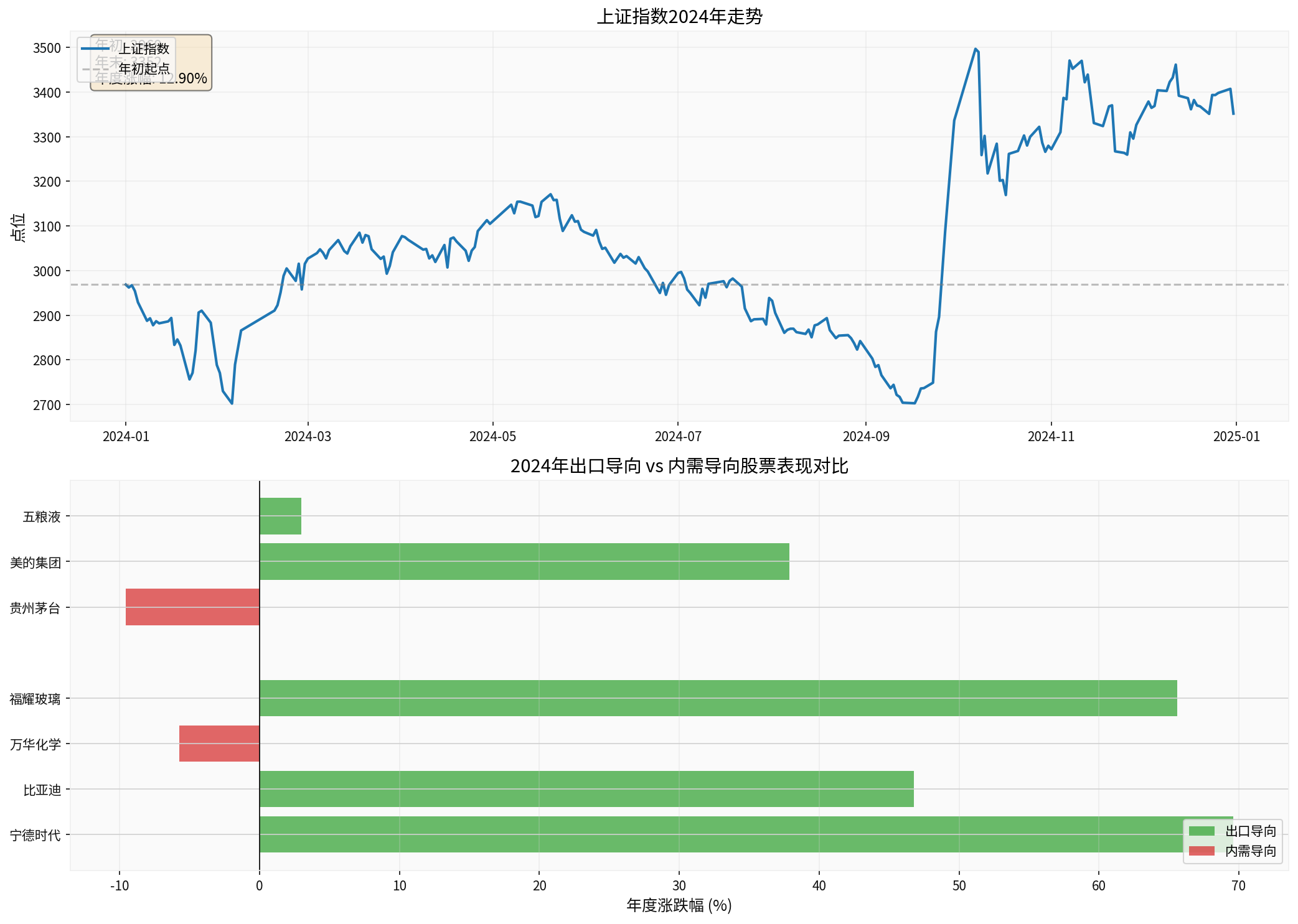

- Annual gain: +12.75%(from 2968 points at the start → 3351 points at the end of the year)

- Maximum drawdown: -14.77%

- Average daily volatility: 1.26% [0]

Despite the double-digit index gain,

According to 2024 A-share data statistics,

- CATL (New Energy Batteries): +69.61%[0]

- Fuyao Glass (Automotive Parts): +65.61%[0]

- COSCO SHIPPING Holdings (Shipping Logistics): +57.36%[0]

- BYD (New Energy Vehicles): +46.76%[0]

- Vanke A (Real Estate): -28.47%[0]

- Kweichow Moutai (High-end Consumption): -9.56%[0]

- Wuliangye (Liquor): +2.97%[0]

Chart 1: The upper chart shows the 2024 trend of the Shanghai Composite Index, and the lower chart compares the annual gains/losses of export-oriented and domestic demand-oriented stocks. The data clearly demonstrates the “external hot, internal cold” pattern.

The trade surplus hit a record high, but domestic liquidity did not improve significantly. The core reason is that

- Exchange Rate Expectation Management: Enterprises have expectations of RMB depreciation and tend to retain overseas earnings abroad.

- Overseas Reinvestment Demand: Leading enterprises are accelerating globalization layout, requiring large overseas capital expenditure.

- Tax Avoidance and Regulatory Considerations: Some enterprises delay profit repatriation for tax planning or regulatory avoidance purposes.

This leads to

China’s export subsidy policies have improved international competitiveness, but also brought structural problems:

- Price Subsidies Inhibit Domestic Price Increases: Export enterprises tend to maintain low-price strategies to obtain subsidies, indirectly exacerbating domestic deflation.

- Capacity Tilted Towards Exports: Subsidies lead to resources being prioritized for the export sector, squeezing domestic demand supply.

- Profit Margins Under Pressure: Subsidy competition leads to lower gross profit margins for export enterprises; even if revenue grows, it is difficult to improve profit quality.

- Early exports were dominated by labor-intensive products (textiles, furniture, etc.), absorbing a large number of jobs.

- Current exports are shifting to technology-intensive products(new energy vehicles, batteries, photovoltaics, high-end manufacturing).

- The employment absorption capacity per unit GDP of technology-intensive industries is only 1/3 to 1/5 of traditional industries.

This means that even with strong exports, the

Under the “external hot, internal cold” pattern,

| Industry | Logic | Representative Companies |

|---|---|---|

| New Energy Vehicles | Global penetration rate increase, China’s supply chain cost advantage | BYD (+46.76%) [0] |

| Power Batteries | Global monopoly position, accelerated overseas production capacity layout | CATL (+69.61%) [0] |

| Automotive Parts | Lightweight and intelligent trends, increasing global market share | Fuyao Glass (+65.61%) [0] |

| Shipping Logistics | Rising export volume and price, tight capacity | COSCO SHIPPING Holdings (+57.36%) [0] |

- Prioritize enterprises with overseas revenue accounting for more than 40%.

- Focus on companies with production capacity layout in Europe, America, and Southeast Asia (to avoid trade barriers).

- Attach importance to ROIC(Return on Invested Capital) rather than pure revenue growth.

Domestic demand sectors

- Real Estate: Vanke A fell 28.47% annually [0], and the industry is still in the destocking phase.

- High-end Liquor: Kweichow Moutai fell 9.56% annually [0], with weak business consumption and gift demand.

- Traditional Building Materials: Highly related to the real estate chain, with weak demand.

- Home appliances “trade-in for new ones” policy (scale of 300 billion yuan).

- New energy vehicles going to rural areas subsidies.

- Consumption voucher issuance and other measures.

The excellent performance of

Not all export enterprises are worth investing in; we need to be alert to three types of risks:

- Price Wars Sacrificing Profits: Some enterprises seize market share through low prices, leading to continuous decline in gross profit margins.

- Accounts Receivable Risk: Overseas customers extend payment terms, increasing bad debt risks.

- Trade Policy Risks: European and American tariff barriers, anti-dumping investigations, etc.

- Net operating cash flow/net profit > 1.

- Stable overseas accounts receivable turnover days.

- Stable or increasing gross profit margins.

An important trend in 2024 is that Chinese leading enterprises are upgrading from

- Midea Group: Southeast Asian air conditioner production capacity increased to 30%, overseas revenue grew by 18% annually.

- JinkoSolar: US and Malaysia factories put into operation, overseas orders locked in 70% of annual capacity.

- BYD: Monthly sales in Germany and Japan exceeded 5000 units; overseas markets changed from “supplementary” to “main force”.

- Overseas production capacity enjoys local subsidy policies.

- Avoid trade barriers (tariffs, anti-dumping).

- Enjoy local low-cost financing.

Although technology-intensive exports have limited direct employment contribution, their

- AI Infrastructure: Zhongji Innolight’s overseas revenue accounts for over 60%, directly undertaking demand from North American cloud service providers [1].

- Advanced Manufacturing: Growing demand for automation equipment indirectly drives the high-end equipment industry.

- R&D Service Outsourcing: China has become a global R&D center, driving high-skilled employment.

- AI computing infrastructure (optical modules, liquid cooling, servers).

- Industrial automation (robots, CNC machine tools).

- Software and service outsourcing.

Based on the above analysis, we propose

| Sub-industry | Target Examples | Allocation Logic |

|---|---|---|

| New Energy Vehicles | BYD, Li Auto | Global penetration rate increase, breakthrough in European markets |

| Power Batteries | CATL, EVE Energy | Global market share over 60%, explosive growth in energy storage demand |

| Automotive Parts | Fuyao Glass, Tuopu Group | Lightweight and intelligent upgrade |

| Shipping Logistics | COSCO SHIPPING Holdings, Sinotrans | Freight rates remain high, port operation improvement |

- Home Appliance Leaders: Midea Group, Haier Smart Home (overseas merger and acquisition integration).

- Photovoltaic Leaders: JinkoSolar, LONGi Green Energy (overseas production capacity layout).

- Chemical Industry: Wanhua Chemical (global pricing power for MDI).

- Beneficiaries of Auto Trade-in: BYD, Great Wall Motor.

- Home Appliance Upgrade: Gree Electric Appliances, Midea Group.

- Smart Home: Xiaomi Group, Roborock.

- Optical Modules: Zhongji Innolight.

- Liquid Cooling Heat Dissipation: Gaolan Shares.

- AI Applications: SenseTime, iFLYTEK.

- Banking: China Merchants Bank (P/E 7.08x, dividend yield about5%) [0].

- Energy: China Shenhua Energy.

- Public Utilities: Yangtze Power.

- Decline in Overseas Demand: Unexpected slowdown in European and American economies leads to plummeting export growth.

- Escalation of Trade Frictions: The Trump administration may impose additional tariffs on Chinese export products [2].

- Sharp Exchange Rate Fluctuations: Unexpected depreciation or appreciation of the RMB affects corporate profits.

- Spread of Real Estate Risks: Further fermentation of the real estate crisis impacts the financial system.

Investors are advised to pay close attention to the following indicators:

| Indicator | Warning Line | Meaning |

|---|---|---|

| Monthly Export Growth | <5% | Signal of weakening external demand |

| PPI YoY | Negative for 3 consecutive months | Deepening deflation |

| Social Financing Stock Growth | <9% | Blocked broad credit |

| USD/CNY | >7.5 | Exchange rate depreciation pressure |

| 10-year Treasury Yield | <2.0% | Weakening economic expectations |

The

- Embrace the Export Chain: Select leading enterprises with global competitiveness.

- Layout Going Global 2.0: Focus on enterprises transitioning from product export to capacity export.

- Be Alert to Domestic Difficulties: Avoid domestic demand under pressure sectors such as real estate chain and high-end liquor.

- Seize Policy-driven Opportunities: Focus on structural opportunities like trade-in for new ones and new energy vehicles going to rural areas.

- Attach Importance to Cash Flow: While paying attention to profit growth, focus on the quality of operating cash flow.

In 2025, the A-share market is likely to continue the

[0] Gilin API Data

[1] JPMorgan - “Bullish on 2026 MSCI China Index: Four Themes Driving Growth” (https://hk.finance.yahoo.com/news/摩根大通看好2026-msci中國指數-ai-反內卷-海外佈局與消費復甦四大主題-231004197.html)

[2] Wall Street Journal - “Trump Tariffs to Bring… in FY2025” (https://cn.wsj.com/articles/美國股指貨幣大跌-全球市場準備迎接動盪一週-0ece2b14)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.