Pop Mart (9992.HK) In-Depth Investment Analysis: Can the IP Matrix Operation Model Support Sustained Growth?

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I will present a comprehensive investment analysis report on Pop Mart:

Pop Mart’s IP matrix operation model has the potential to support it as a ‘great company’ with sustained growth capabilities, but it needs to meet three key conditions:

- Successfully complete globalization transformation(current progress is smooth)

- Maintain continuous innovation and IP incubation capabilities

- Build a complete IP ecosystem(not just relying on trendy play products)

Based on current data, the company has demonstrated strong execution and business model resilience.

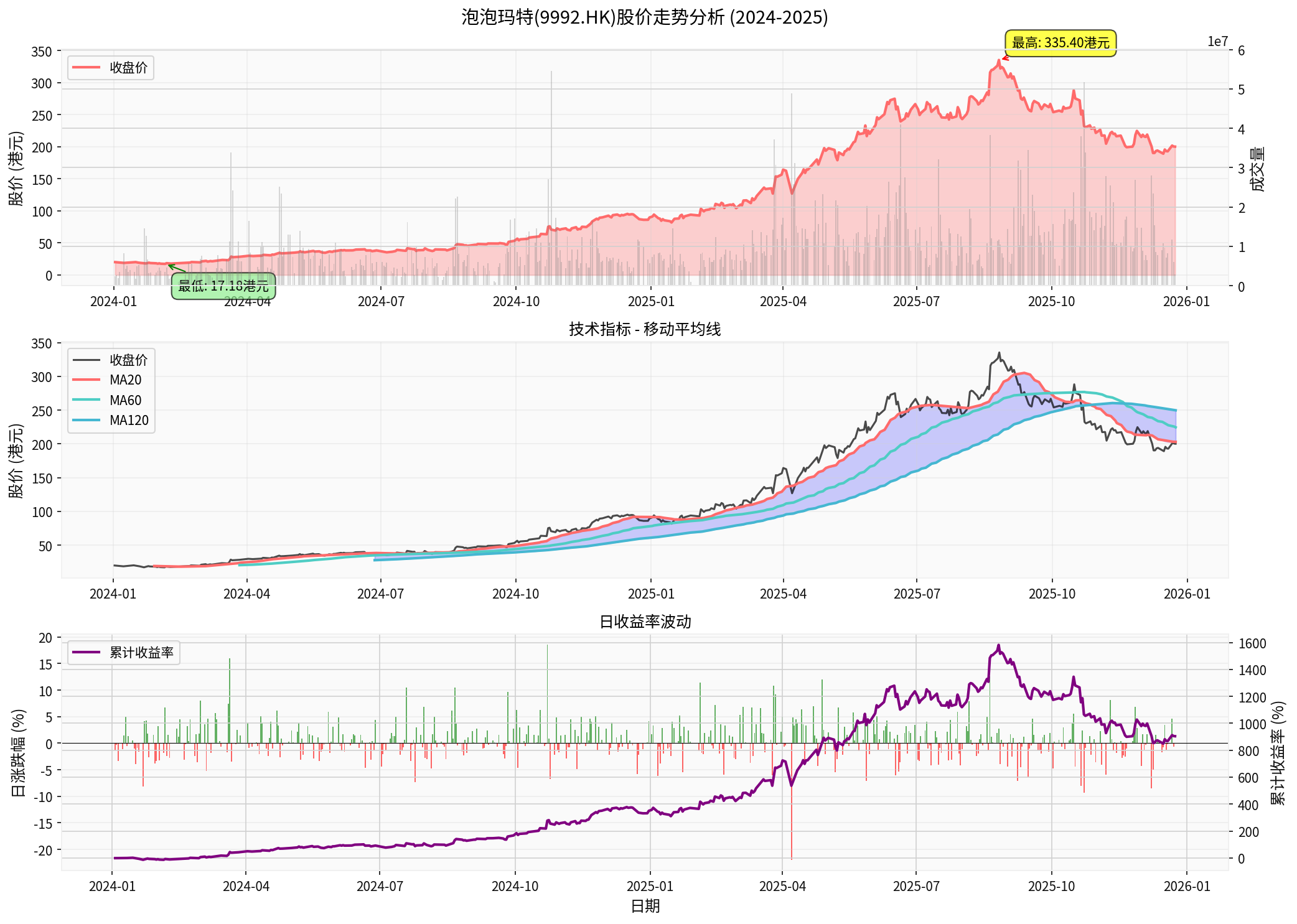

From the chart:

- Current Stock Price: HK$200.20 (as of December 27, 2025)

- Market Capitalization: Approximately HK$265.9 billion

- Annual Performance: +119.64% since 2024, +132.79% in 1 year, +910.09% in 3 years [0]

- 52-week Range: HK$79.50-HK$339.80, currently in the mid-high range

- Period High: HK$335.40 (August 26, 2025)

- Period Low: HK$17.18 (February 5, 2024)

- Annualized Volatility: 56.87%, indicating high volatility [0]

| Indicator | Value | Evaluation |

|---|---|---|

| ROE (Return on Equity) | 54.52% | Extremely Excellent |

| Net Profit Margin | 30.32% | Extremely High Profitability |

| Operating Margin | 40.58% | Industry Leading |

| Gross Margin (2024) | 66.8% | Historical High |

| P/E Ratio | 35.53x | Relatively High Valuation |

| P/B Ratio | 16.98x | Reflects High Growth Expectations |

- Current Ratio: 3.01 (Very Healthy)

- Quick Ratio: 2.63 (Adequate Liquidity)

- Inventory Turnover Days: From 133 days in 2023 to 102 days in 2024 (Significant Improvement in Operational Efficiency) [1]

- Financial Attitude: Conservative

- Debt Risk: Low Risk

- Revenue: RMB 13.04 billion, YoY +106.9%

- Net Profit: RMB 3.4 billion, YoY +185.9%

- Overseas Revenue: RMB 5.07 billion, YoY +375.2% (38.9% of total revenue)

- Gross Margin: 66.8% (Historical High)

- Overall Revenue YoY +165-170%

- China Market Growth +95-100%

- Overseas Market Growth +475-480%

- Americas Market Q1 Revenue Reached Full-Year 2024 Scale

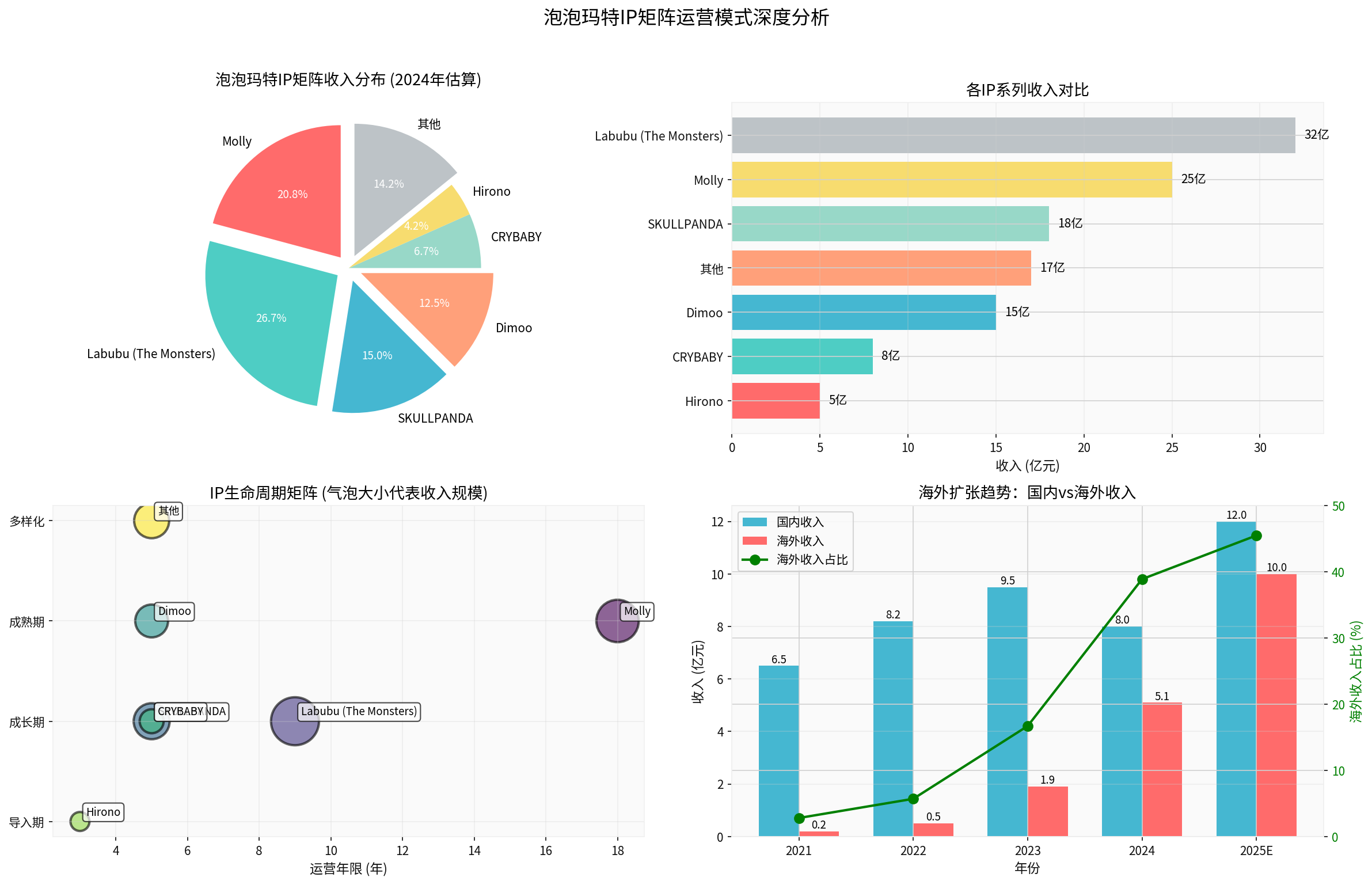

| IP Name | Launch Year | Operation Years | Life Cycle Stage | Revenue (RMB 100M) | YoY Growth | Features |

|---|---|---|---|---|---|---|

| Labubu (The Monsters) | 2015 | 9 | Growth Stage | 32 | 220% | Global Hit, Overseas Driven |

| Molly | 2006 | 18 | Mature Stage | 25 | 15% | Classic IP, Steady |

| SKULLPANDA | 2019 | 5 | Growth Stage | 18 | 45% | Dark Style, Cross-over Success |

| Dimoo | 2019 | 5 | Mature Stage | 15 | 30% | Warm & Healing, Strong Fan Loyalty |

| CRYBABY | 2019 | 5 | Growth Stage | 8 | 180% | Emotional Resonance, Female-Oriented |

| Hirono | 2021 | 3 | Introduction Stage | 5 | 300% | Niche Depth, Collection Value |

| Others | - | - | Diversified | 17 | 25% | Diversified Supplement |

- Moderate IP Concentration: HHI Index 0.179, indicating high IP diversification and reduced single-point risk

- Head Leading & Multi-Polar Support: 4 IPs with revenue over RMB 1 billion in 2024 (Labubu, Molly, SKULLPANDA, CRYBABY)

- Labubu Accounts for 26.7%: Core IP but no over-reliance

- Classic IP Vitality Verified: Molly maintains 15% growth after 18 years, contributing RMB 2.5 billion

- S-level: IP with annual revenue over RMB 1 billion (4 in 2024, increased to 5 in H1 2025)

- A-level/B-level: Potential but Need Cultivation

- C-level: Timely Stop Loss

- Tencent also adopts multi-product matrix strategy

- Honor of Kings launched in 2015, operated for 10 years, Q1 2025 revenue hit historical high

- Traditional game life cycle is only 6-12 months, but continuous operation breaks the rule

- Both have formed ‘Big IP’ concept beyond single product

| Year | Domestic Revenue (RMB 100M) | Overseas Revenue (RMB 100M) | Overseas Share | Overseas Growth |

|---|---|---|---|---|

| 2021 | 65 | 2 | 2.8% | - |

| 2022 | 82 | 5 | 5.7% | 150% |

| 2023 | 95 | 19 | 16.7% | 280% |

| 2024 | 80 | 51 | 38.9% | 375.2% |

| 2025E | 120 | 100 | 45.5% | 96% |

- Americas Market: Q1 2025 YoY +895-900%

- Europe Market: Q1 2025 YoY +600-605%

- Southeast Asia: 2024 Growth +619.1% (Revenue RMB 2.4 billion)

- Overseas Store Efficiency: Average per-store revenue over RMB 10 million (2.9x Domestic)

- Coverage: Entered nearly 100 countries

- IP Creation: Artist Discovery & Signing, In-house IP Incubation

- Product Development: Design, Supply Chain Management, Category Expansion

- Channel Sales:

- Offline: 374 Direct Stores (H1 2024), Robot Stores

- Online: Tmall, JD, Douyin (+5779.8% Growth), Self-operated APP

- Members: 38.927 Million, Repurchase Rate 43.9%

| Category | 2024 Revenue (RMB 100M) | Growth | Share Change |

|---|---|---|---|

| In-house IP Trendy Play | - | - | From 62.7% to 53.2% |

| MEGA Collection Series | 16.8 | 146.1% | High-end Strategy |

| Vinyl Plush | 28.3 | 1289% | Explosive Growth |

| Blind Box | - | - | First Time Below 60% Share |

- Themed Parks: First park落地 in Beijing Chaoyang Park at end of 2023

- Game Business: Dream Home launched in June 2024

- Film & TV Content: Explore IP Reverse Content Filling

- Disney: Film & TV Content → Emotional Connection → Derivatives/Park Monetization

- Pop Mart: Product → User Base → Content/Experience Filling (‘Reverse’ Path)

- Ultimate Goal: Both are ‘IP Ecosystem’ Platforms

- 2023 Size: RMB 773.1 billion

- 2028 Estimate: RMB 993.7 billion

- CAGR: 5.1-5.2%

- 2024 Size: RMB 75.6 billion (43.4% of IP Derivatives Market)

- Fastest Growing Categories: Static Dolls (CAGR 17.2%), Action Dolls (CAGR15.4%)

- 2026 Estimate: Exceed RMB110 billion

- US: RMB387

- Japan: RMB244.7

- China: RMB53.6

- China’s Potential: 1/7 of US,1/5 of Japan

| Echelon | Enterprise | Annual Revenue (RMB100M) | Features |

|---|---|---|---|

| Tier1 | Lego | 1200 | International Giant, Far Ahead |

| Tier2 | Pop Mart | 130.4 | Local Leader, Trendy Play Track |

| Tier2 | Bloks | 43 | Innovation in Building Blocks, Rising Strongly |

| Tier3 | Disney | 25 | Global IP, Lagging Local Penetration |

| Tier3 | Bandai | 23 | Japanese IP, Game Toys |

| Tier3 | Mattel | 15 | US IP, Classic Toys |

| Tier4 | 52TOYS etc. | 8-10 | Chinese Local Enterprises |

- 2020-2024 Revenue CAGR达51.4%

- 2024 Growth Rate106.9%

- Market Share11.9% (2021 Data, CR3=20.5%)

- Any hit IP has life cycle, continuous hit generation has uncontrollable factors

- IP Paradox: Cross-over leads to ‘image abuse’ & ‘scarcity reduction’, core fans may leave

- May eventually lead to sales stagnation

- Multi-IP matrix to smooth single IP cycle fluctuations

- Establish S/A/B/C dynamic classification system

- Continuous new IP incubation (10 IPs with over RMB100M revenue in2024)

- Maintain IP vitality via content & community

- Geopolitical Risk

- Localization Execution Difficulty

- Supply Chain Complexity Increase

- Exchange Rate Fluctuation Impact

- Overseas Gross Margin 8 percentage points higher than domestic

- Store efficiency continues to improve (verify business model replicability)

- Gradual strategy from Asia to Europe & Americas (easy to hard)

- P/E35.53x (Historical High Range)

- Stock price fluctuated greatly in52 weeks (HK$79.50-339.80)

- Need sustained high growth to support valuation

- Analysts expect2025-2027 Net Profit CAGR close to30%

- 2025 Revenue Target RMB20 billion (Overseas RMB10 billion)

- Traditional toy manufacturers transform

- Emerging trendy play brands emerge

- IP licensing industry competition fierce (2758 active IPs in 2024) [2]

- Compete with Disney, Sanrio etc. (Global Top IPs)

- Need to compete for young people’s ‘emotional budget’ [2]

###7.1 Similarity Analysis

| Dimension | Labubu(Pop Mart) | Honor of Kings(Tencent) | Evaluation |

|---|---|---|---|

| Birth Time | 2015 | 2015 | Fully Synchronized (10th Anniversary in2025) |

| Current Stage | Growth Stage(Revenue RMB3.2B, +220%) | Mature Stage but New High(Q12025 Revenue Historical High) | Both Break Traditional Industry Life Cycle |

| Revenue Contribution | Single IP RMB3.04B(2024) | Monthly Avg ~RMB1.2B(H12025) | Labubu Annual Revenue ~5 Months of Honor of Kings’ Revenue |

| IP Ecologization | Expand to Parks/Games/Accessories etc. | Animation/Music/Derivatives | Both Beyond Single Product to Form Big IP |

| Globalization | Overseas Share 38.9%(US/Europe Explosive Growth) | Mainly Domestic(Supercell etc. Overseas) | Labubu More Globalized |

| Life Cycle Management | Multi-IP Matrix Dynamic Allocation | Continuous Content Update & Esports Events | Both Establish Systematic Operation Capabilities |

| Commercialization | Gradually Diversified(Reduce Blind Box Dependence) | Relatively Restrained(Focus on User Experience) | Both Focus on Long-Term Value Over Short-Term Monetization |

###7.2 Core Differences

- Honor of Kings: Virtual Products, Extremely Low Marginal Cost, Fast Iteration

- Labubu: Physical Products, Complex Supply Chain but Stronger Offline Experience

- Honor of Kings: High DAU Stickiness but Facing Ecosystem Aging

- Labubu: Collection Attribute, Repurchase Rate 43.9% but Need Continuous Innovation

- Honor of Kings: MOBA Category Lacks Successors but Game Market Shifts to FPS

- Labubu: Many Competitors in Trendy Play Track but IP Matrix Advantage Obvious

###8.1 Positive Factors(Buy Reasons)

- Formed ‘Head Leading & Multi-Polar Support’ Mature Stage

- 4 IPs Over RMB1B in 2024(6 Expected in2025)

- Moderate IP Concentration(HHI0.179 Reduce Single-Point Risk)

- ROE54.52%, Net Profit Margin30.32%, Operating Margin40.58%

- 2024 Revenue +106.9% & Net Profit +185.9%

- Gross Margin Historical High(66.8%)

- Overseas Share From2.8%(2021) to38.9%(2024)

- Q12025 Overseas +475-480%(US/Europe Explosive)

- Overseas Store Efficiency2.9x Domestic(Verify Replicability)

- Molly Maintains15% Growth After18 Years

- Labubu Born10 Years(Operated6) Still in Accelerated Growth

- Break ‘Trendy Play IP Short Life Cycle’ Doubt

- From Blind Box to MEGA/Plush/Blocks etc.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.