Strategic Significance and Market Impact of the Launch of CSI A500 Index Options

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on collected data and in-depth analysis, I will provide a comprehensive analysis of the strategic significance and market impact of the launch of CSI A500 Index Options.

Since its launch on September 23, 2024, the CSI A500 Index has a core feature:

- Optimized Industry Distribution: Covers emerging strategic industries such as new energy, semiconductors, biomedicine, and artificial intelligence

- Market Capitalization Representation: Gathers high-quality leading companies in various industries, balancing growth and stability

- Risk-Return Balance: Annualized volatility of approximately 22%, between traditional value stocks (20-28%) and high-volatility tech stocks (40-45%) [0]

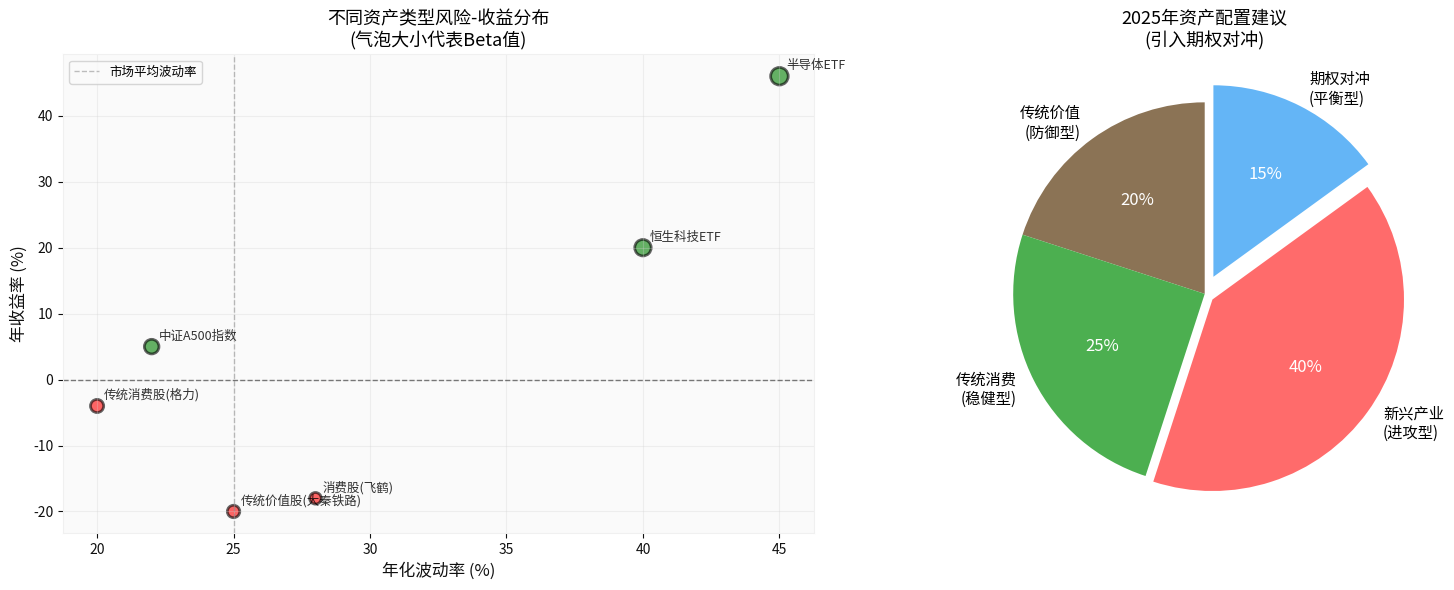

According to 2025 market data, the performance of different asset types shows obvious differentiation:

From the chart:

- Emerging Industry Assets(Semiconductor ETF +46%, Hang Seng Tech ETF +20%): High returns but high volatility (annualized volatility 40-45%)

- Traditional Defensive Assets(Daqin Railway -20%, Feihe -18%): Low or even negative returns, volatility 25-28%

- CSI A500 Index: Balances returns and risks, with an annualized volatility of 22%, suitable for long-term allocation

As mature risk management tools, ETF options reduce market volatility through the following mechanisms:

- Investors buy put options while holding long positions in ETFs

- Limits maximum loss to the premium paid

- Retains upside gains from the underlying asset

- Applicable to: Investors holding emerging industry stocks to hedge against short-term correction risks

- Sell call options while holding ETFs

- Earn premium income and reduce holding costs

- Applicable to: Long-term holders to enhance returns in volatile markets

- Hold ETFs + buy out-of-the-money puts + sell out-of-the-money calls

- Establish risk-return boundaries and reduce portfolio volatility

- Applicable to: Institutional investors to lock in volatility ranges

Global market research shows that the launch of option products usually brings the following positive effects:

- Reduce Spot Volatility: Options provide hedging channels and reduce panic selling

- Improve Market Efficiency: Enhance price discovery function and reduce pricing deviations through arbitrage trading

- Increase Market Depth: Attract investors with different risk preferences to participate

Long-term capital (insurance funds, pensions, sovereign funds, etc.) faces key obstacles to entering the market:

| Pain Point | Option Solution |

|---|---|

Volatility Risk |

Lock in maximum drawdown through option hedging to meet risk budget requirements |

Return Stability |

Earn premium income via covered calls to smooth the return curve |

Asset Allocation Efficiency |

Use option synthetic strategies to achieve flexible tactical asset allocation |

Liquidity Management |

Options provide low-cost exit mechanisms without large-scale spot holdings reduction |

U.S. market data shows:

- SPY options (S&P 500 ETF options) have an average daily trading volume of over 2 million contracts

- Over 60% of institutional investors use options to manage risks

- The depth of the options market and spot market liquidity form a positive cycle

Development path of the Chinese market:

- After the launch of 50ETF options, the scale of ChinaAMC 50ETF grew from 30 billion to nearly 100 billion yuan

- The activity of Shanghai 300ETF options continues to rise, with institutional participation exceeding 40%

- It is expected that CSI A500 options will further enrich the risk management tool system

Based on your qualitative judgment for 2025, the value of CSI A500 options is more prominent:

- In a Low Growth Environment: Option strategies can enhance returns and make up for insufficient returns from single-stock investments

- Against a High Valuation Background: Protective Put strategies prevent valuation correction risks

- In Structural Differentiation: Capture emerging industry opportunities while controlling risks through cross-sector option portfolios

Based on your position structure, the following option strategies are recommended:

Step1: Establish a core position in CSI A500 (30-40%)

- Reason: Balance risk and return, covering high-quality emerging industry targets

- Option matching: Use collar strategy to lock in volatility range

Step2: Retain high-growth exposure (30-40%)

- Semiconductor ETF, Hang Seng Tech ETF

- Option matching: Buy out-of-the-money puts for hedging, with an annual cost of approximately 2-3%

Step3: Allocate option enhancement strategies (15-20%)

- Earn premium income via covered calls

- Use straddle options to capture opportunities in volatile markets

Step4: Cash and liquidity management (10-15%)

- Respond to extreme market conditions and seize opportunities to increase positions

- Liquidity Risk: Insufficient liquidity may occur in the initial stage of option launch

- Hedging Cost: Premium expenses erode investment returns

- Strategy Complexity: Requires management and monitoring by professional teams

- Basis Risk: Changes in correlation between options and underlying spot assets

- Observe pricing and liquidity in the initial stage of option listing

- Pilot protective put strategies on a small scale

- Establish option trading and risk control systems

- Gradually expand the scale of option strategy application

- Explore complex portfolio strategies (collar, spread, etc.)

- Optimize position structure and improve risk-adjusted returns

- Form a mature option investment framework

- Achieve integrated cash and spot asset allocation

- Fully enjoy the dividends of emerging industry development

The launch of CSI A500 Index Options will improve market quality from three dimensions:

- Provide a “shock absorber” for emerging industry investments

- Reduce the probability of extreme market volatility

- Improve risk-adjusted returns of investment portfolios

- Meet the risk management needs of long-term capital

- Reduce market entry thresholds and concerns

- Guide more allocation capital to the real economy

- Improve price discovery mechanisms

- Enhance market liquidity

- Promote the internationalization of the A-share market

- ✅ Effectively balance emerging industry development and volatility risks: Through option hedging, investors can allocate more actively to emerging industries without excessive worry about short-term volatility

- ✅ Attract long-term capital to the market: Option tools solve the risk management pain points of long-term capital, providing a safety cushion for institutional investors such as insurance funds and pensions to enter the market

- ⚠️ Key factors for successful implementation: Rationality of option contract design, cultivation of market depth, investor education, and perfection of regulatory framework

In the 2025 market environment of “low growth, high valuation, and structural differentiation”, CSI A500 Index Options will become an important bridge connecting emerging industry development and long-term capital entry, providing strong financial infrastructure support for the high-quality development of the A-share market.

[0] Gilin API Data and Python Analysis (Market Data, Asset Allocation Analysis)

[1] Bloomberg - “China A500 ETFs Inflows Surge to Record High Toward Year End” (2025-12-19)

[2] Yahoo Finance Hong Kong - “【Fund Manager’s View】2026 Market Conditions Are Policy-Driven, Not a Bull-Bear Contest” (2025-12)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.