Deep Analysis of Pop Mart's IP Operation Capability: Can It Replicate Tencent Games' 'Evergreen' Model?

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on financial data and operational performance,

Indicator |

2022 |

2023 |

2024 |

Growth Rate |

|---|---|---|---|---|

| THE MONSTERS Revenue | RMB 263 million | RMB 368 million | RMB 3.04 billion | 726.6% YoY [1] |

| Plush Toy Revenue | - | - | RMB 2.83 billion | 1,289% YoY [1] |

| Overseas Revenue | - | RMB 1.07 billion | RMB5.07 billion | 375.2% YoY [1] |

| TikTok Shop US Monthly Sales | USD 429,000 | - | USD4.8 million | 1,018% YoY [1] |

- Precise product positioning:The “cute contrast” design (e.g., “Temperature” series) accurately captures Gen Z’s emotional needs [1], with sales exceeding 790,000 sets in 2024.

- Celebrity effect ignites social currency:International stars like Rihanna and Beckham spontaneously shared their purchases, promoting Labubu from “collectible” to “social symbol” [1].

- Global localization strategy:

- Southeast Asia: Buddhist culture co-branded products

- North America: Vietnam production layout to avoid tariffs

- Europe: Cooperation with the Louvre for “Mona Lisa” co-branded products [1]

Labubu’s premium in the secondary market continues to rise, with auction prices hitting new highs [1], reflecting:

- Successful scarcity design mechanism(hidden item probability:0.69%-1/144) [1]

- Market recognition of IP cultural attributes

- Real demand support beyond irrational prosperity

The data you mentioned—“Molly’s sales increased from 40 million to 2 billion yuan, with an annualized growth rate of76%”—itself answers the core question:

Dimension |

Molly (20-year Cycle) |

Labubu (3-year Explosion) |

|---|---|---|

| Time Span | 2006 to present | Exploded in2022 |

| Revenue Growth | RMB40 million → RMB2.0 billion (76% CAGR) | RMB263 million → RMB3.04 billion (726% YoY) |

| Operation Strategy | Series iteration + blind box mechanism | Globalization + celebrity effect + category expansion |

| Life Cycle Verification | ✅ Evergreen verified | ⏳ Need further observation |

- Serial iteration:Continuous refresh of IP content through different theme series (e.g., constellation series, career series)

- Blind box mechanism:Hidden items create repurchase addiction (members contribute 92.7% of sales) [1]

- Full category expansion:From figurines to MEGA collection series, plush toys, and derivatives

- Emotional connection:Molly’s “stubborn girl” persona continues to resonate with consumers

Based on industry research, Tencent Games’ evergreen model (taking Honor of Kings as an example) is built on:

Factor |

Tencent Games |

Pop Mart |

Similarity |

|---|---|---|---|

IP Matrix |

Multiple evergreen games (Honor of Kings, Peace Elite, etc.) | Molly+Labubu+Crybaby+Hirono, etc. | ⭐⭐⭐⭐ |

Continuous content updates |

Regular season updates, new heroes/skins | Serial new product releases (incubate 10+ new IPs annually) [1] | ⭐⭐⭐ |

Social currency attribute |

Team play, tournament culture | “Bag hanging” design, 10-20% premium in secondary market [1] | ⭐⭐⭐⭐ |

Global expansion |

Overseas distribution | 375% growth in overseas revenue [1] | ⭐⭐⭐⭐ |

Technology/supply chain barriers |

Game engine, anti-cheating system | Vietnam/Mexico factories reduce costs by25% [1] | ⭐⭐⭐ |

####4.2 Differentiated Advantages of Pop Mart

- Higher gross margin:Pop Mart’s gross margin is approximately67% [2], vs. Tencent Games’ 50-60%

- Lower R&D costs:Trendy toy IP development costs are far lower than game R&D

- Faster globalization speed:900% growth in the Americas in Q12025 [1], games are more affected by cultural barriers

- Stronger physical attribute:Blind boxes have collection value, while digital games are more replaceable

####4.3 Potential Disadvantages and Risks

- Shorter IP life cycle:Trendy toy IPs are naturally more prone to aesthetic fatigue than game IPs

- Lower competitive barriers:Competitors like Miniso and TOP TOY are following up quickly [2]

- Policy regulatory risks:EU’s Toy Safety Directive may increase compliance costs [1]

- Overvaluation:Current P/E ratio is 35.53x [0], market capitalization is HK$265.9 billion [0], which already reflects high growth expectations

####5.1 Established IP Incubation System

- Self-owned IP (85.3% of revenue):Molly, Labubu, Crybaby, Hirono, etc. [1]

- Exclusive IP (9.7%):PUCKY, Dimoo, etc., locking in scarce design resources [1]

- Non-exclusive IP (5%):Disney co-branded products to expand user coverage [1]

- New IPs like CRYBABY and HIRONO are rapidly growing into important performance drivers [1]

- Plan to incubate 10+ new IPs annually [1]

- The “Pop Mart Theme Park” in cooperation with Fantawild is expected to open in 2027, launching a new monetization model [1]

####5.2 Underlying Logic of IP Incubation Capability

Capability |

Specific Performance |

Comparison with Tencent Games |

|---|---|---|

Designer ecosystem |

Signed 9 artist IPs (e.g., Youyoujiang, Nommi Nuomi’er) [2] | Game producer training system |

Data-driven |

Members contribute92.7% of sales, average customer price is RMB230 [1] | User behavior data analysis |

Supply chain response |

Vietnam/Mexico factories put into production to reduce costs by25% [1] | Global layout of cloud servers/CDN |

Channel control |

401 direct stores + 2,300 robot stores [1] | App stores + self-owned channels |

####6.1 Multi-year Growth Logic

- Continued explosion of overseas markets (growth rate in Americas and Europe exceeds500%) [1]

- New category volume release (1,289% growth in plush toy revenue) [1]

- Institutions continue to raise target prices (Citi HK$308, Morgan Stanley HK$302) [1]

- Continuous expansion of IP matrix (incubate10+ new IPs annually) [1]

- Technology-enabled experience (AR trial, blockchain digital collectibles) [1]

- New monetization model of theme parks (opening in 2027) [1]

- Globalization of supply chain to reduce costs and increase efficiency

####6.2 Core Risk Warnings

- Valuation risk:Current P/E ratio is 35.53x [0], facing valuation correction pressure if growth slows

- IP life cycle risk:Labubu’s popularity may decline; need to prove that Molly’s evergreen ability can be replicated

- Intensified competition:Competitors like Miniso are发力自有IP [2], which may lead to industry profit margin decline

- Regulatory risk:Strict overseas toy safety regulations increase compliance costs [1]

####7.1 Positive Factors

- Verified IP operation capability:Molly’s 20-year evergreen status proves the company’s ability to manage IP life cycles

- Systematic hit incubation mechanism:Labubu’s explosion is the result of “timing, location, and people”, not pure accident

- Globalization exceeds expectations:900% growth in the Americas in Q12025 [1] proves IP’s cross-cultural appeal

- Deepening moat:Self-owned IP accounts for 85.3% [1], global supply chain reduces costs by 25% [1]

####7.2 Factors to Be Verified

- Long-term performance of Labubu:Need3-5 years to verify if it can replicate Molly’s 20-year evergreen status

- Continuous hit capability of new IPs:Can Crybaby and Hirono take over Labubu as the next 1 billion-level IP?

- Theme park monetization:Can the theme park opening in2027 open a second growth curve?

- Competition response:How to maintain high profit margins under the attack of competitors like Miniso

####7.3 Final Judgment

- ✅ Verified:IP incubation capability (Molly, Labubu), globalization capability, high profitability

- ⏳ To be verified:Labubu’s 5+ year performance, continuous hit capability of new IPs, sustainability of competitive barriers

- ⚠️ Risk points:Overvaluation, intensified competition, IP aesthetic fatigue

- Long-term investors:Can allocate strategically, but need to be alert to short-term fluctuations; suggest batch building positions

- Short-term investors:Current valuation already reflects high growth expectations; wait for correction opportunities

- Key indicators to watch:

- Can Labubu’s revenue growth rate remain above50% in2025-2026?

- Can new IPs like Crybaby and Hirono grow into 500 million-level IPs?

- Can overseas revenue account for more than30% from18% in2024?

- Progress and profit expectations of the theme park project

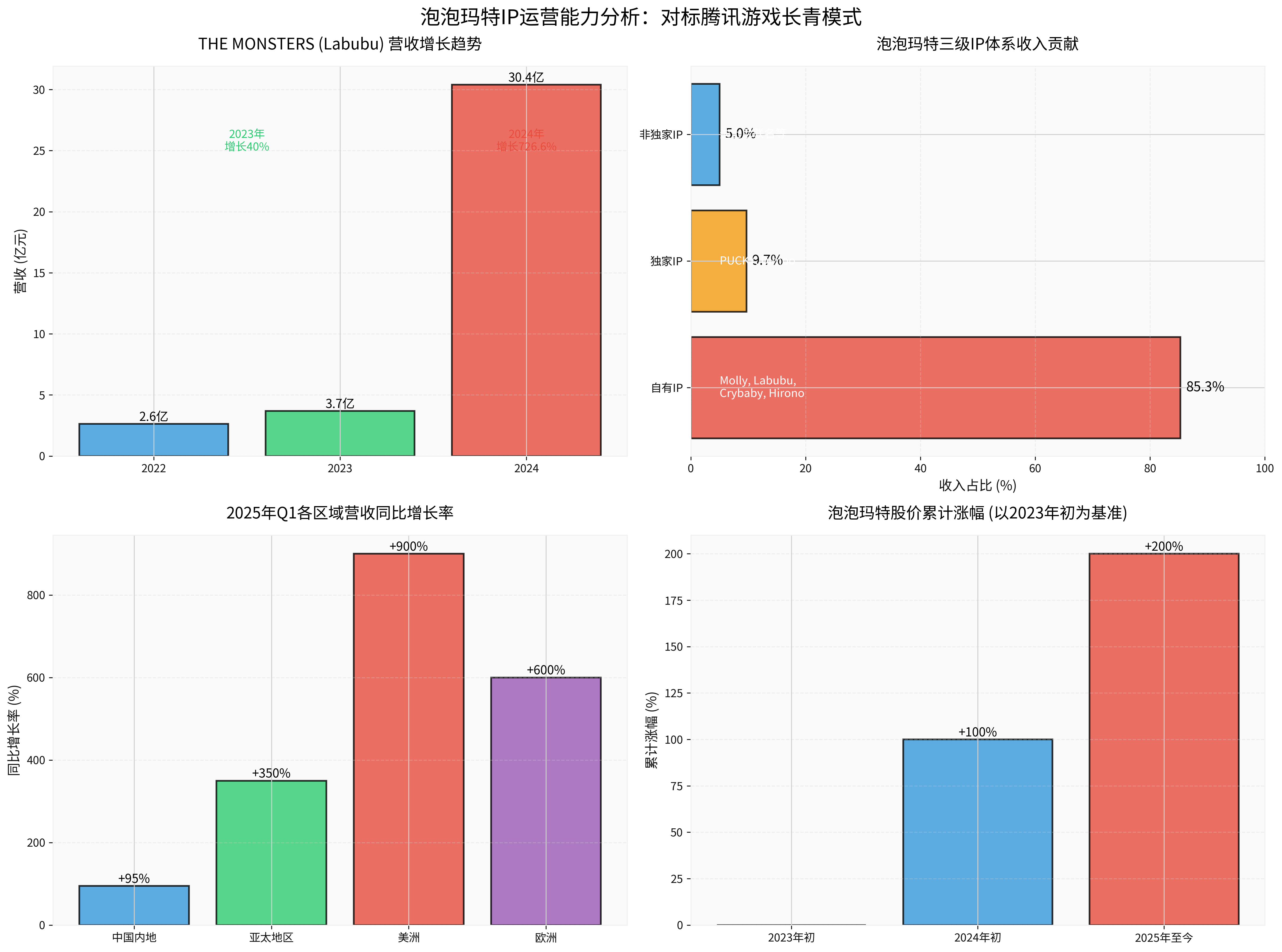

- Top left:THE MONSTERS (Labubu) revenue exploded from RMB263 million in 2022 to RMB3.04 billion in 2024, growing 726.6% in2024

- Top right:Self-owned IP contributes 85.3% of revenue; core IPs include Molly, Labubu, Crybaby, Hirono

- Bottom left:Overseas market exploded in Q12025, with 900% growth in Americas and600% in Europe

- Bottom right:Stock price has increased by over200% since the beginning of2023 (as of 2025)

[0] Gilin API Data - Pop Mart (9992.HK) Financial Data, Stock Performance, Company Overview

[1] Yahoo Finance - “Deep Analysis of Pop Mart’s Investment Value After Surpassing 200% Growth” (2025)

https://hk.finance.yahoo.com/news/深度分析泡泡瑪特爆升逾200-%25E5��投資價值-020500304.html

[2] Yahoo Finance - “Developing Self-owned IP: Can Miniso Replicate Pop Mart’s Explosive Growth Path?” (2025)

https://hk.finance.yahoo.com/news/發展自有ip-名創優品可褣制泡泡瑪特爆發之路-005222684.html

— tags (codes, translate to display labels) —

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.