Investment Strategy Construction Plan for Hong Kong Stock Market Consumer Sector: 'Defense Over Offense'

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on current market data and in-depth analysis, I systematically elaborate on the ‘defense over offense’ investment strategy construction plan for the Hong Kong stock market consumer sector for you.

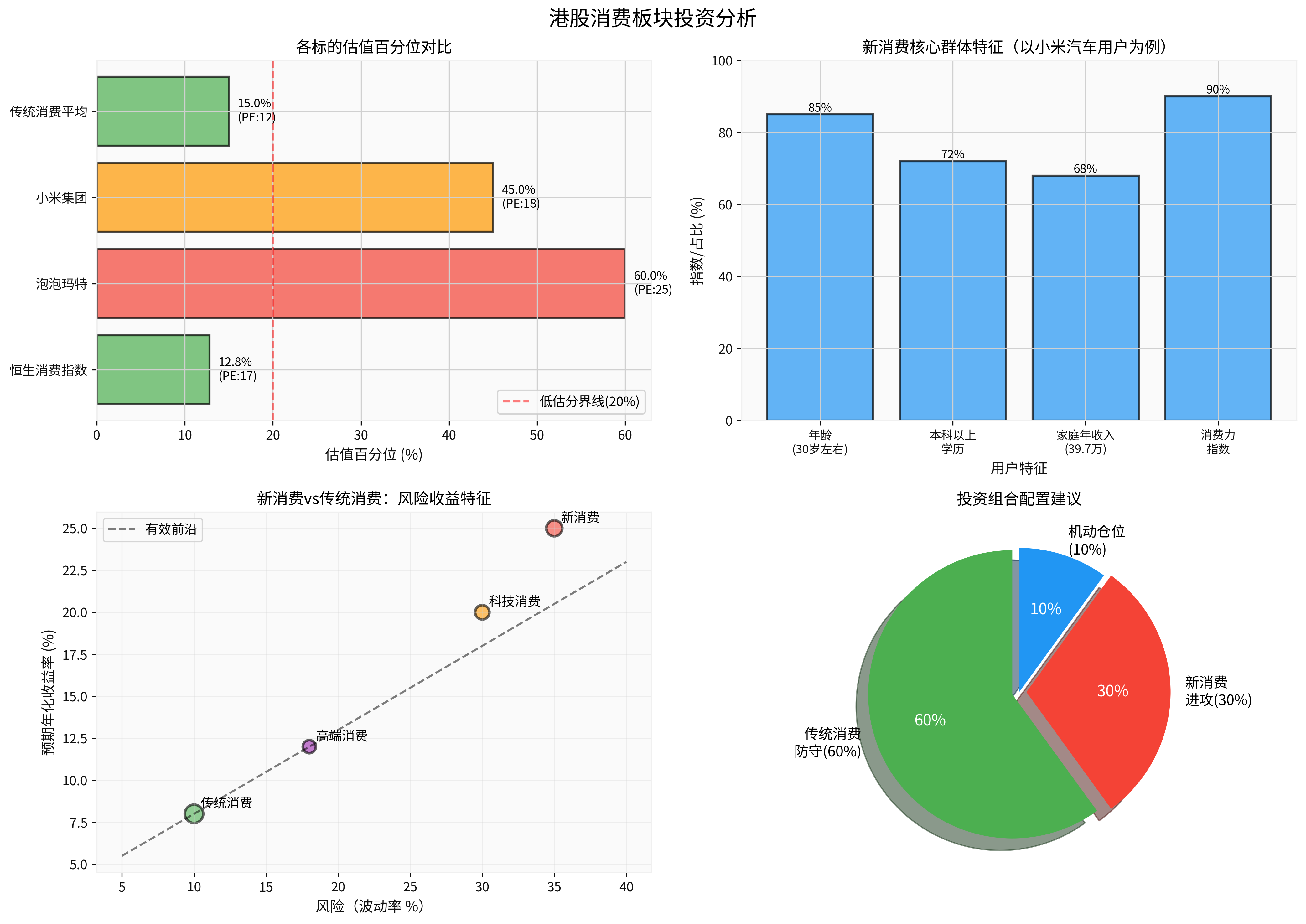

According to the data provided by you, the current price-to-earnings ratio (PE) of the Hang Seng Consumer Index is approximately 17 times, with a valuation percentile of only 12.82%, which is in a

According to the latest market information, Pop Mart (09992.HK) has recently fallen about 40% from its high, and the short-selling ratio has risen to 6.3%, hitting the highest level since August 2023 [2]. The market’s main concerns are:

- U.S. market ‘Black Friday’ sales may be lower than expected

- Labubu’s production capacity has expanded significantly (from 10 million units in the first half of the year to an average of 50 million units per month by the end of the year), triggering doubts about scarcity

- Short-term data fluctuations affect market confidence

The core new consumption groups represented by Xiaomi Auto users have

- Age Structure: Around 30 years old, in the golden period of consumption

- Education Level: Over 70% have bachelor’s degree or above

- Income Level: Family annual income of 397,000 yuan, representing the strongest consumption power group in China

This group has high requirements for quality, innovation and experience, and is the core driving force for the growth of new consumption enterprises.

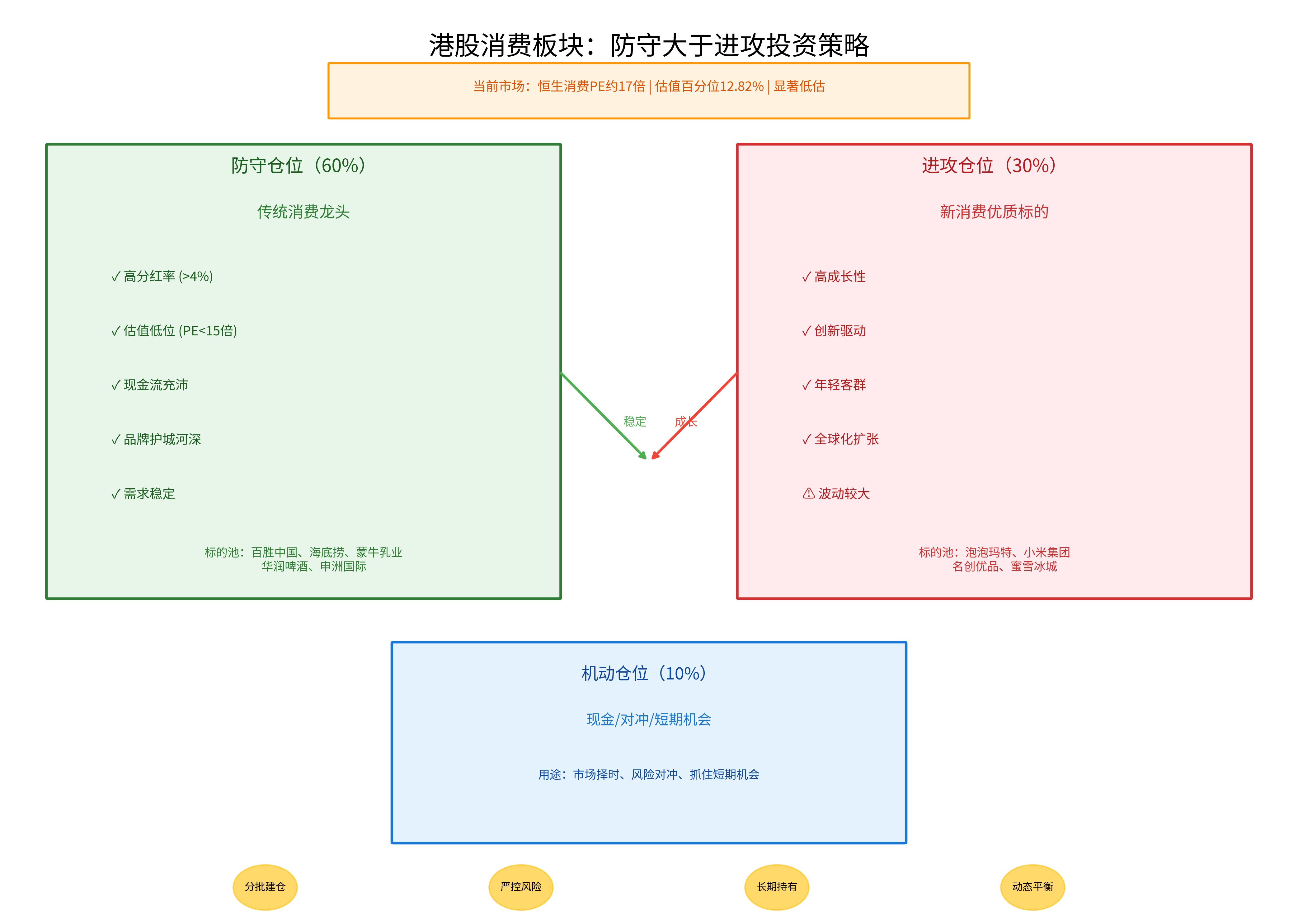

The above chart shows the complete ‘defense over offense’ strategy framework.

- High Growth: Innovation-driven, technology-enabled, strong growth explosiveness

- High-Quality Customer Base: Mainly serves Generation Z and young middle class with strong consumption willingness

- Globalization Potential: Such as Pop Mart and Miniso actively expanding overseas markets

- High Volatility: Significantly affected by IP popularity and market sentiment

- Fierce Competition: Relatively low industry threshold, requiring continuous innovation

- High Valuation: Obvious growth premium, high correction risk

- Low Valuation: PE is generally below 15 times, high margin of safety

- High Dividend: Dividend yield is generally over 4%, providing stable cash flow

- Brand Moat: Leaders like Yum China, Haidilao and Mengniu have deep brand accumulation

- Stable Demand: Relatively less affected by economic cycles

- Slow Growth: Lack of explosive growth opportunities

- Value Trap: Low valuation may reflect fundamental deterioration

| Position Type | Allocation Ratio | Core Role | Investment Target Features |

|---|---|---|---|

Defense Position |

60% | Provide stable cash flow and dividends, control portfolio volatility | Traditional consumption leaders: high dividend, low valuation, abundant cash flow |

Offense Position |

30% | Seize new consumption growth opportunities, enhance portfolio returns | High-quality new consumption targets: high growth, innovation-driven, globalization |

Flexible Position |

10% | Market timing, risk hedging, capture short-term opportunities | Cash and derivatives, flexible adjustment |

- Valuation Safety: PE below 15 times, at historical low valuation

- Dividend Yield: Annual dividend yield >4%

- Financial Health: Abundant cash flow, low debt ratio, stable ROE

- Competitive Position: Industry leader, deep brand moat

- Yum China (09987.HK): Catering leader, cheap valuation, stable dividends

- Haidilao (06862.HK): Hot pot leader, strong brand power, good cash flow

- Mengniu Dairy (02319.HK): Dairy leader, steady growth, high dividend

- CR Beer (00291.HK): Beer leader, benefit from high-end trend

- Shenzhou International (02313.HK): Sportswear OEM leader, high-quality customers

- Growth Space: The track has long-term growth logic

- Innovation Capability: Products/services have differentiated competitive advantages

- Financial Quality: Clear profit model, healthy financial structure

- Globalization Capability: Potential for overseas market expansion

-

Pop Mart (09992.HK): Trend toy leader, strong IP operation capability, global expansion [2]

- Current adjustment provides good layout opportunities

- Valuation is becoming reasonable relative to growth

- Long-term IP matrix and globalization capability

-

Xiaomi Group (01810.HK): Dual-driven by auto and mobile phone, perfect AIoT ecosystem

- Xiaomi Auto user group is high-quality, representing core new consumption power

- Auto business enters volume release period, contributing new growth

- Internet service business profitability improves

-

Miniso (09896.HK): Cost-effective retail, global layout

-

Mixue Ice Cream & Tea (02097.HK): King of sinking market, accelerated internationalization

The upper left of the chart shows the comparison of valuation percentiles of various targets, and it can be seen that the Hang Seng Consumer Index and traditional consumption are in a significantly undervalued state.

- Valuation at historical bottom, low sentiment

- Marginal improvement in liquidity, gradual inflow of southbound funds

- Macro economic data shows signs of stabilization

- Traditional Consumption: Gradually build positions, focus on dividend yield and valuation safety margin

- New Consumption: Deploy in batches, avoid heavy positions at one time, reserve space for short-term fluctuations

- Flexible Position: Maintain high cash ratio, wait for better加仓 opportunities

- Macro economic data stabilizes and rebounds

- Retail sales data improves marginally

- Continuous net inflow of southbound funds into Hong Kong stocks

- Corporate earnings improve, financial reports exceed expectations

- Valuation repair market starts, sentiment warms up

- Institutional funds increase positions in consumer sector

- Traditional Consumption: Lock in dividend income, hold stocks for growth

- New Consumption: Increase allocation, seize the main rising wave

- Flexible Position:适当 reduce cash ratio, increase equity positions

- Clear trend, intensified stock differentiation

- Some targets return to reasonable or even high valuation

- Dynamically adjust positions, select the best and eliminate the worst

- Take profits on some targets with excessive gains and obviously high valuations

- Re-evaluate the portfolio, prepare for the next round of layout

| Risk Control Measure | Specific Requirement |

|---|---|

Concentration Control |

Single new consumption stock position does not exceed 15%, traditional consumption is分散配置 3-5 stocks |

Regular Rebalancing |

Evaluate position deviation every quarter, target allocation deviation does not exceed ±5% |

Stop-Loss Mechanism |

Evaluate fundamentals when individual stocks fall by 15%-20%, decide whether to stop loss |

Hedging Strategy |

Use derivatives to hedge systemic risks when necessary |

- Sustainability of IP popularity (e.g., Pop Mart’s Labubu)

- Overseas expansion progress and profitability

- Changes in competitive landscape

- Performance fulfillment and expected deviation

- Sustainability of dividend policy

- Changes in market share

- Cost control capability

- Changes in industry policies

- Macro Economic Risk: Domestic economic recovery is lower than expected, overall consumption is weak

- Policy Risk: Changes in regulatory policies affect industry profit models (e.g., antitrust, data security)

- Value Trap Risk: Low valuation may reflect fundamental deterioration, need to be alert to ‘value trap’

- New Consumption Volatility Risk: IP popularity fades, competition intensifies, overseas expansion is lower than expected

- Exchange Rate Risk: Hong Kong stocks are affected by RMB/HKD exchange rate fluctuations

- Liquidity Risk: Global liquidity tightening leads to valuation pressure

The current valuation of the Hong Kong stock market consumer sector is at a historical low (valuation percentile 12.82%), with medium and long-term allocation value. It is recommended to adopt a

- 60% Defense Position: Take high-dividend traditional consumption as the bottom position, provide stable cash flow and dividends, control portfolio volatility

- 30% Offense Position: Allocate to high-quality new consumption targets, seize high-growth opportunities, enhance portfolio returns

- 10% Flexible Position: Maintain flexibility for market timing, risk hedging and short-term opportunity capture

- Batch建仓: Do not rush to heavy positions at one time, reserve space for short-term fluctuations

- Strict Risk Control: Set stop-loss positions, single new consumption position does not exceed 15%

- Long-Term Holding: Consumer sector is suitable for long-term investment, avoid frequent trading

- Dynamic Balance: Regularly evaluate positions, adjust allocation ratio according to market changes

According to China Merchants Securities International research report, Hong Kong stocks will move from valuation repair-led to profit growth-led, and 2026 will present a pattern of

For the

[0] Gilin API Data

[1] China Merchants Securities International - 《Hong Kong Stock Market Will Move Towards Profit Growth Leadership》(https://hk.finance.yahoo.com/news/大行-招商证券料美国明年经济保持温和增长港股将迈向-021730564.html)

[2] Yahoo Finance - 《Short Selling Ratio Hits Two-Year High! Pop Mart Plunges Nearly 9%》(https://hk.finance.yahoo.com/news/做空比例逾两年新高-黑色星期五销售疑不及预期泡泡玛特暴跌近9-100005007.html)

[3] Yahoo Finance - 《Hang Seng Index Rises 51 Points in Half Day; SMIC Jumps 7%; Resources and New Consumption Stocks Surge》(https://hk.finance.yahoo.com/news/港股-恒指半日升51点-中芯急升7-资源-新消费股炒上-044148112.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.