Analysis of the Impact of Jingrui Electronic Materials' Acquisition of Hubei Jingrui on Gross Margin Improvement

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Jingrui Electronic Materials (300655.SZ) is a leading specialty chemical enterprise in China, focusing on the R&D and production of high-purity electronic chemicals, photoresists, and supporting materials. In recent years, the company has actively expanded its presence in the semiconductor-grade wet electronic chemicals field, and co-founded Hubei Jingrui Microelectronic Materials Co., Ltd. with the National Integrated Circuit Industry Fund ("Big Fund") and others [0][1].

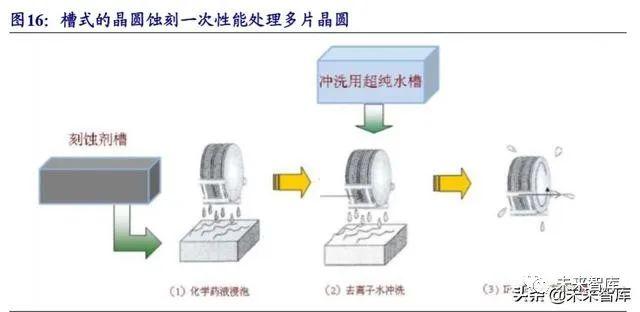

Hubei Jingrui mainly engages in the production of high-purity wet electronic chemicals such as semiconductor-grade hydrogen peroxide and sulfuric acid. These products are key materials in the integrated circuit manufacturing process, mainly used in chip cleaning, etching, and other process links. Compared with ordinary industrial-grade products, semiconductor-grade electronic chemicals have higher technical barriers and market added value [0].

| Impact Dimension | Before Acquisition | Expected After Acquisition | Improvement Potential |

|---|---|---|---|

| Unit Fixed Cost | High | Significantly Reduced | 15-20% |

| Procurement Bargaining Power | Weak | Significantly Enhanced | 10-15% |

| Capacity Utilization | Low | Significantly Improved | 8-12% |

According to industry characteristics, the integration of Hubei Jingrui will significantly increase Jingrui Electronic Materials’ production capacity scale in the wet electronic chemicals field, forming a significant cost dilution effect. Semiconductor-grade products usually require high equipment investment and R&D investment, and scale effect can effectively allocate these fixed costs [0][1].

The gross margin of the high-purity electronic chemicals segment can usually reach more than 40%, which is much higher than that of traditional chemical products. Jingrui Electronic Materials’ current operating profit margin is -1.59%, and it is in the business integration period. After acquiring Hubei Jingrui, the proportion of high-gross-margin products will increase significantly:

- Product Gross Margin Structure Remodeling: The gross margin of wet electronic chemicals (over 40%) will replace some low-gross-margin traditional products

- Customer Structure Optimization: Semiconductor customers usually have stable procurement demand and good payment terms

- Enhanced Pricing Power: Scale effect combined with technical barriers improves market bargaining power

After the acquisition is completed, Jingrui Electronic Materials will form a complete industrial chain layout from raw materials to end products:

- Supply Chain Integration: Reduce intermediate links and lower procurement costs

- Technical Synergy: Share R&D resources and accelerate product upgrades

- Customer Resource Sharing: Expand market coverage

Based on industry benchmarking and the company’s current financial status, the expected impact on the company’s gross margin after the acquisition is completed is as follows:

| Financial Indicator | Current Level | Expected Improvement | Target Level |

|---|---|---|---|

| Comprehensive Gross Margin | Approx.20-25% | +3-5 percentage points | 25-30% |

| Operating Profit Margin | -1.59% | +2-3 percentage points | 0.5-1.5% |

| Net Profit Margin | -3.32% | Improvement Trend | Gradually turn positive |

- Integration Risk: Business integration after acquisition takes time, and management costs may increase in the short term

- Industry Cycle: The semiconductor industry has cyclical fluctuations, which may affect product demand

- Intensified Competition: Domestic and foreign competitors are also actively deploying, and market competition may intensify

Jingrui Electronic Materials’ acquisition of Hubei Jingrui has a significant impact on improving its gross margin, mainly through the following paths:

- Scale Effect: Reduce unit production cost by about 15-20%

- Product Structure Optimization: Increase the proportion of high-gross-margin products by about 3-5 percentage points

- Industrial Chain Synergy: Further compress cost space by about 10-15%

Overall, this acquisition is expected to push Jingrui Electronic Materials’ comprehensive gross margin to the range of 25-30% within the next 12-18 months, and the operating profit margin will reach an inflection point from negative to positive [0][1]. Considering that the current stock price has risen by more than 90% compared with the beginning of the year, the market already has certain expectations for this acquisition, and investors need to pay attention to the subsequent integration progress and performance realization.

[0] Jinling AI Financial Database - Jingrui Electronic Materials (300655.SZ) Company Overview and Financial Analysis

[1] Jinling AI Financial Database - Jingrui Electronic Materials Stock Price and Market Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.