Analysis of China's Service Consumption Stimulus Policy Upgrade Impact on A-share Investment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

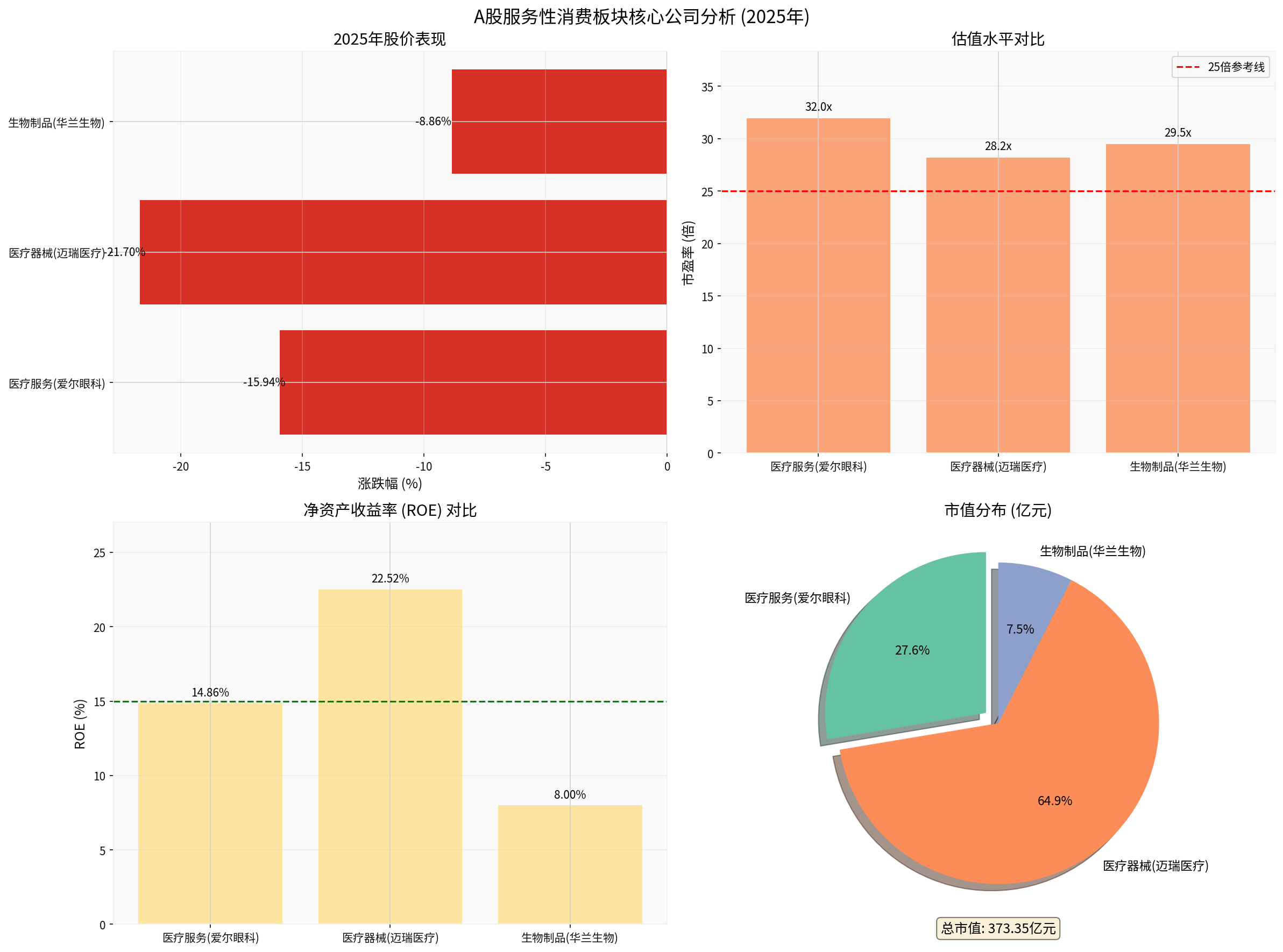

Now let me provide a comprehensive investment analysis based on the obtained data. First, here is a comprehensive analysis chart of core companies in relevant sectors:

Chart Description: This chart shows the 2025 performance comparison of three representative companies in the A-share medical service consumption sector, including stock price changes, P/E ratio valuation, Return on Equity (ROE), and market capitalization distribution. Data source: Gilin API Data [0]

According to the speech by Member Zhang Junkuo at the “2025 Sanya·Finance International Forum”, China’s consumption stimulus policies during the “15th Five-Year Plan” period will show three major structural changes [2]:

- Optimize the support structure for commodity consumption: On the premise of maintaining total support and continuous efforts, optimize the scope and structure of support for commodity consumption

- Increase support for service consumption: Support service consumption with greater intensity, especially in areas closely related to people’s livelihood such as education, healthcare, elderly care, and childbirth

- Simultaneously promote supply-side reforms: Expand the supply of high-quality services by reducing access restrictions and optimizing regulatory policies

This policy orientation marks the transformation of China’s consumption stimulus policies from “universal” to “precision-oriented and structured”, and

- Aier Eye Hospital Group (300015.SZ): Stock price fell by 15.94% in 2025, current P/E ratio is 31.96x, ROE is 14.86%, market capitalization is 103.1 billion yuan [0]

- Mindray Medical (300760.SZ): Stock price fell by 21.70% in 2025, current P/E ratio is 28.18x, ROE is 22.52%, market capitalization is 242.2 billion yuan [0]

- Deepening of payment reforms: In 2025, the reform of medical insurance payment will continue to advance, the pricing mechanism for medical services will be optimized, and high-quality medical service institutions will benefit [5]

- “One Elderly, One Child” Strategy: Elderly health services and children’s medical services are listed as policy priorities, and demand for related specialized medical services will continue to be released

- Strengthening of primary medical care capabilities: The state will increase investment in primary medical institutions, and medical device and equipment suppliers will face incremental markets

- Liberalization of the Foreign Investment Catalog: The “Catalogue of Encouraged Foreign Investment Industries (2025 Edition)” clearly encourages high-end medical device manufacturing, intelligent medical equipment, and other fields [4]

- Valuation Repair Potential: Mindray Medical’s P/E ratio of 28x is in the historical low range, and ROE of up to 22.52% indicates strong profitability [0]

- Stable Cash Flow: Mindray Medical’s free cash flow in 2024 reached 10.47 billion yuan, and its financial health rating is “low risk” [0]

- Increasing Market Concentration: The healthcare service industry is undergoing supply-side reforms, and leading enterprises will gain larger market shares through scale and brand advantages

- Continuous pressure from medical insurance cost control

- Industry valuations are still in the digestion period

- China’s population aged 60 and above has exceeded 300 million, equivalent to the total population of the United States [6]

- An average of 20 million people enter retirement each year, equivalent to 55,000 people per day [6]

- The average age of parents of high-net-worth individuals when first entering elderly care institutions is 70.3 years old, with an average annual payment of 275,000 yuan [6]

- Top-level Institutional Design: In January 2025, the “Opinions of the Central Committee of the Communist Party of China and the State Council on Deepening the Reform and Development of Elderly Care Services” was released, marking the first systematic institutional design for elderly care services in the name of the Central Committee and the State Council [5]

- Key Support for Smart Elderly Care: The Encouraged Foreign Investment Catalog clearly supports the R&D and manufacturing of smart health and elderly care products, including elderly medical devices, rehabilitation aids, and smart wearable devices [4]

- In-depth Promotion of Integration of Medical and Elderly Care: Policies encourage cooperation between medical institutions and elderly care institutions, and the “integration of medical and elderly care” model will accelerate its development

- Rehabilitation Medical Equipment: Policies encourage the manufacturing of rehabilitation aids, benefiting related equipment manufacturers

- Elderly Care Service Institutions: High demand for high-end elderly care institutions, especially intelligent and integrated medical-care institutions

- Internet + Elderly Care: Demand for smart elderly care services such as telemedicine, portable smart devices, and AI diagnosis and treatment is growing rapidly [6]

- Aging Adaptation Renovation: Aging adaptation and barrier-free renovation of public facilities have become policy priorities [4]

- Data on investment quantity and amount in China’s elderly care industry from 2019 to 2024 shows that 2022 reached a peak, and investment activity rebounded in 2024 [6]

- 27% of high-net-worth individuals expect elderly care institutions to have intelligent functions [6]

- “Double High Construction Plan” (2025-2029): Establishes the core orientation of “high-level school-running ability and high-quality industry-education integration”, opening the paradigm transformation of higher vocational education from connotation construction to service empowerment [7]

- Deepening Industry-Education Integration: Policies strengthen the weight of enterprise evaluation, taking the contribution rate of graduates’ local employment and the conversion rate of technical achievements as core indicators [7]

- Digital Transformation: Taking digital transformation as a core reform task, promoting deep integration of technology with education and teaching [7]

- International Expansion: Adhere to “education follows production, schools and enterprises go hand in hand” to enhance the international influence of China’s vocational education [7]

- Vocational Training Institutions: High-quality vocational education institutions that align with policy orientations will benefit from policy support and demand growth

- Education Informatization: Digital transformation drives demand for online education and smart education platforms

- Industry-Education Integration Service Providers: Enterprises that provide supporting services such as cooperation services between schools and enterprises and training base construction

- Oversold High-Quality Leaders: Healthcare service leaders with core competitiveness such as Mindray Medical (down 21.70% in 2025) and Aier Eye Hospital Group (down 15.94% in 2025) already have a high margin of safety [0]

- Direct Beneficiaries of Policies: Leaders in niche areas such as smart elderly care equipment, rehabilitation medical devices, and vocational education services

- Policy implementation details and enforcement intensity

- Local government supporting financial support situation

- Order and performance fulfillment situation of relevant listed companies

- Healthcare Sector: Focus on the improvement of profitability of medical service institutions after medical insurance payment reform

- Elderly Care Sector: Demand for smart elderly care products and services will continue to be released; focus on enterprises with productization capabilities

- Education Sector: Performance of vocational education institutions will grow with the expansion of enrollment scale and increase in customer unit price

- Financial Health (low leverage, strong cash flow)

- Industry Position (leader or hidden champion in a niche area)

- High Policy Sensitivity (directly benefit from policy support)

- Reasonable Valuation (P/E ratio is in the historical middle to low range)

China’s population aging trend is irreversible, and

- Elderly Health Management: Chronic disease management, rehabilitation care, health monitoring

- Elderly Care Finance: Pension management, pension insurance, elderly care wealth planning

- Aging-Adapted Products: Household medical devices, wearable health devices, smart home

- Elderly Care Real Estate and Services: High-end elderly care communities, home-based elderly care services, etc.

- Policy Execution Risk: Uncertainty exists in policy implementation intensity and effect

- Valuation Risk: Valuations of some individual stocks in the healthcare service sector are still at historical highs

- Market Competition Risk: Policies attract more capital, which may intensify competition

- Macroeconomic Risk: Residents’ consumption capacity and willingness are affected by economic cycles

The upgrade of China’s service consumption stimulus policy marks a

- Short-term (0-6 months): Driven by policy expectations; focus on valuation repair opportunities of oversold leaders

- Mid-term (6-18 months): Performance fulfillment period; focus on order growth and profit improvement

- Long-term (18+ months): Golden period of silver economy; layout high-quality enterprises with core competitiveness

At the current point in time, it is recommended that investors

[0] Gilin API Data - Including stock price data, financial indicators, company profiles, and market performance of companies such as Aier Eye Hospital Group, Mindray Medical, and Hualan Biology

[1] CICC: Path of Supply-Side Consumption Promotion - Wall Street News

[2] Zhang Junkuo: Consumption Stimulus Policies Should Continuously Optimize the Scope and Structure of Support for Commodity Consumption on the Premise of Maintaining Total Support and Continuous Efforts - Sina Finance

[3] Liu Shijin et al.: Ideas and Measures for Coordinated Reforms of Expanding Consumption, Strengthening Social Security, and Stabilizing the Stock Market - Ai Si Xiang

[4] Catalogue of Encouraged Foreign Investment Industries (2025 Edition) - National Development and Reform Commission

[5] 2025 Annual Innovation White Paper on Healthcare Services: Deepening Payment Reform, Focus on “One Elderly, One Child” - Investment Circle

[6] 2025 China High-Net-Worth Individuals Quality Elderly Care Report - Hurun Report

[7] “Double High Construction Plan”: Strategic Engine for High-Quality Development of Vocational Education - Sina Finance

[8] Looking at Education Reform from One Reduction and One Increase (People’s Commentary) - Securities Times

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.