Analysis of the Impact of NetEase's Core Executive Changes on the Long-Term Strategy and Growth Sustainability of Its Game Business

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

According to the latest financial data, NetEase’s current market capitalization reaches

- Gradual succession arrangement: The successorHu Zhipengwas promoted toExecutive Vice Presidentin March 2025, on par with Ding Yingfeng, and beganattending earnings conferences frequentlyto speak for the game business externally [2][3]. This indicates that NetEase has laid out the power transition for at least 9 months.

- Retaining advisor role: Ding Yingfeng will serve as a company advisor after retirement, meaning his experience and connections can still be utilized to ensure a smooth strategic transition [1][2].

- Two-group structure: NetEase’s game business is mainly composed of theInteractive Entertainment Group(led by Ding Yingfeng) and theLeihuo Group(led by Hu Zhipeng). After Hu Zhipeng takes over, the two groups may face integration or clear division of labor, which is both a challenge and an opportunity for strategic unity.

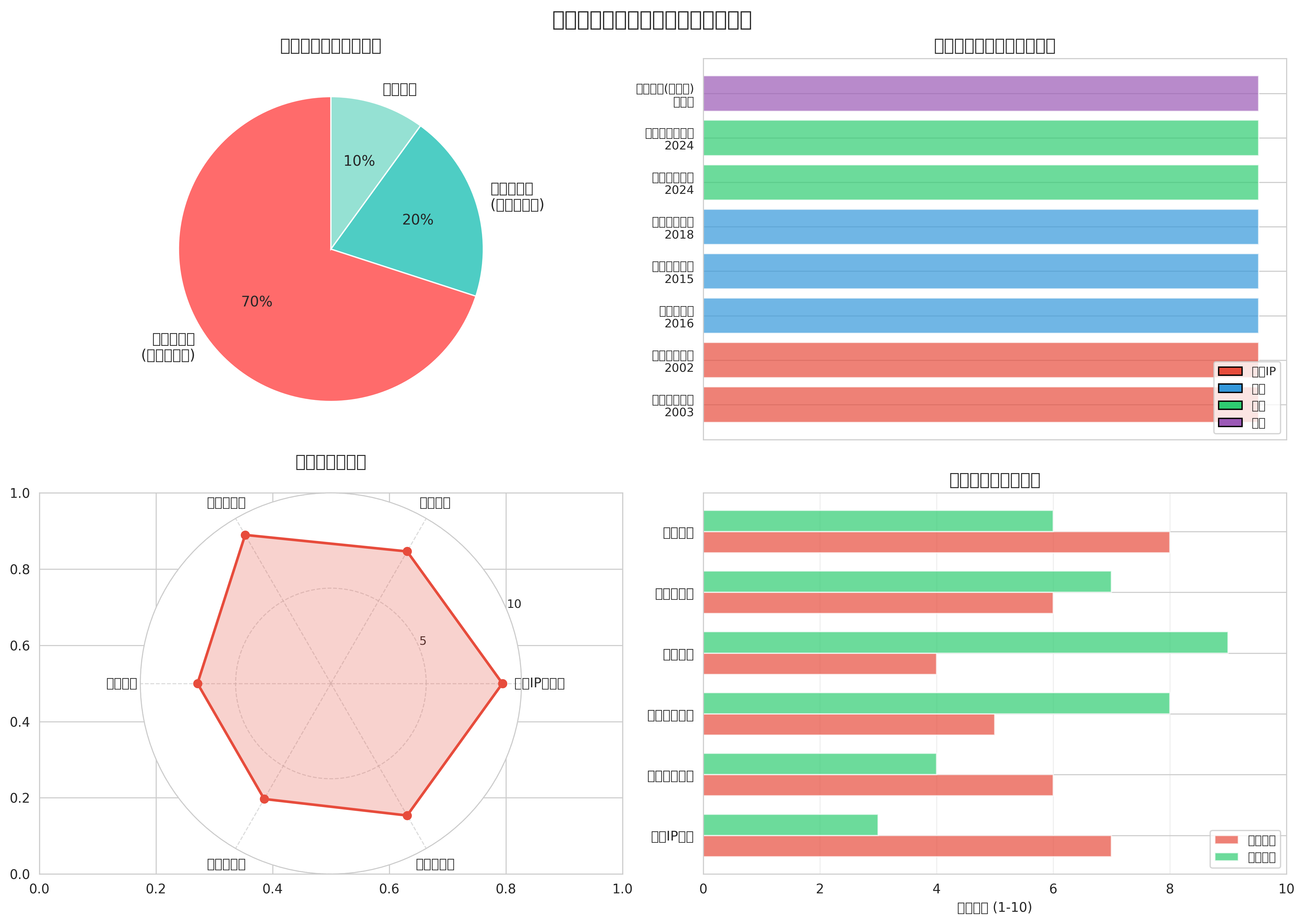

- Interactive Entertainment Group(led by Ding Yingfeng) contributes about70%of game revenue, with core products including Fantasy Westward Journey, Westward Journey Online II, Onmyoji, Romance of the Three Kingdoms: Strategy Edition, and Identity V [1][4].

- Leihuo Group(led by Hu Zhipeng) contributes about20%, with product lines including Justice Online and Naraka: Bladepoint [3].

- Fantasy Westward Journey(launched in 2003) remains NetEase’s revenue pillar. After launching the Play Freely Server in July 2025, its PCU (Peak Concurrent Users) reached3.58 million, a record high [1]. This proves the strong vitality of core IPs.

- Marvel Rivals(launched in 2024) had over40 million users in its first monthand was nominated for the TGA Best Ongoing Game Award, showing international potential [1][4].

- Yanyun Sixteen Soundsoverseas version exceeded15 million players in its first month, once ranked TOP2 on Steam’s best-selling list with an 89% positive rating [5].

Ding Yingfeng’s departure may accelerate NetEase’s strategic transformation from

NetEase’s financial situation is stable with a

During Ding Yingfeng’s tenure, he established a sound

- Core products like Fantasy Westward Journey and Westward Journey Online II have been operated for over 20 years, with a large user base but limited growth space. How to promote innovation while maintaining stable revenue is a major test for the successor.

- Data shows that the user base of Fantasy Westward Journey may decline, posing a potential threat to revenue stability.

- Marvel Rivals had high initial popularity, but the average number of players in February 2025 decreased by 25.51% compared to January, highlighting player retention issues [4].

- Yanyun Sixteen Sounds adopts a high DAU, low ARPU model, does not sell numerical values, and profits from skins and monthly cards, but has problems such as many ‘sightseeing players’ and insufficient optimization [4].

- This exposes NetEase’s shortcomings in long-term operation capabilities of new products, which need continuous improvement.

- NetEase CEO Ding Lei stated that he hopes NetEase’s game business will account for 40%-50% of revenue from overseas marketsin the future [6]. Currently, this proportion still has much room for improvement.

- Although there are successful cases like Yanyun Sixteen Sounds and Marvel Rivals, internationalization is still in the early stage and requires continuous localization operation capabilities.

After Hu Zhipeng takes over, he may promote

- Sharing and reuse of R&D capabilities

- Unified optimization of distribution channels

- Institutionalization of talent flow

Hu Zhipeng’s diversified exploration in the Leihuo Group (such as the competitiveization of Naraka: Bladepoint and MMO+AI integration of Justice Online) may be promoted to the company-wide level, accelerating NetEase’s transformation from an

Gui Tang (single-player ARPG), for which Hu Zhipeng personally serves as producer, has been secretly developed for several years, with PV views approaching 6 million, showing determination to benchmark AAA standards [3]. This marks NetEase’s important layout in the single-player field, which may become a new growth point.

Based on the above analysis, I assess the continuity of NetEase’s game business after the executive changes (full score 10):

| Evaluation Dimension | Score | Explanation |

|---|---|---|

Core IP Stability |

9/10 | Products like Fantasy Westward Journey have strong vitality, and the innovative Play Freely Server was successful |

New Product Pipeline |

8/10 | Marvel Rivals and Yanyun Sixteen Sounds had good starts, but retention needs observation |

Financial Health |

9/10 | High profit margin, strong cash flow, supporting business adjustments [0] |

Talent Reserve |

7/10 | Sound producer system, but lacks a soul figure at Ding Yingfeng’s level |

Strategic Continuity |

7/10 | Hu Zhipeng has gradually taken over, but integration of the two groups has uncertainty |

Internationalization Capability |

8/10 | Yanyun Sixteen Sounds was successful overseas, but the proportion of overseas revenue still needs improvement [5] |

###1.

- Gradual power transition reduces the risk of sudden strategic changes

- Core IP (Fantasy Westward Journey) still has strong profitability

- New products (Marvel Rivals, Yanyun Sixteen Sounds) have great global potential

- Stable finances and reasonable valuation (P/E 17.22x) [0]

- Decline in user base of core MMO products

- Unverified long-term operation capabilities of new products

- Uncertainty in integration of the two groups

- Intensified market competition (Tencent, MiHoYo, etc.)

###2.

In the next 6-12 months, it is recommended to pay attention to the following indicators:

| Indicator | Current Value | Attention Threshold |

|---|---|---|

| Game Revenue Growth Rate | +11.8% QoQ | Sustained >10% |

| Overseas Revenue Proportion | Undisclosed | Sustained increase |

| Core IP MAU | Fantasy Westward Journey PCU:3.58 million | Keep stable |

| New Product Retention Rate | Marvel Rivals monthly retention undisclosed | >60% |

| Market Performance | Stock price $138.07 | Break through resistance level of $159.55 |

###3.

- Short-term (3-6 months): Hold or buy on dips, pay attention to Hu Zhipeng’s strategic statements in earnings conferences

- Medium-term (6-12 months): Observe new product retention data and evaluate long-term operation capabilities

- Long-term (12+ months): Pay attention to the proportion of overseas revenue and single-player game layout

- Accelerate integration of the two groups to improve R&D and operation efficiency

- Strengthen long-term operation capabilities of new products to reduce user churn

- Promote global strategy implementation to increase overseas revenue proportion

- Continue to invest in new technologies like AI to improve game experience

Ding Yingfeng’s retirement marks NetEase Games entering the

- Stable power transition arrangement: Hu Zhipeng has been taking over for 9 months, with a smooth transition

- Strong business foundation: Core IPs are strong, new products have good starts, and finances are healthy

- Sound institutional guarantees: Producer system and incubator culture reduce reliance on individuals

However,

- Aging of core MMO products and decline in user base

- Need to improve long-term operation capabilities of new products

- Need to strengthen execution of global strategy

- Complexity of integrating the two business groups

Comprehensive judgment: The growth sustainability of NetEase’s game business has

Investors should closely monitor financial report data and business indicators in the next few quarters, especially the retention data of new products, the proportion of overseas revenue, and the strategic execution effect of Hu Zhipeng. From a valuation perspective, the current level of P/E 17.22x and ROE 24.25% [0] provides

[0] Gilin API Data (financial data, stock price information, analyst ratings)

[1] Game Core - ‘Just Now, NetEase Suddenly Announced the Retirement of Game Business Executive Ding Yingfeng’ (https://www.cgames.com/contents/2/9988.html)

[2] IT Home - ‘NetEase Games Veteran Ding Yingfeng Announces Retirement: 23 Years in Office, Created Classic IPs Like Fantasy Westward Journey’ (https://www.ithome.com/0/908/404.htm)

[3] GameNews - ‘Leihuo Boss Hu Zhipeng Personally Serves as Producer! The ‘Big Pie’ Drawn by Wukong, NetEase is Determined to Eat It’ (https://gamenewstc.com)

[4] GameNews - ‘After Half a Year of Hype, NetEase Switches from Offense to Defense, Back to the ‘Life and Death Gate’?’ (https://gamenewstc.com)

[5] 21st Century Business Herald - ‘From Genshin Impact to Black Myth: Wukong, the Advanced Path of Chinese Game Overseas’ (https://www.21jingji.com/article/20251224/herald/85a58846ffac3e2cdd81709bdf66bad9.html)

[6] Relevant Report from IT Home - ‘Ding Lei: Hopes NetEase’s Game Business Will Account for 40%-50% of Revenue from Overseas Markets in the Future’

中国AI数据监管趋严对国内AI企业的全面影响分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.