Analysis of the Impact of the National Data Bureau's Guidance on Long-Term Capital Investment in Data Technology Sector on A-Share Investments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now let me provide a comprehensive analysis of the impact of the National Data Bureau’s policy on the A-share data technology industry chain.

The National Data Bureau officially issued the “Implementation Opinions on Strengthening Data Technology Innovation” (Guo Shu Ke Ji [2025] No.70) on December 25, 2025, and publicly released it on December 27 [2]. This policy is an important guiding document in the data technology field, focusing on the medium and long-term goals of achieving phased breakthroughs by 2027 and establishing a complete data technology innovation system by 2030 [2].

The policy clearly proposes the following key initiatives [2][3]:

- Increase fiscal and financial support: Strengthen the leading role of government investment and guide financial institutions to support data technology innovation

- Guide long-term capital investment: Drive more long-term capital, patient capital, and high-quality capital to invest in the data technology sector

- Investment direction guidance: Encourage “investing early, investing in small enterprises, investing long-term, investing in hard technology”

- Collaborative investment mechanism: Form a sustained and stable investment mechanism with collaborative linkage between government, market, and society

- Policy incentive measures: Leverage policies such as tax incentives for high-tech enterprises and special guarantees for technological innovation to reduce the innovation costs of data technology enterprises

The data technology industry chain covers the following core links:

- Data center construction and operation

- Data storage equipment

- Network communication facilities

- Computing power infrastructure

- Big data analysis platform

- Data governance and security

- Data annotation and cleaning

- Data transaction and circulation

- Industry data applications (finance, medical care, government affairs, etc.)

- AI large model training

- Data element circulation

- Enterprise digital transformation services

Mainly covering the following细分领域:

- Data centers and infrastructure: Inspur Information (000977), Sugon (603019), Baosight Software (600845)

- Data platforms and software: Yonyou Network (600588), Dongfang Guoxin (300166), Glodon (002410)

- Data elements and circulation: E-Hualu (300212), NavInfo (002405)

- Communication equipment and networks: ZTE (000063)

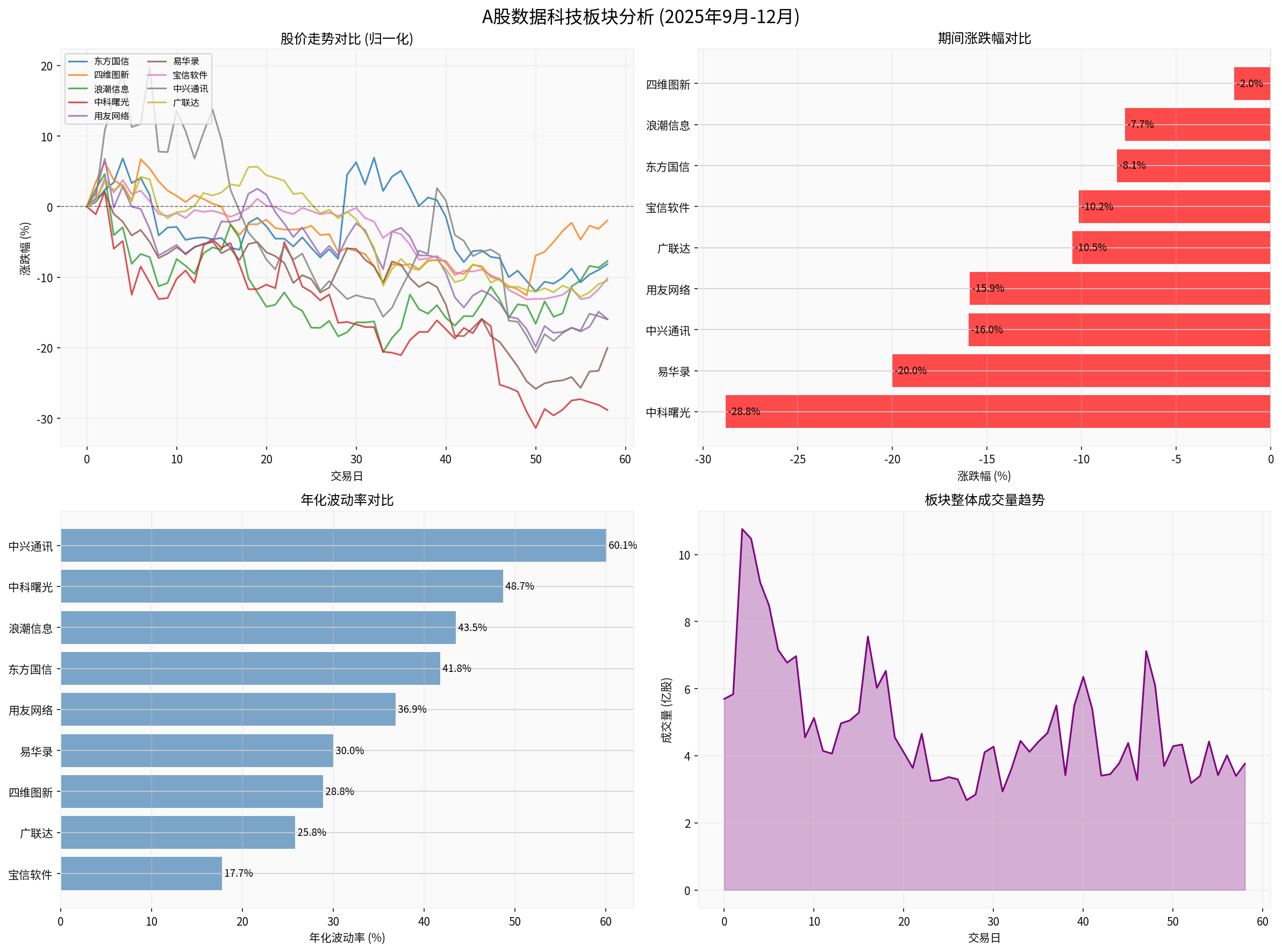

According to brokerage API data, the performance analysis of the A-share data technology sector over the past 90 days (September 28 to December 27, 2025) is as follows [0]:

| Indicator | Value |

|---|---|

| Average Price Change | -13.24% |

| Standard Deviation of Price Change | 7.94% |

| Average Volatility | 37.04% |

| Number of Rising Stocks | 0 |

| Number of Falling Stocks | 9 |

| Maximum Decline | -28.82% (Sugon) |

| Minimum Decline | -1.95% (NavInfo) |

| Stock Code | Stock Name | Initial Price | Final Price | Price Change | Volatility |

|---|---|---|---|---|---|

| 603019.SS | Sugon | 120.55 | 85.81 | -28.82% | 48.73% |

| 300212.SZ | E-Hualu | 21.53 | 17.22 | -20.02% | 30.03% |

| 600588.SS | Yonyou Network | 15.32 | 12.88 | -15.93% | 36.86% |

| 000063.SZ | ZTE | 45.11 | 37.90 | -15.98% | 60.05% |

| 002410.SZ | Glodon | 13.93 | 12.47 | -10.48% | 25.79% |

| 600845.SS | Baosight Software | 23.04 | 20.70 | -10.16% | 17.73% |

| 300166.SZ | Dongfang Guoxin | 10.81 | 9.93 | -8.14% | 41.80% |

| 000977.SZ | Inspur Information | 72.60 | 67.00 | -7.71% | 43.48% |

| 002405.SZ | NavInfo | 9.23 | 9.05 | -1.95% | 28.85% |

From the above data, we can see [0]:

- Overall Pressure: The sector fell by an average of 13.24% over the past 90 days, with all sample stocks declining

- High Volatility: The average volatility reached 37.04%, significantly higher than the market average

- Obvious Differentiation: The difference between the largest decline (Sugon: -28.82%) and the smallest decline (NavInfo: -1.95%) is nearly 27 percentage points

- Valuation Risk: Stocks with large previous gains and high valuations face greater correction pressure

- Policy Catalyst Effect: The National Data Bureau’s implementation opinions provide a clear policy support signal for the data technology sector, helping to improve market expectations for the industry’s prospects [2][3]

- Improved Liquidity: Policies guiding long-term capital and patient capital are expected to bring incremental funds and ease liquidity pressure on the sector

- Increased Risk Preference: The policy orientation of “investing early, investing in small enterprises, investing long-term, investing in hard technology” may increase market risk preference for small and medium-sized market capitalization, high R&D investment technology companies

- Technical Trend: In an upward trend (breakthrough day, to be confirmed), a buy signal appeared on December 22

- Key Price Levels: Resistance level at $68.39, next target at $70.63, support level at $63.79

- Technical Indicators: MACD is bullish, KDJ is bullish, but RSI indicates overbought risk

- Valuation Level: P/E ratio (TTM) is 39.78x, P/B ratio is 4.68x

- Valuation Pressure: The overall valuation of the sector is still relatively high, and policy benefits may have been partially or fully reflected in stock prices

- Profit-Taking: Stocks with large previous gains face profit-taking pressure

- Market Differentiation: Policy implementation takes time, and the market may show structural differentiation in the short term

- Focus on Policy Implementation Rhythm: Closely track the release of supporting policies by the National Data Bureau and local implementation rules

- Select High-Quality Targets:

- Leading enterprises with reasonable valuations and high performance certainty (e.g., Baosight Software)

- Hard technology companies with high R&D investment intensity and high technical barriers

- Platform-type companies benefiting from the market-oriented reform of data elements

- Control Position: The overall valuation of the sector is not low; it is recommended to布局 in batches and avoid chasing highs

- Focus on Catalysts:

- Local data bureau policy supporting measures

- Progress of data element trading pilots

- Commercialization of AI applications

- Focus on Performance Realization: Select companies that can convert policy dividends into actual orders and revenues

- Layout Core Tracks:

- AI computing power infrastructure (servers, storage, network equipment)

- Data governance and security

- Industry data applications

- Emphasize Cash Flow: Select companies with sufficient free cash flow and sound financials

- Inspur Information: Financial analysis shows low risk classification, but free cash flow is negative (-150 million yuan) [0]

- Sugon: Financial analysis shows neutral attitude, low risk classification, free cash flow is positive (1.862 billion yuan) [0]

- Grasp Industrial Trends: Focus on long-term trends such as AI large models, market-oriented data elements, and digital China construction

- Accompany High-Quality Enterprises: Select leading enterprises with core technical advantages and excellent management teams for long-term holdings

- Dynamic Adjustment of Allocation: Dynamically adjust investment portfolios according to changes in industry prosperity and technological progress rhythm

- Risk of Policy Implementation Falling Short of Expectations: There is a time lag between policy formulation and actual implementation, and the effect may fall short of expectations

- Technology Iteration Risk: Technologies such as AI and big data develop rapidly, and there is a risk of technology route iteration

- Valuation Correction Risk: Some individual stocks are at historical high valuations and face correction pressure

- Macroeconomic Fluctuation Risk: Macroeconomic fluctuations may affect enterprise IT expenditure

- International Competition Risk: Intensified global technological competition may affect industrial chain security

- Financial Attitude: Aggressive accounting policies, low depreciation/capital expenditure ratio

- Debt Risk: Low risk classification

- Free Cash Flow: -150 million yuan

- Current Price: 67.00 yuan (December 26, 2025)

- Technical Trend: In an upward trend (breakthrough day, to be confirmed)

- Valuation: P/E ratio 39.78x, P/B ratio 4.68x

- Beta: 0.35 (relative to CSI 300)

- Leading AI server company, benefiting from the explosion of AI computing power demand

- Policy support for long-term capital investment helps improve the company’s financing environment

- Technical analysis shows a breakthrough signal, but attention should be paid to valuation level and performance realization

- Financial Attitude: Neutral

- Debt Risk: Low risk classification

- Free Cash Flow: 1.862 billion yuan (sufficient)

- 90-Day Decline: -28.82% (largest in the sector)

- Volatility: 48.73% (high volatility)

- More attractive valuation after overselling

- Sufficient free cash flow and sound financials

- Leading high-performance computing company, benefiting from national scientific research investment

-

Significant Policy Significance: The National Data Bureau’s implementation opinions provide clear policy support and funding guarantees for the development of the data technology industry, and are important catalysts for the sector [2][3]

-

Limited Short-Term Impact: The policy was released recently, and its actual impact on the market still needs to be observed; the recent overall weak performance of the sector (-13.24%) [0] reflects the market’s digestion of previous high valuations

-

Promising Medium-Term Space: Continuous investment of long-term capital and patient capital is expected to improve the sector’s liquidity and drive the industry’s prosperity to pick up

-

Clear Long-Term Logic: Data technology is an important part of the “new economy” and aligns with the general direction of China’s economic transformation and upgrading [5]

- Current Point in Time (End of December 2025): The policy has just been released, and the market is still in the digestion period; it is recommended to be cautiously optimistic and pay attention to policy implementation and performance realization

- 2026 Outlook: According to online searches, 2026 will be a year of “valuation contraction + profit growth”, and enterprise profits are expected to become the core driving factor for stock prices [6]. It is recommended to focus on high-quality targets with high performance certainty

- Hard Technology Direction: Companies that align with the “invest in hard technology” policy orientation and have core technical barriers

- Data Element Direction: Companies benefiting from the market-oriented reform of data elements

- AI Computing Power Direction: Infrastructure providers benefiting from AI large model training demand

- Industry Application Direction: Companies with in-depth layout and application scenarios in vertical industries

[0] Gilin API Data - A-share data technology sector market data, financial analysis, technical analysis

[1] China Launches National and Three Regional Venture Capital Guidance Funds to Patiently Cultivate Hard Technology Giants - Yahoo Finance

[2] National Data Bureau Issues “Implementation Opinions on Strengthening Data Technology Innovation” - SecRSS (https://www.secrss.com/articles/86462)

[3] National Data Bureau: Encourage Investing Early, Investing in Small Enterprises, Investing Long-Term, Investing in Hard Technology, Forming a Sustained and Stable Investment Mechanism with Collaborative Linkage Between Government, Market, and Society - Sina Finance

[4] Media Report | National Data Bureau: Guide High-Quality Data with Public Welfare Attributes to Enter Open Source Communities - National Data Bureau

[5] “This Time Is Really Different”, Global Top Investment Institutions Voice Out! - China Fund News

[6] Public Fund Annual “Report Card” Is About to Be Finalized, Active Equity Led the Rise in 2025, Long-Term Performance Becomes the Focus - Securities Times (https://stcn.com/article/detail/3552760.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.