Analysis of Investment Opportunities in A-share Infrastructure and Cyclical Sectors Amid Increased Fiscal Stimulus in China

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Yu Yongding, a member of the Academic Division of the Chinese Academy of Social Sciences, stated at the Sanya·Finance International Forum on December 27 that whether China’s economic growth rate can maintain 5% depends on the expansion of fiscal policy. He suggested raising the deficit rate to around 5% and supporting infrastructure investment through large-scale bond issuance to help local governments resolve local debt issues and stabilize the real estate market [1]. He emphasized:

- Sufficient Fiscal Space: The central government has ample fiscal policy space, and residents have strong demand for national bonds, so it is fully possible to significantly increase the deficit rate

- Role of Infrastructure Investment: Historical experience shows that increasing the growth rate of infrastructure investment is an effective policy tool to address insufficient effective demand

- Economic Growth Model: The 15th Five-Year Plan proposal mentions infrastructure 19 times, indicating that the investment scale will be extremely large in the next five years

According to Deloitte Research and online searches, China’s fiscal policy is undergoing the following major changes [2]:

- No Longer Emphasizing Deficit Rate Ceiling: Minister of Finance Lan Fo’an clearly stated that “the central government still has considerable space for debt issuance and deficit increase”

- Local Debt Resolution: Planning to increase the debt quota by a large scale at one time to replace hidden stock debt of local governments, with a “quite large” intensity

- Expanded Scope of Special Bonds: Allowing special bonds to be used for land reserves and purchasing existing commercial housing as indemnificatory housing

- Rising General Deficit Rate: The general deficit rate will approach 10% in 2025, providing financial support for infrastructure investment

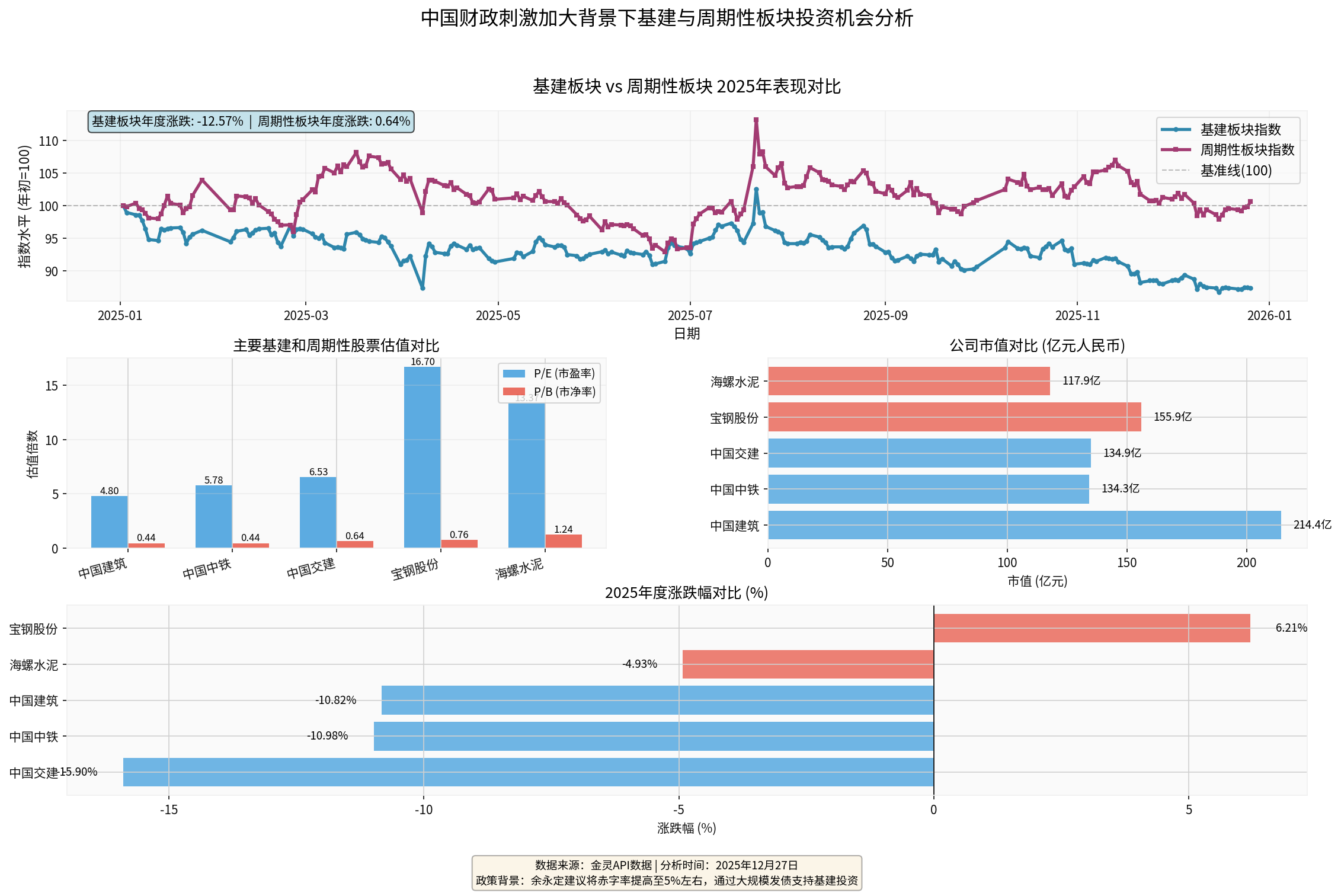

According to full-year 2025 data, the performance of the infrastructure sector is as follows [0]:

| Stock Code | Company Name | Current Price | YTD Change | P/E Ratio | P/B Ratio | Market Cap (100M CNY) |

|---|---|---|---|---|---|---|

| 601668.SS | China State Construction Engineering | $5.19 | -13.64% |

4.80x | 0.44x | 2,144.52 |

| 601390.SS | China Railway Group | $5.43 | -15.16% |

5.78x | 0.44x | 1,343.10 |

| 601800.SS | China Communications Construction | $8.36 | -11.83% |

6.53x | 0.64x | 1,349.10 |

- Extremely Undervalued: The average P/E of the three infrastructure stocks is only 5.7x, and the average P/B is only 0.5x, which is at a historical bottom

- Weak Annual Performance: Down 11%-15% cumulatively for the year, significantly underperforming the broader market

- Large Market Cap Scale: Total market cap exceeds 480 billion CNY, making it an important weight sector in A-shares

- Trend Status: Sideways consolidation, no clear direction

- Key Price Levels: Support at $5.16, resistance at $5.22

- Technical Indicators:

- MACD: No crossover signal

- KDJ: K:63.0, D:56.1, J:76.9 (bullish bias)

- Beta Value: 0.35 (low volatility, strong defensive attribute)

- 20-day MA: $5.45

- 50-day MA: $5.55

- 200-day MA: $5.64

- The stock price is below all moving averages, showing a weak consolidation trend

- Deficit Rate Raised to 5%: Expected to bring an additional 2-3 trillion CNY of government investment

- Special Bond Expansion: The quota of special bonds increased in 2025, used to supplement the capital of government investment projects

- New Policy Financial Tools: 500 billion CNY has been implemented, driving a total project investment of about 7 trillion CNY

- Start of 15th Five-Year Plan: Economic growth in 2026 will mainly rely on infrastructure investment

- New Infrastructure Fields: Digital economy, artificial intelligence, urban renewal, etc., become key investment directions

- Traditional Infrastructure Upgrade: Continuous demand for construction and transformation of transportation, energy, and underground pipe networks

| Stock Code | Company Name | Current Price | YTD Change | P/E Ratio | P/B Ratio | Sector Attribute |

|---|---|---|---|---|---|---|

| 600019.SS | Baosteel Co., Ltd. | $7.35 | +5.15% |

16.70x | 0.76x | Steel |

| 600585.SS | Anhui Conch Cement Co., Ltd. | $22.20 | -6.60% |

13.37x | 1.24x | Cement & Building Materials |

- Good Performance of Steel Sector: Baosteel Co., Ltd. rose 5.15% for the year, significantly outperforming infrastructure stocks

- Cement Sector Under Pressure: Anhui Conch Cement fell 6.60%, reflecting the impact of the sluggish real estate market

- Valuation Differentiation: Steel stocks are relatively reasonably valued, while cement stocks are relatively overvalued

- Infrastructure Investment Pull: Every 1 trillion CNY of infrastructure investment drives about 10-15 million tons of steel demand

- Supply Side Optimization: Industry capacity continues to be cleared, and leading steel enterprises’ bargaining power improves

- Performance of Baosteel Co., Ltd.: The highest annual increase reached 22.2%, showing increased market recognition

- Real Estate Drag: Real estate investment is still at the bottom, limiting cement demand

- Limited Infrastructure Hedge: Infrastructure investment is difficult to fully offset the downward pressure of real estate

- Price Pressure: Cement prices remain low, and enterprises face greater profit pressure

- Copper and Aluminum Benefit: Power grid investment and new energy infrastructure drive copper and aluminum demand

- Precious Metals as Safe Haven: Increased global economic uncertainty enhances the allocation value of gold

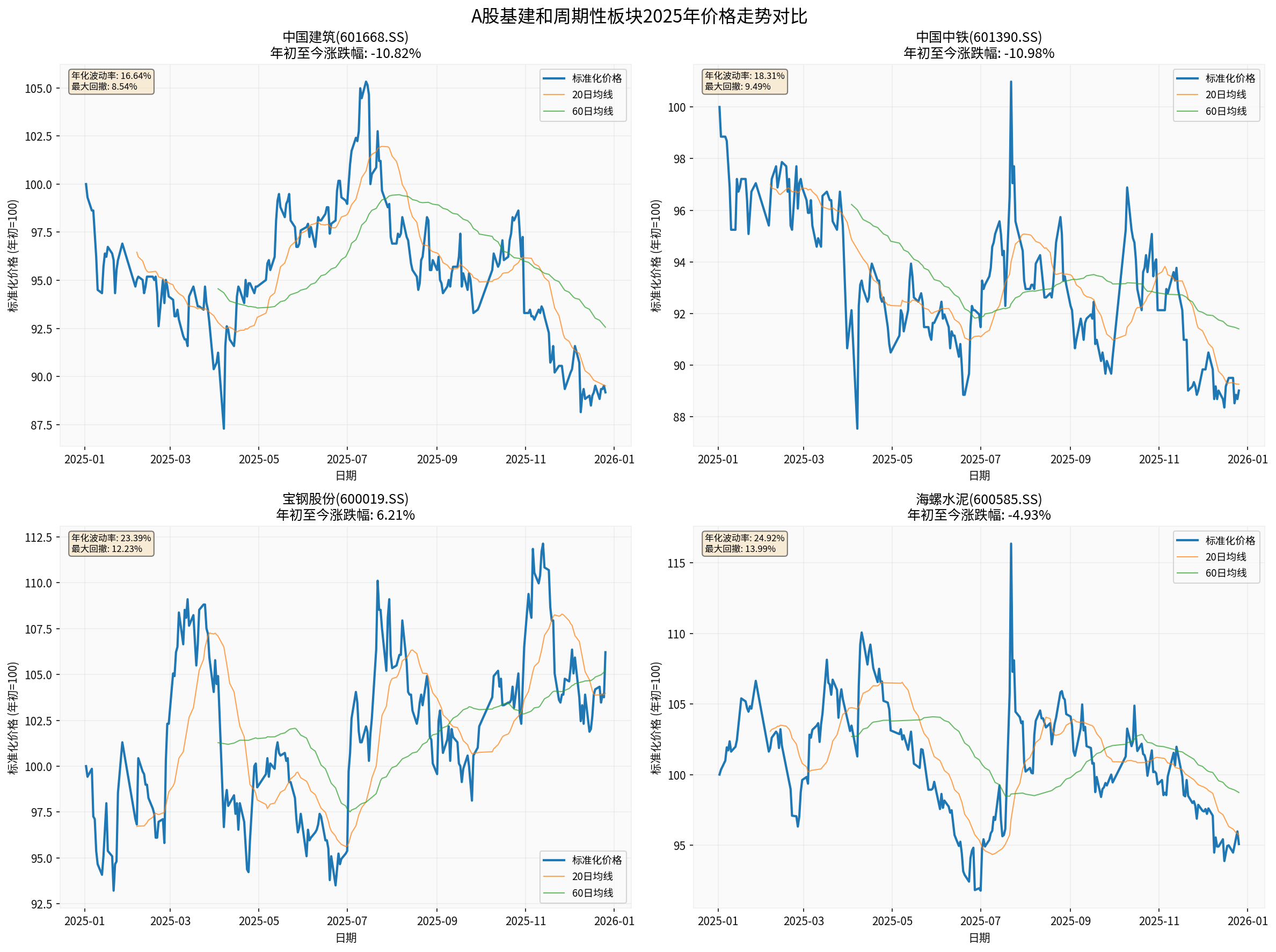

According to visual analysis [0]:

- Infrastructure Sector: Showed a震荡下行 trend throughout the year, with a cumulative decline of about 13%

- Cyclical Sectors: Differentiated performance, with steel stocks strengthening and cement stocks weakening

- Volatility: Cyclical sectors have higher volatility than infrastructure sectors

| Dimension | Infrastructure Sector | Cyclical Sector |

|---|---|---|

Policy Sensitivity |

Extremely High (direct benefit) |

Medium (indirect pull) |

Valuation Level |

Extremely Low (P/E 4-6x) |

Medium (P/E 10-17x) |

Rebound Elasticity |

Medium (Beta 0.35) | High (Steel Beta >1) |

Certainty |

High (government project guarantee) |

Medium (need to observe demand) |

Dividend Yield |

High (3-5%) |

Medium (2-3%) |

- Extremely Undervalued Valuation: Current P/E is only 4-6x, far below the historical average

- Certain Growth: Deficit rate raised to 5% brings incremental funds

- High Dividend Attribute: Dividend yield is generally 3-5%, providing a safety cushion

- New Infrastructure Transformation: Traditional infrastructure enterprises transform to new energy and digitalization

- China State Construction Engineering (601668.SS): Largest market cap (214.4 billion CNY), lowest valuation (P/E 4.8x), benefits from new urbanization construction

- China Railway Group (601390.SS): Leading enterprise in rail transit construction, benefits from the transportation power strategy

- China Power Construction (601669.SS): Leading enterprise in new energy infrastructure, benefits from energy structure transformation

- Demand Side Improvement: Infrastructure investment drives steel demand

- Supply Side Optimization: Capacity continues to be cleared, industry concentration increases

- Key Targets: Baosteel Co., Ltd. (600019.SS), Valin Steel

- Real Estate Drag: Difficult to fundamentally improve in the short term

- Worsening Competitive Landscape: Overcapacity problem still prominent

- Suggestion: Wait for clear stabilization signals in the real estate market before布局

- Copper: Benefits from power grid investment and new energy construction

- Aluminum: Benefits from lightweight trend and photovoltaic demand

- Gold: Hedges against global economic uncertainty

- Infrastructure Sector: Layout leading stocks with oversold dips, pay attention to policy implementation rhythm

- Steel Sector: Continue to hold, pay attention to peak season inventory replenishment market

- Cement Sector: Cautious observation, wait for fundamental improvement

- Infrastructure + New Infrastructure: Focus on new infrastructure targets with digital transformation

- Cyclical Leaders: Pay attention to the leading premium brought by increased industry concentration

- High Dividend Strategy: Allocate high-dividend assets as defensive bottom positions

- Policy Risk: Fiscal policy intensity is lower than expected

- Economic Risk: Macroeconomic growth continues to decline

- Valuation Risk: Sector valuation is suppressed for a long time

- Liquidity Risk: Market liquidity tightens

- Deficit Rate Increase Less Than Expected: Actual deficit rate may be lower than the 5% target

- Insufficient Local Government Matching: Local financial constraints affect project implementation

- Fund Use Efficiency: Large-scale investment may have fund waste

- Continuous Sluggish Real Estate: Drags down the performance of related cyclical sectors

- Weak External Demand: Global economic recession affects export-oriented industries

- Market Style Switch: The resurgence of growth stocks may divert funds

- Infrastructure Stocks: Project payment risk, gross profit margin decline risk

- Cyclical Stocks: Price fluctuation risk, overcapacity risk

Increased fiscal stimulus in China will

- First Choice Infrastructure Sector: Valuation repair + policy catalysis + high dividend

- Optimize Cyclical Leaders: Steel industry is better than cement industry

- Moderate Diversified Allocation: Combination of infrastructure + steel + non-ferrous metals

- Long-Term Holding Strategy: Policy dividends take time to release

[0] Gilin API Data (Real-time stock prices, historical data, technical analysis, financial indicators, Python calculation)

[1] Dongwang - “Yu Yongding: Increasing Infrastructure Investment Can Promote Stable Economic Growth and Make Up for Insufficient Effective Demand” (2025-12-27)

https://hk.on.cc/hk/bkn/cnt/finance/20251227/bkn-20251227154039585-1227_00842_001.html

[2] Deloitte China Research - “2026 Economic and Industry Outlook Monthly Economic Overview Issue 101” (2025-12-26)

https://www.deloitte.com/cn/zh/our-thinking/research//issue101.html

[3] National Business Daily - “2026 Macro Outlook: Economic Resilience and Opportunities Under the Start of the 15th Five-Year Plan” (2025-12-26)

https://www.nbd.com.cn/articles/2025-12-26/4196159.html

[4] FastBull - “Six Major Changes in China’s Fiscal Policy” (2025-12)

https://www.fastbull.com/cn/news-detail/4310223_1

[5] Sina Finance - “Seven Brokerage Chiefs Judge 2026 Chinese Market: A-shares and Hong Kong Stocks Are Likely to Continue to Rise” (2025-12)

https://www.chnfund.com/article/AR1ad1cf25-d40a-b336-9b5a-3a1e51b1d934

[6] TechThink - “Tariffs Soar but Exports Increase, Behind the Stock Market’s Unexpected Performance: China’s Economy Has Changed Its Resilience Engine” (2025-12-26)

https://t.cj.sina.cn/articles/view/1776773647/69e76a0f020017v2y

[7] Investing.com - “How Do Foreign Investors View China’s Economy in 2026?” (2025-12)

https://cn.investing.com/analysis/article-200496706

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.