Can Envicool's Liquid Cooling Technology Support a 90-Billion RMB Market Cap Valuation Logic?

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on a comprehensive analysis of Envicool’s fundamentals, financial data, technical aspects, and valuation, I believe

| Valuation Indicator | Current Value | Reasonable Range | Risk Assessment |

|---------------------|--------------|-----------------|----------------|----------------|----------------|

| P/E (TTM) | 212.69x | 30-50x | Severely Overvalued |

| P/B (TTM) | 32.03x |5-10x | Severely Overvalued |

| DCF Valuation (Weighted) | $32.28 | Current $110.59 | Down 70.8% |

| Stock Price Position | Near resistance level of $113.32 | Support level of $86.03 | Technically Overbought |

Envicoo was founded in 2005, headquartered in Shenzhen, and listed on the Shenzhen Stock Exchange in 2016. The company has formed four core product lines [1]:

| Product Line | 2024 Revenue | Proportion | YoY Growth Rate |

|--------------|--------------|------------|-----------------|-----------------|----------------|

| Data Center Temperature Control & Energy Saving Products | 2.441 billion RMB |53.19%| +48.83% |

| Cabinet Temperature Control & Energy Saving Products |1.715 billion RMB |37.37%| +17.03% |

| Bus Air Conditioning |111 million RMB |2.43%| +20.71% |

| Rail Transit Train Air Conditioning |75 million RMB |1.63%| -29.71% |

Envicoo has obtained verification from top global cloud service providers [2]:

- NVIDIA: UQD products are included as NVIDIA MGX ecosystem partners

- Google: Launched CDU products compliant with Google Dechutes5 standards in October 2025, supplied via Tianhong (Google’s main AI server contract manufacturer)

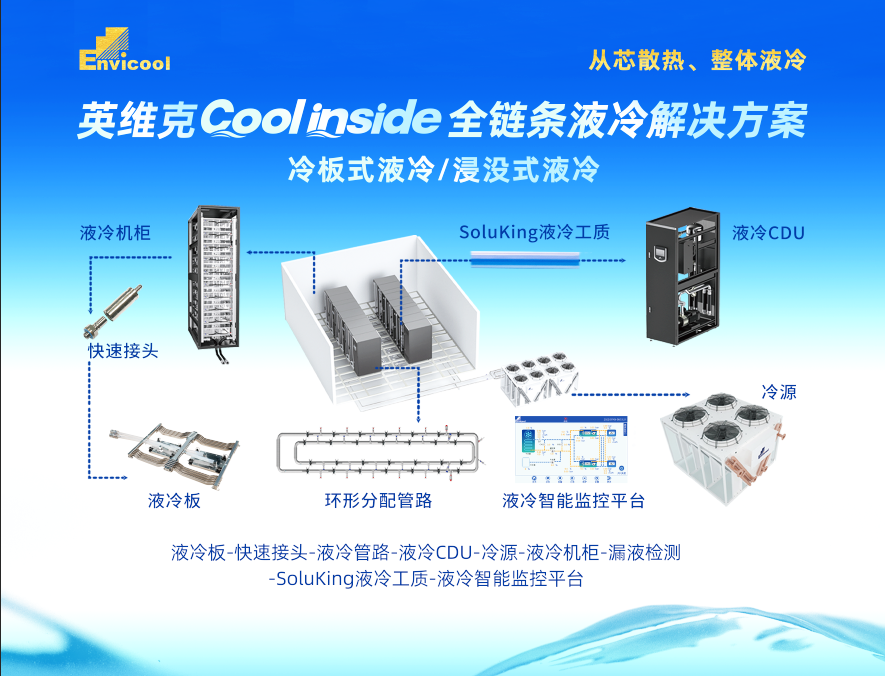

- Intel: Coolinside full-chain liquid cooling solution passed Intel verification, becoming the first cold plate liquid cooling solution integrator for the Xeon 6 platform

- Meta: Previously provided data center liquid cooling services for Meta; further cooperation is expected

| Indicator | 2022 | 2023 | 2024 | CAGR |

|---|---|---|---|---|

| Revenue | 2.228 billion RMB | 3.529 billion RMB | 4.589 billion RMB | 27.3% |

| Net Profit Attributable to Parent Company | 220 million RMB | 344 million RMB | 453 million RMB | 27.2% |

| Gross Margin | 29.3% | 32.3% | 28.8% | - |

| ROE | 12.5% | 15.0% | 16.9% | - |

- Q1 2025 net profit declined 22.53% YoY

- Inventory surged: Q1 2025 inventory was 1.135 billion RMB, up nearly 80% YoY

- Negative free cash flow (-153 million RMB)

The exponential growth in computing power demand from AI large models is driving the upgrade of data center heat dissipation technology from air cooling to liquid cooling:

| Time Node | Per-Cabinet Power Density | Technical Requirement |

|---|---|---|

| Traditional Air Cooling | 6-8kW | Near physical limit |

| Current Mainstream | 30kW+ | Liquid cooling becomes inevitable |

| AI Server | 100kW+ | Full liquid cooling solution |

According to Goldman Sachs forecasts, the liquid cooling penetration rate for AI training servers will jump from 15% in 2024 to 80% in 2027 [2]. Industry estimates indicate that the global server liquid cooling market size is expected to reach 80 billion RMB by 2026 [1].

Envicoo’s competitors in the liquid cooling field include:

- Domestic: Gaowen Co., Ltd., Shenling Environment

- Overseas: Vertiv, Asetek

Envicoo’s advantage lies in its “full-chain” self-research and production capabilities, especially in the high technical barrier field of quick connectors (UQD) [2]. However, in terms of R&D expenditure comparison, Envicoo has the highest investment, but competitors are also catching up quickly.

Market expectations for Envicoo’s orders are very optimistic:

- Google TPU orders: Expected share of ~25%, corresponding orders有望 reach 3 billion RMB [3]

- Meta orders: Expected to land by late 2025 or early 2026, size of several hundred million RMB

- 2026 overseas computing power business confirmed orders of ~4 billion RMB

- 2025 interim report shows Envicoo’s liquid cooling-related revenue was only over 200 million RMB [2]

- Among the 1.351 billion RMB revenue from data center temperature control products, the proportion of liquid cooling is still low

- There is uncertainty in order fulfillment; Google’s factory audit progress and actual order placement time are still unknown

| Valuation Indicator | Envicoo | Industry Average | Deviation Magnitude |

|---|---|---|---|

| P/E (TTM) | 212.69x | 40-60x | 3-5x |

| P/B (TTM) | 32.03x | 5-8x | 4-6x |

| P/S (TTM) | 18.80x | 3-5x | 4-6x |

From the perspective of traditional manufacturing valuation system, Envicoo’s current valuation has seriously deviated from the reasonable range [2].

| Scenario | Valuation Price | Gap vs. Current Price | Assumptions |

|---|---|---|---|

| Conservative Scenario | $11.21 | -89.9% | Zero Growth |

| Base Scenario | $23.95 | -78.3% | 28.1% historical growth rate |

| Optimistic Scenario | $61.67 | -44.2% | 31.1% high growth |

Weighted Average |

$32.28 |

-70.8% |

Comprehensive Scenario |

Even in the optimistic scenario, DCF valuation still shows a 44.2% downside potential for the current stock price.

The current market trading logic is shifting from “P/E ratio” to “potential market size” [2]:

- Traditional performance growth cannot explain the nearly 300% annual increase

- The market expects Envicoo to jump from a regional temperature control manufacturer to a core supplier in the global AI computing power supply chain

- But this expectation is based on extremely optimistic order assumptions

- Current P/E ratio exceeds 180x; any underperformance will trigger a “valuation kill” decline

- Market sentiment retreat risk: If the market style switches back to low-valued blue chips, tech growth stocks will be the first to be hit

- Google factory audit rumors have not been officially confirmed

- Uncertainty in actual order landing time and scale

- Long supplier verification cycle for North American customers, which may be slower than market expectations

- High inventory (up nearly 80% YoY) with impairment risk

- Sustained negative free cash flow, insufficient self-funding capacity

- Gross margin fluctuates significantly due to changes in accounting policies

- Rapid iteration of liquid cooling technology; doubt whether R&D investment can maintain leadership

- Competitors catching up quickly, which may erode market share

- Short-term stock price increase is too large, with heavy profit-taking pressure

- Technical indicators like KDJ and RSI have shown overbought signals

Need to pay close attention to:

- Google factory audit results and actual order landing situation

- 2025 annual report performance fulfillment situation

- Progress in increasing the proportion of liquid cooling business revenue

If Envicoo can successfully enter the global top computing power supply chain such as Google and NVIDIA, its 2026 revenue is expected to reach 7-8 billion RMB [3], profit exceeding 2 billion RMB; calculated at 30x P/E, the market cap could reach 60 billion RMB.

- Orders land as scheduled

- Gross margin remains stable

- Free cash flow turns positive

As a leader in the liquid cooling track, Envicoo does have strong technical advantages and customer expansion capabilities. However, the current 90-billion RMB market cap has fully discounted the optimistic expectations for the next 2-3 years.

From the valuation perspective:

- A 212x P/E means the market expects the company’s annual net profit growth rate to maintain above 50% in the future

- DCF valuation shows over a 70% downside potential for the current stock price

- Technical indicators have sent obvious overbought signals

For investors who already hold positions, it is recommended to reduce positions on rallies to lock in gains; for investors on the sidelines, it is recommended to wait for the stock price to pull back to the support level or for order certainty to improve before entering.

[1] NetEase News - “Stock price nearly tripled in half a year, market cap exceeded 90 billion RMB: Why is Envicoo surging?” (https://www.163.com/dy/article/KH0PUA120514R9P4.html)

[2] Sina Finance - “Liquid cooling super bull stock, exploding!” (https://t.cj.sina.cn/articles/view/5930172409/161773ff900101hf6o)

[3] Roadshow Era - “Guohai Computer Envicoo: Computing Power Liquid Cooling Update and Outlook” (https://admin.luyanshidai.com/student/press/read/id/899.html)

[4] 36Kr - “3x bull stock! Liquid cooling leader approaches 100 billion” (https://m.36kr.com/p/3604978444879105)

[5] Jinling API Data - Company Overview, Financial Analysis, Technical Analysis, DCF Valuation

江南农商行收购启东珠江村镇银行协同效应分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.