Strategic Analysis of Delijia Gearboxes in Response to the Self-Development Trend of Complete Machine Manufacturers

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

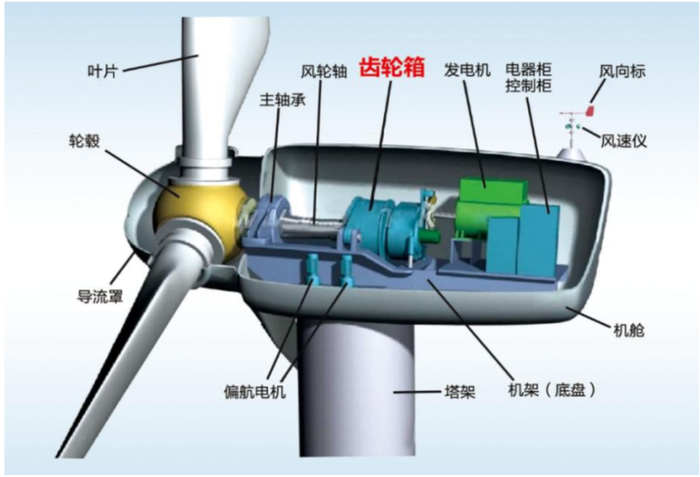

According to the latest data, Delijia Transmission Technology holds an important position in China’s wind power gearbox market. In 2023, the company’s global market share reached 12.77%, ranking 3rd globally; its China market share reached 20.68%, ranking 2nd in China, with revenue exceeding 4 billion RMB [0]. The company has R&D and production capabilities for full-series products from 1.5MW to 22MW, and is leading the industry in key indicators such as power density, transmission efficiency, and gear safety factor.

Notably, according to the 2024 global wind power gearbox shipment ranking released by the Gear and Electric Drive Branch of China General Machinery Components Industry Association,

The core motivation for complete machine manufacturers to choose self-development of gearboxes is to break the “black box” model and achieve systematic optimization. A relevant person in charge of Envision Energy pointed out that in the past, wind turbine and gearbox enterprises operated independently, lacking technical collaboration—“Wind turbines only provided partial load data to gearbox enterprises, while gearbox enterprises only delivered the final product to the main engine factory without handing over process data; both parties did not fully open up technology and data, making it impossible to achieve systematic optimization of wind turbines” [1].

Against this background, Envision Energy began to develop its own gearboxes in 2018, continuously investing funds and resources for the first four years, and gradually seeing results in the fifth year. This “main engine + core component” development model enables coordinated progress of component and complete machine technology, placing higher requirements on the overall strength of enterprises [1]. CRRC also relies on its core technical advantages accumulated in the rail transit equipment field to build an industrial pattern covering the entire wind power industry chain.

Facing the self-development trend of complete machine factories, Delijia should continue to strengthen its leading technical advantages, especially in the

- R&D of ultra-large offshore wind gearboxes above 15MW

- Development of high-reliability products suitable for complex working conditions

- Upgrade of modular and platform-based product systems

Top main engine factories tend to choose either deep binding with gearbox manufacturers or self-supply models for supply chain stability. Delijia should establish closer strategic partnerships with major clients through

In addition to traditional wind power complete machine manufacturers, Delijia should actively explore clients in

Currently, the wind power industry’s “anti-involution” has achieved phased results, and the winning bid prices of complete machines have generally rebounded, providing space for gearbox enterprises to improve their operating conditions [1]. Delijia should:

- Improve production automation levels to reduce unit costs

- Strengthen supply chain management and optimize raw material procurement

- Increase product yield and delivery efficiency

The wind power gearbox industry has high barriers, including technical barriers (adaptability to complex working conditions, 20-25 year service life requirements), capital and scale barriers (large investment in high-end equipment), and verification barriers (2-3 year verification cycle required to enter the supplier directory) [0]. Delijia should make full use of its first-mover advantage, continue to increase R&D investment, and consolidate its technological moat.

The wind power industry is transforming from simply pursuing large-scale to “large-scale + intelligent + deep integration”. Insiders at the Wind Energy Exhibition pointed out that deep integration of the industrial chain will become the main direction—“Industrial chain integration is definitely good, as it can perform system-level optimization of large components such as blades, gearboxes, and electrical systems, as well as loads” [1].

Against this background, Delijia’s role positioning as a professional gearbox supplier needs to be further clarified:

[0] Huatai United Securities’ IPO Sponsorship Letter for Delijia Transmission Technology (Jiangsu) Co., Ltd. (https://qxb-pdf-osscache.qixin.com/AnBaseinfo/ddc7a9f334b2908e46b440a32717222f.pdf)

[1] Securities Times - Slowdown in Wind Turbine Large-Scale Trend, Industrial Chain Moves Towards Deep Integration (https://www.stcn.com/article/detail/3530582.html)

[3] Dongfang Fortune Securities - Brief Analysis of the Wind Power Gearbox Industry (https://pdf.dfcfw.com/pdf/H3_AP202509091740689051_1.pdf)

万果园超市"胖改"转型效果与可持续性分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.