In-depth Investment Analysis Report on Seres

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Seres’ valuation logic as the ‘Chinese Tesla’

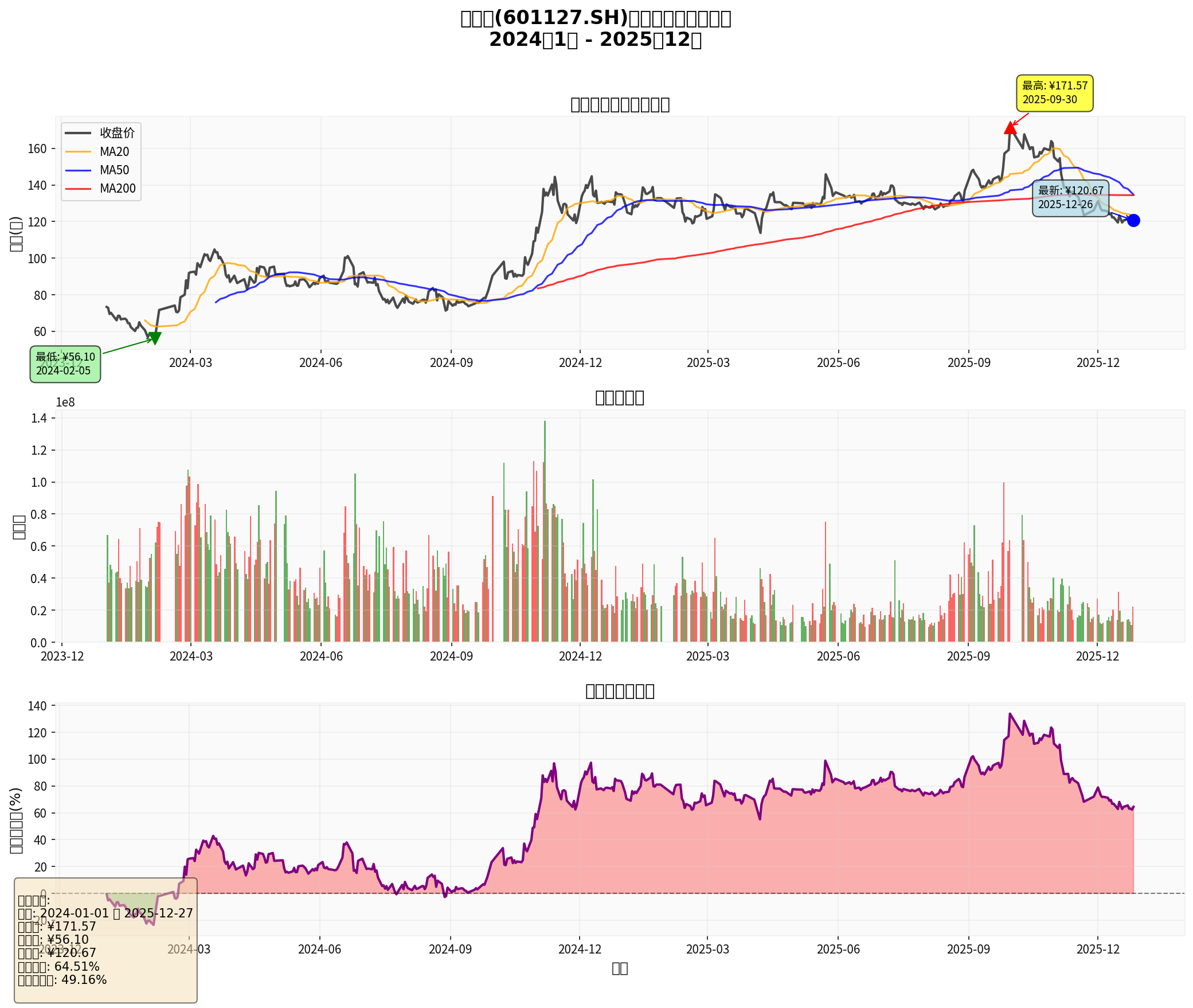

According to brokerage API data, Seres (601127.SS) showed the following characteristics from October 8, 2024 to December 26, 2025 [0]:

- Period Performance: Opening price 99.46 yuan → Closing price 120.67 yuan, up 21.33%

- Volatility Characteristics: Highest price 174.66 yuan, lowest price 85.20 yuan, price fluctuation range up to 105%

- Latest Status(December 26, 2025): Closing price 120.67 yuan

- Below the 20-day moving average (123.14 yuan)

- Below the 50-day moving average (134.75 yuan)

- Below the 200-day moving average (134.43 yuan)

- Technical Interpretation: The moving average system shows a bearish排列 (downtrend), with large short-term adjustment pressure, and the stock price is in the medium-term correction phase

- September 30, 2025: Reached the highest price of the period at 171.57 yuan (pre-National Day high)

- December 26, 2025: Fell back to 120.67 yuan, a correction of about 30% from the high (consistent with the user’s description of ‘a drop of about 30% after the National Day’)

The average daily trading volume during the period was 3.243 million shares, with an average daily turnover of about 3.243 billion yuan, indicating high market activity. However, trading volume has shrunk since Q4 2025, reflecting strong wait-and-see sentiment among funds [0].

Seres’ cooperation with Huawei has upgraded from the initial ‘Smart Selection Car Model’ to an in-depth binding model of ‘

- First Stage (2021-2022): Pilot of Huawei Smart Selection Car Model, launch of AITO M5/M7

- Second Stage (2023-2024): Sales explosion period, AITO New M7 delivered nearly 200,000 units annually, AITO M9 accumulated over 150,000 units delivered

- Third Stage (2025-present): Strategic upgrade period

- Seres acquired 10% equity of Huawei’s Yinwang Intelligence by cash

- Business cooperation extended from channels and R&D to supply chain and equity levels

- Huawei ADS 3.0 system continues to iterate, and intelligent driving capabilities remain leading

- November 2025: Seres’ new energy vehicle sales were 55,203 units, a year-on-year increase of 49.84% [1]

- AITO M9: Accumulated delivery exceeded 260,000 units, ranking first in the 500,000-level luxury car sales for 11 consecutive months [1][2]

- AITO M8: Accumulated delivery exceeded 130,000 units, performing strongly in the 400,000-level luxury market [1]

- AITO New M7: Delivered nearly 200,000 units in 2024, winning the annual sales first place among new power models [2]

- The overall gross profit margin in the first half of 2025 increased to 28.93%(significantly improved compared to 2024)

- Net profit attributable to parent company increased by 81.03%year-on-year, and the high-end strategy has initially shown results [1]

- Technical Empowerment: Supported by core technologies such as Huawei ADS 3.0 system, HarmonyOS intelligent cockpit, and electric drive system

- Channel Synergy: Huawei stores are deeply involved in sales, significantly improving user experience and brand power

- Supply Chain Optimization: Huawei’s supply chain management capabilities help with cost control and quality assurance

- Brand Endorsement: Huawei’s brand effect helps the AITO series break through the high-end market

| Dimension | Tesla | Seres/AITO | Gap Assessment |

|---|---|---|---|

Intelligence |

FSD autonomous driving leading | Huawei ADS 3.0 leading in China | ✅ Comparable in the Chinese market |

Brand Positioning |

Global high-end electric vehicles | 500,000+ luxury car sales champion (M9) | ✅ High-endization has been verified |

User Ecosystem |

Super charging network + software subscription | HarmonyOS Intelligent Mobility Ecosystem | ⚠️ Ecosystem is still under construction |

Vertical Integration |

Self-developed chips + batteries + manufacturing | Dependent on Huawei + partial manufacturing capabilities | ❌ Weak vertical integration capabilities |

Globalization |

Global layout | Focus on the Chinese market | ❌ Internationalization just started |

- Technical Moat: Huawei’s intelligent driving technology is in the first echelon in China, leading new car-making forces by 1-2 years [3]

- High-end Market Breakthrough: The success of AITO M9 in the 500,000-level luxury car market proves the ability to move up the brand ladder

- Scale Effect: Sales growth drives gross profit margin improvement, and expense ratio is expected to continue to optimize

- Ecosystem Value: Potential monetization capabilities of HarmonyOS Intelligent Mobility Ecosystem (software, services, subscriptions)

-

Huawei Dependence Syndrome(Core Risk)

- Lack of independent R&D capabilities, core technologies are ‘controlled’ by Huawei

- If Huawei adjusts its strategy or deepens cooperation with other car companies, Seres may be marginalized

- Investors question that Seres has become a ‘Huawei foundry’, and the valuation ceiling is suppressed

-

Intensified Market Competition

- Competitors such as Xiaomi SU7, Li Auto L series, NIO ET series iterate rapidly

- Traditional luxury brands (BBA) accelerate electrification transformation

- Price wars continue, and ‘price war’ supervision in the Chinese auto market became stricter in 2025, with competition shifting from ‘volume for price’ to technology and quality [4]

-

Valuation Digestion Pressure

- The market value corresponding to the stock price high in September 2025 exceeded 500 billion yuan (dynamic PE over 100 times)

- Even with rapid performance growth, high valuations still need time to digest

- Investors’ tolerance for ‘growth stock valuation premium’ has decreased

-

Uncertainty of New Businesses

- New businesses such as robots and low-altitude economy are still in the early stage, with large investment and slow monetization

- Joint venture with Aerospace Rainbow to layout the civil low-altitude field, but has not yet formed scale revenue [5]

On December 15, 2025, the Ministry of Industry and Information Technology officially announced China’s

- First Batch of Approved Models: One pure electric sedan each from Changan Deepal and BAIC Arcfox

- Pilot Areas: Designated urban roads, highways and urban expressways in Beijing and Chongqing

- Technical Standards: Can realize legal hands-free driving, independently complete lane changes, overtaking, avoidance and other tasks

- Policy Significance: 2026 is expected to be the first year of L3 mass production [4]

- Huawei ADS 3.0 system already has L3 capabilities and is expected to be in the next batch of approved lists

- Policy implementation will provide legal endorsement for the intelligent driving functions of the AITO series, enhancing product competitiveness

- CICC predicts that L3 mass production will start in 2026, and the market size will exceed 1.2 trillion yuan by 2030 [4]

- Trade-in Policy: The 2025 auto trade-in policy was implemented, and National IV models were included in the subsidy scope [4]

- Price War Supervision: In May 2025, CAAM issued an initiative against ‘bottomless price wars’, and industry competition shifted from ‘volume for price’ to technology, quality and supply chain health [4]

- Export Support: China’s new energy vehicle exports continue to grow, but trade barriers in Europe and the US are intensifying

- AITO M9 delivery continues to climb, with monthly average delivery stable above 20,000 units

- The revised M8/M7 contributes increments, and the new model M6 is expected to be launched in H1 2025

- Gross profit margin maintains a high level of 28%+, and expense ratio decreases with scale effect

- Investment income from Yinwang is expected to be reflected in 2026

- AITO M6: Expected to be launched in H1 2025, positioned in the 300,000-400,000 yuan market

- M9L/M8 Revision: Launched in 2026, with extended-range/pure electric dual power

- New Technology Implementation: Huawei ADS 4.0, 800V high-voltage platform, solid-state battery technology

- Q4 performance preview/annual report disclosure (January-March 2025)

- Official release and launch of AITO M6

- OTA update of new Huawei ADS functions

- Inflow of southbound funds from Hong Kong Stock Connect

- Official implementation of L3 autonomous driving policy (AITO models approved)

- Launch of 2026 new models (M6, M9L)

- Progress in overseas market expansion

- Reflection of investment income from Yinwang equity

- Huawei’s intelligent driving technology iterates to L4 level

- Monetization of HarmonyOS Intelligent Mobility Ecosystem (software subscription, service income)

- Landing of new businesses such as robots and low-altitude economy

- Breakthrough in globalization layout (European, Southeast Asian markets)

- The technical moat brought by in-depth binding with Huawei is real

- The success of AITO M9 in the high-end market proves product strength

- The trend of profitability improvement is clear (both gross profit margin and net profit margin increase)

- HarmonyOS Intelligent Mobility Ecosystem has long-term monetization potential

- Huawei dependence cannot be solved: Valuation is difficult to break through the ‘Huawei foundry’ ceiling

- Weak independent R&D capabilities: Lack of core technologies, poor bargaining power

- Deteriorating competitive landscape: Xiaomi, Li Auto, NIO are catching up rapidly

- High valuation to be digested: Sustained high growth is needed to digest valuations

-

Long-term Value Investors:

- Wait and see mainly, wait for the valuation to correct to a reasonable range (corresponding to 2025 PE 30-40 times)

- Pay attention to the progress of Seres’ independent R&D capability building

-

Trend Investors:

- Be cautious in the short term, the technical side is weak, wait for stabilization signals

- Pay attention to the 120 yuan support level, be alert to further correction if it breaks

-

Event-driven Investors:

- Pay attention to catalysts such as L3 policy implementation and new model launches

- Short-term trading needs to pay attention to high volatility risks

- Conservative Scenario (AITO sales 500,000 units): Target market value 350-400 billion yuan (corresponding to stock price 100-115 yuan)

- Neutral Scenario (AITO sales 550,000 units): Target market value 450-500 billion yuan (corresponding to stock price 130-145 yuan)

- Optimistic Scenario (AITO sales 600,000+ units): Target market value 550-600 billion yuan (corresponding to stock price 160-175 yuan)

- Huawei Cooperation Risk: Huawei adjusts its strategy or deepens cooperation with other car companies

- Policy Risk: New energy vehicle subsidy withdrawal, stricter autonomous driving supervision

- Competition Risk: Continuous price wars, higher-than-expected sales of competitors

- Valuation Risk: High valuations cannot be digested, leading to a sharp correction in stock prices

- Technical Risk: Huawei’s intelligent driving technology iteration is slower than expected

- Operational Risk: New businesses (robots, low-altitude economy) have large investment and slow results

The in-depth binding between Seres and Huawei provides it with a strong competitive advantage in the intelligent era. The valuation logic of ‘

[0] Gilin API Data - Seres (601127.SS) stock price, trading volume, technical indicator data (2024-2025)

[1] Economic Reference News - ‘Seres Reports Double Good News in Sales and Capital, High-end Strategy Initially Shows Profitability’ (December 2, 2025)

https://jjckb.xinhuanet.com/20251202/e467bba73a21445f84df85f06c415784/c.html

[2] Sina Finance - ‘AITO M9’s 2025: Not Just Sales Champion, But Also China’s Auto Industry’s Upward Declaration’ (December 22, 2025)

https://finance.sina.com.cn/stock/relnews/cn/2025-12-22/doc-inhcsexm7869943.shtml

[3] Soochow Securities - ‘2025 Investment Strategy for Automotive Intelligence’ (December 2024)

https://pdf.dfcfw.com/pdf/H3_AP202412081641219266_1.pdf

[4] Securities Times/36氪 - ‘L3 Mass Production Opens, Battery National Standard Upgrades, Top 10 News of China’s Auto Industry in 2025’ (December 2025)

https://eu.36kr.com/zh/p/3609484650808323

[5] Securities Times - ‘Seres (sh601127) Market Trend - Investor Q&A’ (November-December 2025)

https://www.stcn.com/quotes/index/sh601127.html

泸州老窖数字化转型与年轻化战略深度分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.